"Net zero emissions" is a buzz word and a challenge every country is facing. In our newsletter of December 2020, we introduced an excerpt of the joint article by IAC and EPO, "EPO-IEA study: rapid rise in battery innovation playing key role in clean energy transition". As of 2021, Japan has set up a goal of zero net emissions by 2050. The use of renewable energy and electric vehicles is indispensable for realizing a carbon-free society, and the development of rechargeable battery technology is getting more attention. This article focuses on and analyzes four types of next-generation rechargeable batteries (which use materials other than lithium): potassium-ion batteries, sodium-ion batteries, magnesium batteries and calcium-ion batteries, with regard to their patent applications to the JPO.

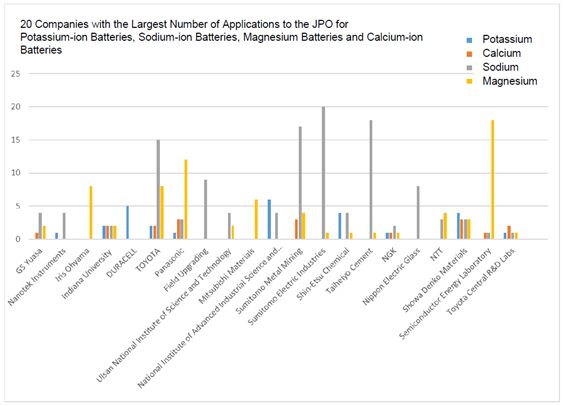

Top 20 Companies Filing Next Generation Batteries patent applications

The following graph shows the 20 companies filing the largest number of applications related to the aforementioned four types of batteries. It shows that each company tends to file applications across multiple types, despite many of them focusing on one type.

Resource: Cyber Patent Desk

Subject: patent publications and unexamined patent applications filed at the JPO from 2016 to 2020

Search conditions: We have extracted inventions related to "potassium, sodium, magnesium or calcium" x battery in abstract. We have excluded inventions related to "lithium battery" in the name and inventions not relating to batteries.

Many Japanese companies have ranked on the list. Meanwhile, the overall list, including companies outside the above ranking, has the following ratios based on the number of cases:

- Japanese companies to foreign companies is about 3:1

- Business enterprises to universities/public research institutes is about 6:1

Furthermore, we have also compared the number of applications filed by the top five companies for next generation batteries and their number of applications related to lithium-ion batteries. All of the companies have a large number of lithium-ion battery related applications, which is generally in proportion to their number of next generation battery applications.

| Company | The Number of Applications for Next Generation Batteries | The Number of Applications for Lithium-ion Batteries | |

| 1 | Toyota | 27 | 508 |

| 2 | Sumitomo Metal Mining | 24 | 118 |

| 3 | Semiconductor Energy Laboratory | 20 | 96 |

| 4 | Taiheiyo Cement | 19 | 48 |

| 5 | Panasonic IP Management | 14 | 71 |

Resource: NRI

We have extracted the title of the Invention: Lithium* Battery" x each applicant name for patent publication and unexamined patent applications filed at the JPO from 2016-2020.

Breakdown by Type

Next, we have analyzed the number of applications and applicants by type of batteries.

It shows a wide gap, with the number of applications related to sodium/magnesium being two to five times larger than the number of applications related to potassium/calcium.

| Types of batteries | Number of Cases | Top filing applicants |

| Potassium | 65 | National Institute of Advanced Industrial Science and Technology, Duracell US Operations (US), Toyota |

| Sodium | 260 | Toyota, Field Upgrading (US), Sumitomo Metal Mining, Sumitomo Electric Industries, Taiheiyo Cement |

| Magnesium | 204 | Semiconductor Energy Laboratory, Panasonic, Toyota, Iris Oyama |

| Calcium | 52 | Toyota (including group companies), Panasonic, Sumitomo Metal Mining |

Toyota, which filed many applications in all four of these

categories, shows a very positive attitude toward the R&D and

manufacturing of batteries. Toyota established Prime Planet Energy

& Solutions, which is a joint venture company with Panasonic,

on April 1, 2020. The company engages in the R&D, manufacturing

and sales of square-type lithium-ion batteries for hybrid and

electric vehicles (EVs), as well as the R&D and manufacturing

of all-solid-state batteries and other next generation batteries

for automotive use.

Summary

The EPO-IAE report mentioned that Japan and Korea are leading in the R&D of batteries describing that "The study also shows that Japan and South Korea have established a strong lead in battery technology globally.", and our analysis of applications to the JPO proves that Japanese companies accounted for the top applicants. In addition, it is also acknowledged that Japan has 41% of the inventors involved in global patent applications from 2014 to 2018, and that Japan already led the world in battery innovation in the 2000s, with the gap between Japan and other countries widening further in the past decade. Although it can be expected that the number of Japanese companies would be relatively high since the analysis in this article is based on applications to the JPO, the fact that nine of the top ten companies are Japanese can represent that Japanese companies are aggressively engaged in the R&D and patenting of next generation batteries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.