The provisions of section 20 of the Act provides that taxpayers can set off their balance of assessed losses carried forward from the preceding tax year against their income in determining taxable income.

Any unutilised assessed loss balance may be carried forward to future years of assessment to be set off against future income. This means that a taxpayers will only be liable to paying income tax only when they have earned a taxable profit and their assessed loss balance is exhausted.

In the 2020 Budget announcement, National Treasury made a proposal to broaden the corporate income tax base by restricting the offset of the balance of assessed losses carried forward to 80 per cent of taxable income.

National Treasury indicated that the proposal will apply to the balance of assessed losses available at the time of implementation of the proposed amendment. This will contribute to providing the fiscal room for government to lower the corporate tax rate. The effect of the proposed restriction is that only companies that would be in a positive taxable income position before setting off the balance of assessed losses would be affected.

On the 19th of January 2022 government published in the Government Gazette the Tax Law Amendment Act no. 20 of 2021, in which the proposal in the 2020 Budget speech relating to the limitation of assessed loss balances by corporates when determining taxable income, were made into law. Section 18 of the Tax Amendment Act No:20 of 2021 states that section 20 of the Income Tax Act, is amended in such manner that a company is allowed to deduct from taxable income any balance of assessed loss incurred by that person in any previous year which has been carried forward from the preceding year of assessment, to the extent that the amount of such set-off does not exceed the higher of R1 million and 80 per cent of the amount of taxable income determined before taking into account the application of this provision.

The new provision means that to the extent that the balance of assessed loss exceeds 80 per cent of current taxable income, companies will be able to deduct the higher of R1million or 80 per cent of taxable income.

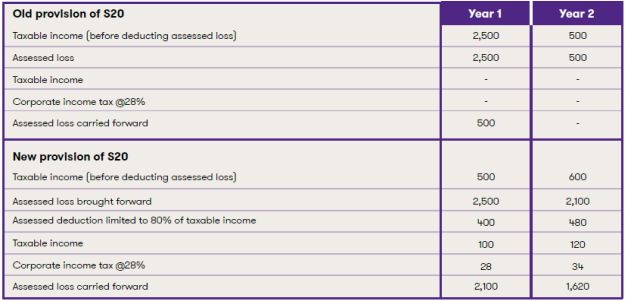

To illustrate the impact of the new provision, please refer to the example below relating a company:

The example above indicates that when applying the old provision in section 20 of the Act, in both year 1 and year 2 the company will not be liable to paying any tax amount as the assessed loss exceeds the taxable income in year 1 and is equal the taxable income in year 2.

However, under the new provision of section 20, in year 1, the assessed loss that will be allowed as deduction will be limited to 80% of the taxable income of R500. As a result, only R400 will the amount of the assessed loss that will be deducted from taxable income resulting in taxable income of R500. As a result, only R400 will the amount of the assessed loss that will be deducted from taxable income resulting in taxable income after assessed loss of R100 and income tax payable of R28.

Similarly, in year 2 the assessed loss deductible will be limited to R480 (80% of R600) resulting in taxable income of R120 and tax payable of R34.

This amendment to section 20 of the Income Tax Act is effective for companies with years of assessment ending on or after 31 March 2023. The above change will not only impact on taxable income for the years of assessment post the effective date but will impact recognition of deferred tax asset in relation to the assessed loss prior the effective date.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.