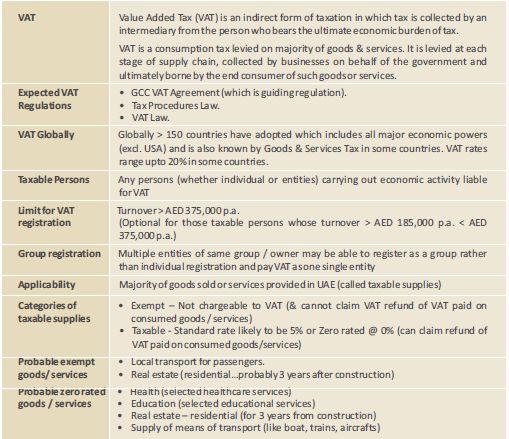

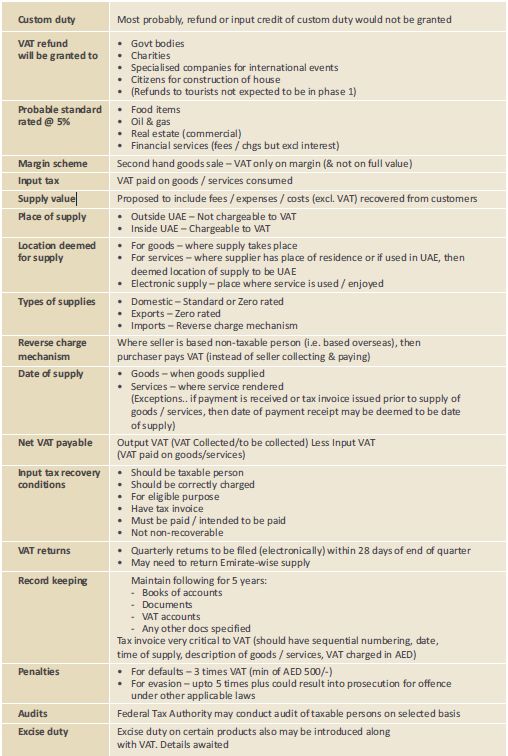

Gulf Co-operation Council countries agreed in 2015 for GCC wide implementation of VAT. UAE as a part of this drive to increase non-oil revenue has proposed to implement VAT on 1st Jan 2018. Federal Tax Authority has already been setup, which will oversee implementation & enforcement of VAT as well as any other forms of taxation that UAE may implement at any stage in future. Though guiding regulations viz. Tax Procedures Law and VAT Law are yet to be announced, some basic information regarding VAT & its implementation has been presented by UAE Ministry of Finance at various forums. We give herein below some basic information & issues in this respect though various specifics will be clearer only once the laws / regulations pertaining to this are announced.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.