On 8 June 2022, South Africa's Minister of Finance published regulations to introduce a domestic reverse charge on "valuable metal" relating to gold-containing material, which includes secondary gold sources as well as certain mine dumps. Under a domestic reverse charge mechanism, the purchaser accounts for the VAT (at 15%) on the transaction rather than the supplier.

The Regulations will come into operation on 1 July 2022 and vendors are afforded one month (i.e., until 31 July 2022) to become compliant.

Background and purpose of the Regulations

The main purpose of the Regulations is to curb VAT refund fraud involving illicit gold trading suspected by the South African Revenue Service ("SARS") to be prevalent in the second-hand gold industry. The illicit gold is believed to originate mainly from illegally melted Krugerrands, illegally mined gold (so-called "zama-zama" gold), and illegally imported gold. The fraudulent scheme is premised on vendors introducing illicit gold (which does not carry VAT) into the supply chain and unlawfully claiming VAT refunds using fabricated documents.

Although concerns of VAT refund fraud in the second-hand gold industry are not new, a new modus operandi whereby the fraud is supposedly committed has been identified. In recent years, fictitious businesses (shell companies) are registered for VAT and required documentation (e.g., tax invoices) are fabricated. This is done to enable the purchasing vendor to claim actual (not notional) input tax deductions in respect of VAT at 15% supposedly charged by a fictitious supplier. Typically, the VAT reflected on the false documentation is never paid over to SARS.

Mechanics of the Regulations

Ordinarily, a VAT registered supplier will charge VAT on a taxable supply of goods or services (e.g., gold sales) to a purchaser. The purchaser will pay the VAT to the supplier and the supplier is required to declare and pay such VAT to SARS. A VAT-registered purchaser who has acquired the goods or services for taxable purposes (e.g., gold for on-sale in the local or export market) can claim the VAT incurred as an input tax deduction. However, where VAT refunds are claimed fraudulently SARS is out of pocket. The Regulations are therefore aimed at ensuring SARS is left in a neutral cash flow position.

The Regulations provide that the purchaser is required to self-account (reverse charge) the VAT on the purchase of "valuable metal" before that purchaser is entitled to claim a corresponding input tax deduction on the transaction, whether in the same or a subsequent VAT return. As a result, no VAT will go "missing" in the supply chain as the purchaser declares and pays the VAT directly to SARS instead of the supplier. This ensures that no VAT refunds will be paid by SARS to purchasers in instances where suppliers are fictitious.

The ambit of the Regulations

The Regulations will find application to a transaction when all three of the following elements are present:

- Both the seller and the purchaser are VAT-registered vendors;

- The goods supplied are "valuable metal" as defined in the Regulations; and

- The transaction is subject to VAT at 15%.

By implication, the Regulations will not apply to transactions between a VAT registered purchaser and a non-VAT registered supplier (e.g., the general public, or illegal miners), zero-rated sales (e.g., gold exports, or sales of Krugerrands when intact), or goods that do not fall within the "valuable metal" definition.

For example, if an illegal miner (natural person, not VAT registered) sells illicit gold (valuable metal) to a VAT-registered purchaser, the Regulations will not apply. As the illegal miner is not registered for VAT there would not and should not be a VAT charge to the purchaser on the transaction. However, if the purchaser tries to interpose a fictitious VAT registered business as a front to conceal the true (illicit) origin of the goods and unlawfully claim the VAT supposedly incurred on the transaction in its VAT returns, the Regulations will apply as all three of the above requirements will be met.

The Regulations will also apply if VAT-registered vendors melt Krugerrands or manufacture them into purpose-made jewellery and try to conceal the origin thereof by misrepresenting the goods as "scrap gold" or "scrap jewellery" on tax invoices.

"Valuable metal", as defined

What constitutes "valuable metal" is defined in the Regulations as any goods containing gold in the following prescribed forms: jewellery, bars, blank coins, ingots, buttons, wire, plate, granules, in a solution, residue (being any debris, discard, tailings, slimes, screening, slurry, waste rock, foundry sand, beneficiation plant waste or ash) or similar forms, including any ancillary goods or services.

The following supplies are specifically excluded from the definition and therefore not caught by the Regulations:

- In relation to mines, supplies of goods produced from raw materials by any "holder" as defined in section 1 of the Mineral and Petroleum Resources Development Act, 2002 ("MPRDA"). However, it is important to note that mine dumps created by mining operations conducted before 1 May 2004 when the MPRDA took effect are not regulated under the MPRDA and therefore do indeed fall within the ambit of the Regulations.

- In relation to contract miners, supplies of goods produced from raw materials by any person contracted to such "holder" to carry on mining operations in respect of the mine where the "holder" carries on mining operations.

- Supplies contemplated in section 11(1)(f) of the VAT Act, being gold supplied to a South African registered bank, the South African Reserve Bank ("SARB"), or the South African Mint Company (Proprietary) Limited in certain prescribed forms. However, the impact of the recent High Court Case of Lueven Metals (Pty) Ltd v CSARS (19 May 2022) should be carefully considered.

- Supplies of certain gold coins (including the Krugerrand) "as such" as contemplated in section 11(1)(k). Therefore the supply of these coins is excluded from the Regulations only when they are intact and not melted.

- Supplies contemplated in section 11(1)(m), being movable goods sold and delivered to a customs-controlled area enterprise or SEZ (special economic zone) operator.

Reporting obligations

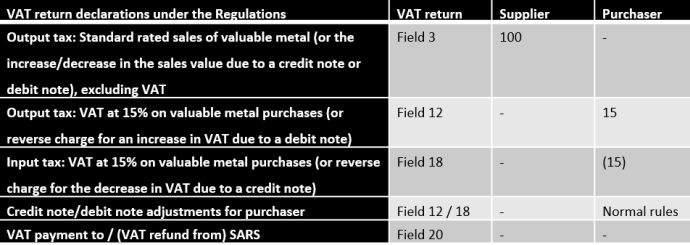

From a practical perspective, it is important to note that transacting vendors to whom the Regulations apply will no longer be declaring their transactions in fields 1 and 4 (for output tax on sales) or field 15 (for VAT claims on purchases) of their respective VAT returns.

To demonstrate, once the Regulations come into effect the transacting vendors' respective VAT returns will look as follows:

Vendors supplying valuable metal that are subject to the Regulations must revalidate (update) their VAT registration status with SARS. The Regulations also contain additional requirements for tax invoices to comply with, as well as detailed documentation requirements to be adhered to. Affected vendors are advised to contact their tax advisors for clarification if they are unsure.

Liability for VAT

Failure to apply the domestic reverse charge on supplies of valuable metal will result in the supplier and purchaser, being VAT registered vendors, being held jointly and severally liable for any VAT loss suffered by the fiscus in this regard. However, recipient vendors are expected to bear the brunt of SARS' enforcement action in respect of any obligation to account for and pay VAT to SARS in terms of the Regulations.

Vendors operating in the second-hand gold industry should ensure that they fully understand the ambit of the Regulations and their respective obligations in terms thereof before the Regulations come into effect.

Reviewed by Charles de Wet, an Executive Consultant in ENSafrica's tax department.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.