The combined effect of robust technology development and the prevalence of businesses based on the ICT utilization has served to promote the concept of Mobility-as-a-Service (MaaS) which integrates various forms of transportation services into one seamless service. MaaS allows users to combine the most appropriate transportation services based on their mobility needs with smartphone apps and offers them efficient and cost-effective routes to specific destinations. Of all the MaaS-related technologies, ride-hailing and car sharing have been drawing the most attention amongst the public. Multimodal transportation systems, which provide effective and comfortable transportation services available on demand, have also been becoming popular along with these technologies. This article analyzes patent filing trends in the self-driving technology and MaaS-related technology fields at the major five IP offices in the U.S., Europe, China, Korea, and Japan between 2014 and 2018.

Market trends

The autonomous vehicles (AVs) market has ramped up with ultimate goal of the AVs being full driving automation, Level 5 of the SAE standard (SAE: The Society of Automotive Engineers). It is expected that approximately 44 million units or over one third of the global units will achieve Level 3: conditional driving automation by 2040. In Japan, Honda Motor received type designation for their autonomous technology which fulfills Level 3 in November, 2020.

Following the AV market growth, the market size of MaaS is estimated to be worth about 19.5 billion USD in 2025 and 70 billion USD in 2030. As new business models have been created, the U.S.-based Uber and China-based DiDi were founded in 2009 and in 2012 respectively. Since then, other businesses related to MaaS have popped up in every corner of the world, expanding its scope to consumer delivery, logistics, bike-sharing, and so forth. MaaS has optimized human mobility and, through being able to collect mobility data, has created new business opportunities, enabling society to analyze various information. On top of that, MaaS has started to apply to logistics in addition to human mobility. Europe and the U.S. have actively developed regulations on AVs and MaaS whereas Japan has lagged behind building legislature, let alone the market growth. It seems that Japan is the midst of its transition period.

Furthermore, the development of MaaS technologies is attributed to the inherent needs for transportation in each country and region. In Southeast Asia, malfunctions in the transportation system encouraged the creation of ride-sharing services and Chinese and Singaporean companies are rising to the challenge. On the other hand, there is no dire need for ride-sharing services in Japan. This is because the Japanese public transportation system is sectionalized into each service, such as buses, railways, and taxis. Each of the transportation services independently exist and do not interact with other services.

Patent Filing trends

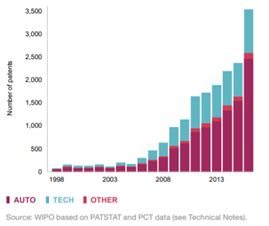

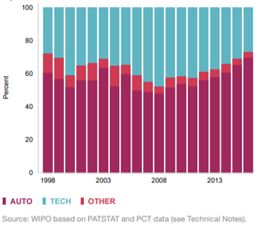

According to the statistics published by the World Intellectual Property (WIPO), the number of self-driving technologies has jumped since the late 2000's. Looking into a breakdown of the technologies, AI, robotics, and MaaS-related technologies have been behind the momentum of the increase, and these technologies account for nearly half of AV-related patents.

Fig. 1: Sectoral breakdown of AV-related patents by frequency

Fig. 2: Sectoral breakdown of AV-related patents by share

The Japan Patent Office (JPO) analyzed patent filing trends of self-driving technologies and MaaS-related technologies. The data below shows its results and our further analysis.

[Search conditions]

Year of filing (based on priority date): 2014 through 2018

Countries filed: U.S.A., Europe (except for Germany), Germany, China, Korea, and Japan

Detailed technology description:

( Self-driving )

vehicle-mounted sensor, dynamic map, telecommunication technology, recognition technology, anticipation technology, determination technology, operation technology, artificial intelligence, human machine interface, operational design domain, emergency response, operational management, remote control, driving assistance system, traveling modes, automatic driving control device, automation level, scene/place, challenge

( MaaS )

ride-hailing, carpooling, operational management/arrangement, enabling technology (vehicle control, passenger recognition), application (map display, route search, payment, etc.), collection of big data, application of big data, area of application, disaster prevention information, traffic information, scene/place, challenge

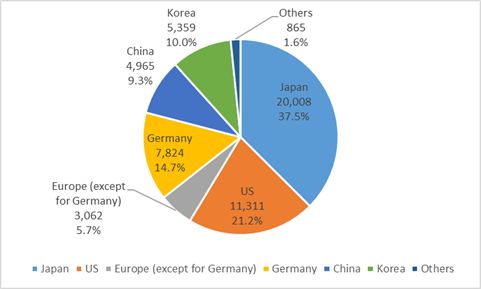

The following pie chart shows that Japanese companies have filed 20,008 cases which accounts for 37.5% of the total number of patent applications filed to the major IP offices in this technical field. The rest of the chart breaks down as follows: U.S.: 11,311 cases, Germany: 7,824 cases, Korea: 5,359 cases, China: 4,965 cases, other European nations: 3,062 cases.

