Tax Considerations

Trading Stock Stolen or Damaged

How to account for the loss?

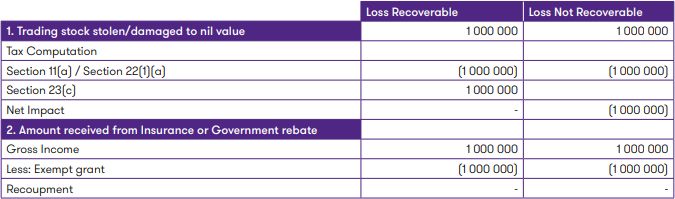

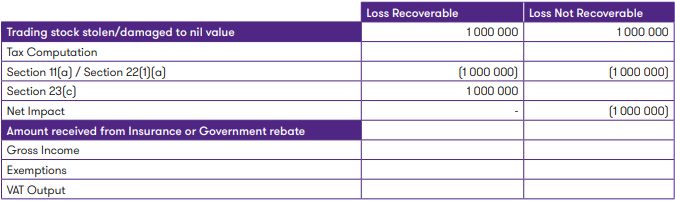

The loss incurred due to stock being stolen or damaged may be deductible for income tax purposes if the loss is not recoverable from an insurance claim. If you are registered for VAT there is no requirement to declare output on the value of stolen goods.

How to account for recovery through insurance claims?

You may be prohibited to deduct the loss if the loss is recoverable under an insurance contract whether you submitted a claim or not. Where the loss was deducted and recovered from the insurance, you will be required to include the proceeds received from insurance claim in your gross income as a recoupment. You will be required to declare Output VAT on the insurance claim received if you are a registered VAT Vendor. There will be no implications if the insurance proceeds relate to a part of the business that is exempt from VAT . Where the insurer repairs or replaces the damaged or stolen goods and there is no cash payment there will be no need to declare output VAT.

How to account for recovery through government disaster relief grant?

You will not be required to pay tax on the government grant as the disaster relief grants are generally exempt from tax. However, if you use the grant to buy trading stock, you may be required to reduce the cost incurred by the grant you received.

Damaged Fixed Property

How to account for the loss?

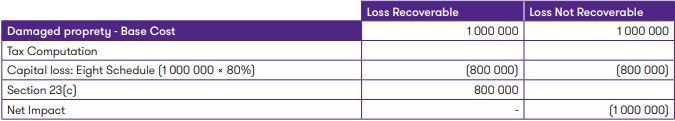

Damage to fixed property or other assets like escalators that have tax lives of 10 years or more may be written off as a capital loss. For other depreciable assets you can claim scrapping allowance as a deduction.

How to account for recovery through insurance claims?

The amount recouped from an insurance claim where you deducted the scrapping allowance will need to be included in the gross income as a recoupment. Where you incurred a capital loss, there are some tax relief available if the proceed from insurance result into a recoupment. Subject to certain requirements, you will be allowed to roll over the recoupment to certain period if such assets are to be replaced. The VAT implications will be the same as those discussed under trading stock stolen or damaged.

How to account for recovery through government disaster relief grant?

As mentioned earlier the grant will generally be exempt from tax. If you use the grant to buy or replace the fixed property, you may be required to reduce the base cost incurred by the grant you received.

Practical Examples

Originally Published 11 August 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.