Introduction

2021 has been a landmark year for the Nigerian Oil and Gas Industry. With the conclusion of the marginal field bidding rounds and the passage of the Petroleum Industry Act (PIA), the Oil and Gas Industry is poised to attract the relevant the investment needed to reposition the industry. This is notwithstanding the challenges posed by the clean energy transition agenda. The Government is mindful of this fact and is focused on developing the midstream sector to harness the country's gas resources for the domestic market. Consequently, Nigeria is committed to accelerating the exploration and development of her petroleum resources before the lack of demand makes oil production less attractive. Unfortunately, the new Omicron variant of Covid-19 is already affecting oil price because of the adverse impact on demand triggered by the new restrictions and lockdowns imposed by various countries.

This edition of our newsletter focuses on some of the significant developments in the industry since our last publication.

1. Updates on the Petroleum Industry Act (PIA) 2021)

The President assented to the PIA on 16 August 2021. Subsequently, the President inaugurated the PIA Implementation Steering Committee ("the Committee") headed by the Minister of State, Petroleum Resources, Timipre Sylva to guide the effective and timely implementation of the PIA. Other members of the Committee include the Permanent Secretary-Ministry of Petroleum Resources, Group Managing Director- NNPC, Executive Chairman- Federal Inland Revenue Services, Representative of the Ministry of Justice, Representative of the Ministry of Finance, Budget and National Planning, Senior Special Assistant to the President on Natural Resources, Olufemi Lijadu as External Legal Adviser, while the Executive Secretary - Petroleum Technology Development Fund, will serve as the head of the Coordinating Secretariat and the Implementation Working Group.

The Committee was given a 12-month duration for the assignment, and periodic updates are to be provided to the President on the progress of the PIA implementation. However, it is doubtful whether the PIA can be fully operationalized within the defined time frame. Based on the amount of work required, the general expectation is that it will take between 18-24 months for the PIA to be fully operationalized.

As of now, the following activities have taken place:

- NNPC limited has been incorporated. Though the Board of the Company has been set up, the inauguration has been delayed due to certain issues relating to the Chairman of the Board.

- The Boards of the Nigeria Upstream Regulatory Commission (NUPRC) and the Midstream/Downstream Regulatory Authority have been inaugurated and staff transferred from the erstwhile regulatory agencies. Consequently, the Department of Petroleum Resources (DPR), Petroleum Products Pricing Agency (PPRA) and the Petroleum Equalization Trust Fund (PET) have been scrapped.

- The President has written to the National Assembly to consider expanding the number of the members of the governing boards of both regulators to reflect the six (6) geopolitical zones. Currently, each regulator comprises 9 members- 3 executives and 6 non-executives. It is, therefore, possible to have representations from all the 6 zones without necessarily increasing the number of the members. This will also help in managing the cost of governance, which has been a major concern since the concept of dual regulators was enshrined in the PIA.

2. The Upstream Commission's Website Launch

The NUPRC website is now live and has replaced the DPR's former website1. The website has several features, such as the Commission's profile, operations, guidelines, media, reports on oil prices, production and rig disposition.

Also, there are several publications, revenue information for various payments, operations and services, and the relevant Acts and Regulations available on the new website. A notice on the marginal field bid round, news on the inaugural board meeting of the NUPRC and the oil production status report as of October 2021 are some of the publications currently available on the NUPRC website. The expectation is that the Commission will upload new or updated regulations as soon as they become available.

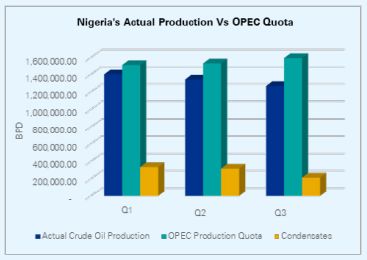

3. Nigeria's Actual Production vs OPEC Production Quota

In the first three (3) quarters of 2021, Nigeria was not able to meet its OPEC production quota. The average daily production during the first 9 months was 1.3 million barrels per day (This excludes condensate daily production of 300, 000 barrels per day as these do not form part of OPEC quota) compared to average OPEC production quota of 1.5 million barrels per day. The major reasons are oil theft, pipeline vandalism and technical issues in restarting reservoirs that have been shut in because of pipeline attacks and the need to comply with OPEC production quota.

The graph below illustrates the average daily production for crude oil, OPEC quota and condensates:

4. Oil Prices.

The average price per barrel for the brent crude, the benchmark for Nigeria's crude, for the first 9 months was about $70. The average price in November was about $80. Most investment banks are very bullish and expect oil price to rise to $100+ in 2022, notwithstanding the impact of the new Omicron variant and the possible release of strategic petroleum reserves (SPR) by some of the western countries. In fact, the SPR release is not expected to have any significant impact on oil prices and may even send prices higher in the future.

This bullish sentiment is driven by the prospects of a more vibrant global economy, OPEC's limited capacity to boost production and the premature shift to reliance on renewable energies, which is leaving many countries vulnerable to the weather and thereby increasing their dependence on fossil fuels. In other words, oil will continue to play a central role in meeting the world's energy need beyond 2050. The general expectation is that oil and gas investment will need to return to the pre- Covid 19 level of $525 billion to restore market balance. In 2021, the investment is estimated at $341 billion.

5. Stamp Duties Audit.

The Federal Government has now shifted the focus of the stamp duties audit to the oil and gas industry. This is not surprising given the importance of the sector to revenue generation. The audit started with government agencies that are saddled with the responsibility for generating revenue. Thereafter, it moved to the banking industry. According to the Federal Government, stamp duties will be second to oil revenue and has the potential to generate up to N1 trillion, if properly harnessed. Consequently, enforcement of the provisions of the extant law will be a priority in 2022. Operators, therefore, need to proactively review their records to determine their level of compliance and the related potential exposure. It is also important for companies to review their tax operating environment to evaluate the ability of their tax processes to capture transactions that are liable to stamp duties. To help companies manage the potential exposure, a stamp duties policy and procedural manual may be required in this regard.

Conclusion

The outlook for the global oil industry looks bright based on the general expectation that oil prices will continue to trend upwards until the imbalance in the market is restored. However, Nigeria can only benefit from the high oil prices if we are able to meet our average OPEC production quota by addressing the security and related technical problems relating to shut-in production. Meeting our quota has even become more critical given the fact that some of the oil exports will be diverted to meeting domestic needs when Dangote Refinery comes onstream. It is therefore imperative that the PIA 2021 results in aggressive exploration and development activities to boost our proved reserves, which can ultimately lead to an increase in our OPEC quota.

Though the PIA 2021 may not become fully operational within the next 12 months, it is important that operators conduct a review of their internal capabilities with a special focus on the business and operating models to drive their strategic response to the opportunities and challenges presented by the PIA. Companies in the sector must, therefore, identify the relevant compliance requirements in the PIA and plan towards meeting them in a proactive manner.

Footnote

1. https://www.nuprc.gov.ng/index.php

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.