Fig. 3 Ratio among applicants filing patent applications related to self-driving technology

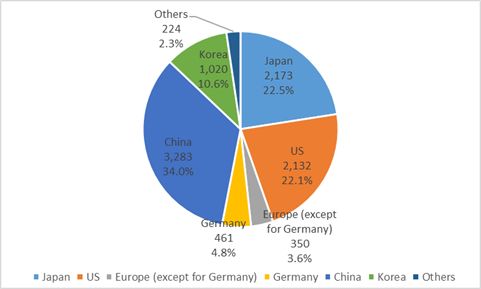

The pie chart showing the number of patent applications of MaaS-related technologies looks different from the above one. China leads this technical field with 3,283 cases, one third of the total cases. Japan follows China with 2,173 cases. The U.S. ranks third with 2,132 cases, Korea, fourth with 1,020 cases, Germany, fifth with 461 cases and other European countries last with 350 cases.

Fig 4: Ratio among applicants filing patent applications related to MaaS-related technologies

The above two charts prove that Japanese companies have actively engaged in the technical development of self-driving technologies, but they hold fewer patents and/or business models related to MaaS. Compared with the Japanese companies, Chinese companies have focused on developing a wide range of MaaS using human mobility data rather than self-driving technology itself. Taking a closer look at filing trends of the public transportation when categorized into bus, taxi, railway, etc., Chinese companies dominate the number of cases filed in every transportation service. In addition, taking a much closer look at a breakdown of technologies, Chinese companies predominantly file applications in the following technical fields: arrangement and payment via apps, application of big data on urban studies and planning, individual trip survey, and analysis of traffic flow analysis.

On the one hand, the U.S. companies exceed other applicants in the fields of reservation via apps, ride-hailing, and carpooling.

In summary, the above charts show that Chinese companies surpass other applicants in the various MaaS technical fields ranging from ride-hailing to data analysis.

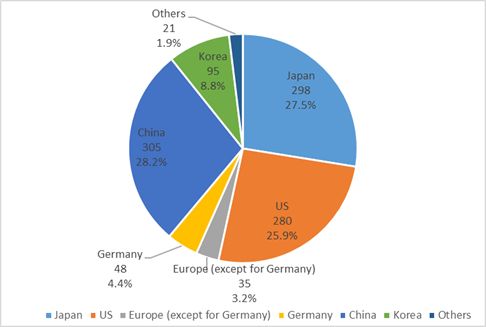

Moreover, the JPO calculated the number of patent applications related to multimodal transportation system. The following 1,082 cases were sorted out from among the above self-driving and MaaS-related applications. China (28.2%), Japan (27.5%), and the U.S. (25.9%) compete with each other in terms of the number of the patent applications.

Fig 5: Ratio among applicants filing patent applications related to multimodal transportation system

Having said that, Chinese companies have been filing more and more patent applications, which relate to multimodal transportation systems in each mobility service, and MaaS applications. Obviously, Chinese companies are key players in MaaS-related technologies.

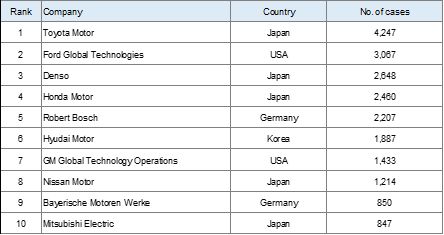

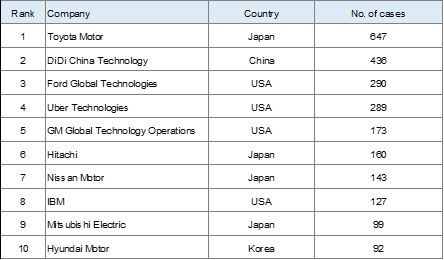

Top 10 ranking of applicants

The rankings below suggest that Japanese companies have a competitive edge in self-driving technology, but its filing activity in Maas is dull. These charts highlight the dominance of Chinese and US companies.

( Self-driving )

( MaaS-related technologies )

Market and filing outlook

As for R&D trends referred to in a number of scientific publications, European companies most actively publish papers while Japanese companies are completely different. As mentioned in the first part of this article, this is because Japanese transportation businesses are uniquely shaped by their services. Hence, the current transportation environment is less likely to create a MaaS-oriented system. In order to change the ecosystem, Japan needs to establish a multimodal transportation system that includes car sharing and on-demand transportation. Then, it is of great importance that companies regardless of automobiles or telecommunications can access a common pool of data and platforms based on MaaS. In addition, Maas technologies would further enhance and create a new business model by encompassing self-driving technologies.

Presumptively, new services and business models based on the mobility of humans and things will emerge in the future. Not only automakers and ICT companies but also start-ups, which are invested in by the industry, will make a foray into MaaS. Entrants and incumbent companies will generate disruptive innovation in response to users' demands.

Reference

- Technical trend report: Analysis of Maas from the view point of self-driving technology published by the Japan Patent Office in March 2021 (As of June 2021, Japanese only) https://www.jpo.go.jp/resources/report/gidou-houkoku/tokkyo/document/index/2020_03.pdf

- Auto and tech companies – the drive for autonomous vehicles, Chapter 3, World Intellectual Property Report 2019 https://www.wipo.int/edocs/pubdocs/en/wipo_pub_944_2019-chapter3.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.