In the last week of December, 2021, the Ministry of Justice published the Law Amending Certain Provisions of the Laws on Tax No. 01/NA, dated August 7, 2021, in the Government Gazette. The Law will come into force on January 1, 2022.

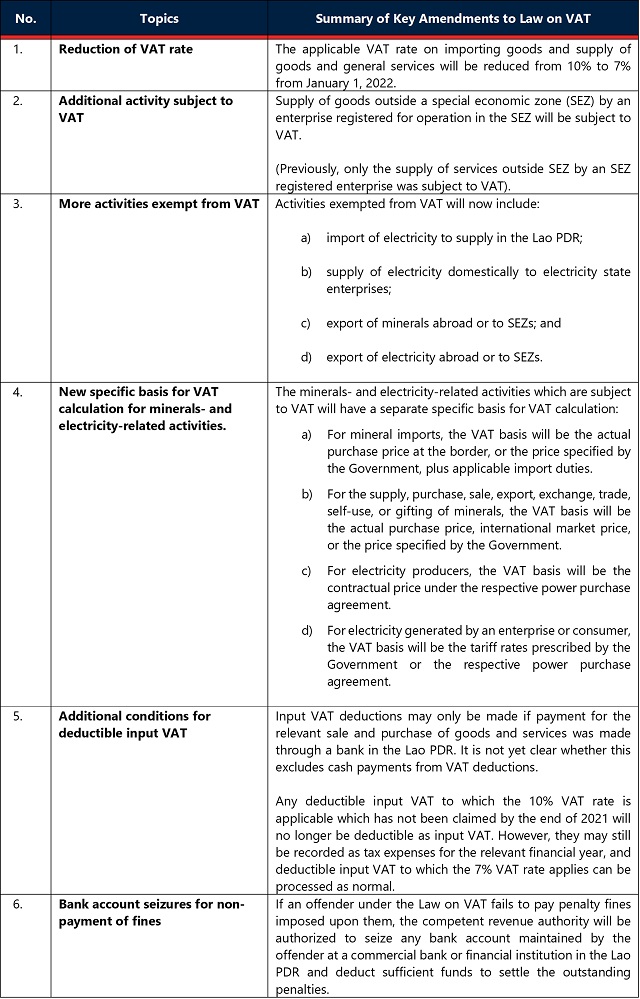

The most notable amendments relate to Value Added Tax (VAT), which are summarized below.

The new law also makes changes to the laws on tax management, income tax, and excise tax, which Tilleke & Gibbins will provide updates on in due course.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.