On 28 July 2021, the Luxembourg Tax Administration ("LTA") published Circular L.G.-A no 67 setting out general guidance on the application of administrative fines in cases of tax fraud, criminal fraud and the cooperation between the tax administration and the judicial authorities (the "Circular").

-

Administrative fines

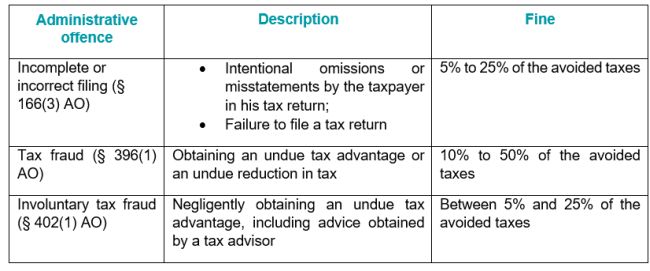

Luxembourg's general tax law dated 22 may 1931 (Abgabenordnung) ("AO") provides for a number of offences sanctioned by administrative fines:

In order to avoid any distortions and to ensure uniform application of these fines, the Circular provides the following guidance:

- The determination of the amount of fines is at the discretion of the LTA, which must consider all the facts at its disposal;

- The fine must be set according to the circumstances of the case, be proportionate to the taxpayer's actions and to his ability to pay;

- The LTA must effectively consider and explicit the particular circumstances which it has considered when setting the fine which may be influenced by considerations of fairness and opportunity;

- The fine must comply with the minima and maxima thresholds set by the law.

The fine must be paid within one month of the notification by registered post. The decision is deemed notified 3 days after it is sent by post.

The fine can be challenged by an administrative appeal (réclamation) that must be filed within 3 months of notification by registered post.

The new regime is applicable as from the tax year 2017, so that penalties may be imposed for all declarations filed as from 1 January 2017, even if the tax assessment concerns earlier years.

-

Criminal tax fraud and penalties

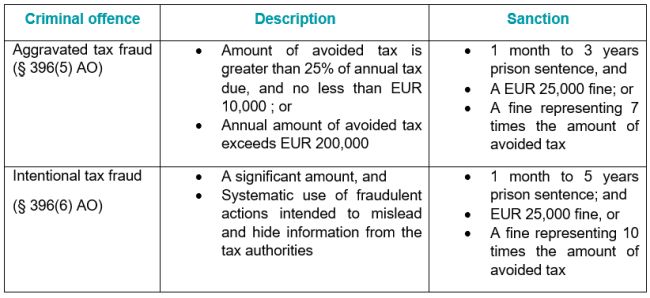

Luxembourg law provides for two types of criminal tax fraud. These offences are defined according to threshold amounts of tax avoided and, in the most serious cases, by the fraudulent behaviour of the taxpayer.

Cases of aggravated and intentional tax fraud are handled by the Parquet (Public Prosecutor's Office) and investigated by a specialised unit the Cellule de Renseignement Financier (Financial Intelligence Unit)

-

Cooperation between the LTA and the judicial authorities

The Circular also provides guidance on the cooperation between the tax authorities and judicial authorities. In accordance with article 16 of the law of 19 December 2008 on inter-administration and judicial cooperation, the LTA must transmit to the judicial authorities (i) information which may be useful to investigate money laundering or terrorism financing (ii) information they acquire about possible crimes or misdemeanours and in particular suspected cases of aggravated or intentional tax fraud, money laundering and terrorism financing, forgeries or violations of commercial law. In this context, the LTA must also communicate to the judicial authorities the information in its possession such as reports and interview transcripts.

The LTA must also cooperate with the judicial authorities' requests for information.

These information-sharing obligations constitute an exception to the principle of tax secrecy (secret fiscal) according to which the LTA is prohibited from revealing information about a taxpayer's tax situation.

In accordance with the law of 19 December 2008 on inter-administration and judicial cooperation, the Public Prosecutor's Office and Financial Intelligence Unit must also share with the LTA information, which may be useful for the correct assessment and collection of taxes. If, after analysis, the information shared gives rise to a finding of tax fraud, the LTA must impose a fine or, if the information reveals possible offences of aggravated or intentional tax fraud, return the case to the judicial authorities or the Financial Intelligence Unit for further investigation and eventual prosecution.

Conclusion

The new circular is a welcome clarification of the LTA's approach, confirming the current practice of imposing fines and of systematically referring cases of aggravated and intentional tax fraud to the judicial authorities. Your usual BSP contacts are at your disposal to advise and assist in cases regarding tax fines or tax fraud.

Originally published 20 August 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.