Market Update

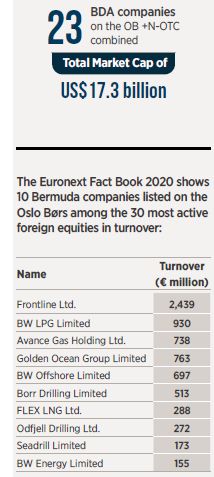

Welcome to Conyers' 2021 Norway Practice Bulletin. Our annual publication underscores the importance of the Norwegian market to our Bermuda corporate practice.

The 12 months since our last issue have been very different, to say the least, and something of a roller-coaster with second and third waves of Covid-19.

In general, 2020 was an especially difficult year for raising capital in the shipping sector. Across the segments total raised capital dropped 52% on 2019, according to Norwegian investment bank Fearnley Securities. Nonetheless, Oslo-listed Bermuda companies in the shipping and offshore energy sectors completed some offerings, including:

- Stolt-Nielsen's US$180.5 million bond offering in June 2020

- Avance Gas's $65m private placement of new shares in April 2021

- Frontline's $100 million public offering of ordinary shares in June 2020

- Golden Ocean's significantly oversubscribed private placement of new shares which raised US$337 million in February 2021

- Borr Drilling's US$46 million equity offering in January 2021 and US$32.8 million equity offering in two tranches in September 2020.

A few companies announced share buy-backs, including Flex LNG Ltd and GoodBulk.

M&A activity included New Fortress Energy Inc.'s acquisition of Hygo Energy Transition Ltd. and Golar LNG Partners LP for US$2.8 billion in January 2021, and the take-private of Höegh LNG Holdings Ltd. in May 2021.

Two Bermuda companies delisted in the past year: Team Tankers from the Oslo Børs, and Independent Tankers Corp. from the N-OTC.

Not surprisingly, we have seen a significant amount of restructuring activity, especially in the offshore energy sector. On page 3, we discuss different options for restructuring a Bermuda company.

While Bermuda's tourism industry has been badly hit by the pandemic, a bit of a silver lining has recently emerged with the announcement that Viking Ocean Cruises will homeport in Bermuda for the first time this summer. You can learn more on page 2.

Although once again the pandemic has prevented us from making our usual visit to Norway, we will be there virtually at the Capital Link Maritime Forum on 26 and 27 May, and hope to connect with you. We remain committed to our relationships with Norwegian law firms, defence clubs, shipowners and financial institutions and look forward to seeing you again.

Our Recent Transactions

- Advised Avance Gas in relation to a $65m private placement of new shares (Guy Cooper)

- Advised New Fortress Energy Inc. on its acquisition of Hygo Energy Transition Ltd and Golar LNG Partners LP. The combined transactions are valued at a US$5.1 billion enterprise value and a US$2.43 billion equity value. (Jason Piney, Robert Alexander, Amber Wilson)

- Advised Larus Holding Limited, a 50/50 joint venture company, between Leif Höegh & Co. Ltd. and funds managed by Morgan Stanley Infrastructure Partners in connection with the take private of Höegh LNG Holdings Ltd. (Guy Cooper, Edward Rance)

- Advising Seadrill Limited and its Bermuda subsidiaries on their joint Chapter 11 restructuring (Jennifer Panchaud, Niel Jones, Karoline Tauschke)

- Advising Seadrill Partners LLC and its Bermuda subsidiaries on their joint Chapter 11 restructuring (Jennifer Panchaud, Edward Rance, Angela Atherden, Aleisha Hollis)

- Advised Viking Cruises Ltd. in connection with its offering of US$350 million senior unsecured notes, and Viking Ocean Cruises Ship VII Ltd in connection with its offering of US$350 senior secured notes (Jason Piney, Andrew Barnes, Hailey Edwards, Aleisha Hollis)

- Advised Standard Chartered in relation to a US$374m facility for Hafnia (Guy Cooper)

- Acted for CMB Financial Leasing Co., Ltd. in relation to a three vessel sale and leaseback for Stolt Tankers Limited (Guy Cooper)

- Acted for a Norwegian Bank in relation to a restructuring of a Bermuda incorporated drilling company (Guy Cooper)

- Acted for various banks in connection with three separate facilities for Frontline Ltd. (Guy Cooper)

- Acted for Avenir LNG Limited in relation to a facility with Danske Bank (Guy Cooper, Andrew Barnes)

- Acted for Team Tankers in relation to the sale of Team Tankers Regional Ltd. to the De Poli Tankers Group (Guy Cooper, Aleisha Hollis)

- Advised Viking Cruises in connection with an additional US$500 million investment by its existing minority shareholders, TPG Capital and Canada P ension Plan Investment Board (CPP Investments), in parent company Viking Holdings Ltd. (Jason Piney, Jennifer Panchaud, Andrew Barnes)

- Advised Stolt-Nielsen on the issuance of NOK1.5 billion (US$180.5 million) senior unsecured bonds (Guy Cooper, Andrew Barnes)

- Advised Viking Cruises Ltd. in connection with its private offering of US$675 million senior secured notes (Jason Piney, Andrew Barnes)

Viking Cruise Ship Homeports in Bermuda for First Time

Bermuda will be a homeport f or a major cruise line for the first time in the summer of 2021, as cruise companies seek new options to return to safe sailing.

Viking Ocean Cruises plans to homeport the Viking Orion in Bermuda for June and July. It is offering six eight-day cruises that will take passengers out into the Atlantic Ocean and into the island's three ports at Hamilton, St. George's and Dockyard.

In a press release, Torstein Hagen, chairman of Viking, applauded the government of Bermuda for its "collaboration and support in restarting the cruise industry safely."

The Viking Orion will reduce its regular passenger capacity by half. Only those who are vaccinated against Covid-19, and children with clear t est results, will be allowed to join the cruises. The crew will also have been vaccinated.

Cruise ship companies with interests in Bermuda include Carnival, Norwegian Cruise Lines, Princess Cruise Lines, Seabourn Cruise Lines and Viking Cruises.

Restructuring a Bermuda Company

Conyers has seen a significant amount of restructuring activity over the past year, in particular in the offshore energy sector. The firm advised Valaris on its US$7.1 billion restructuring and emergence from Chapter 11 bankruptcy and is advising Oslo-listed Seadrill Limited and Seadrill Partners LLC on their respective Chapter 11 restructuring plans. There is no one-size-fits-all approach to a restructuring and every company's situation will call for a different approach.

'Light Touch' Provisional Liquidation

Provisional liquidation is an insolvency process supervised by the Bermuda courts that is often used in a restructuring as a way to protect the company from creditor claims while the company devises and implements a recovery plan. This process is being used in the Seadrill Limited Chapter 11 restructuring.

Provisional liquidation can be used by any company incorporated in Bermuda, including those listed overseas and which have their operations overseas. Several court precedents have confirmed that Bermuda provisional liquidation proceedings are recognised in other jurisdictions.

Bermuda law allows for a 'light-touch' provisional liquidation, in which the provisional liquidators are appointed with limited powers. This means that day-to-day control of the company remains in the hands of the existing directors, but the provisional liquidators work alongside them to effect the restructuring. If successful, the provisional liquidators are then discharged and the company would continue as a going concern.

Bermuda Scheme of Arrangement

For a Bermuda-incorporated company, a court-supervised scheme of arrangement is often the most straightforward and cost-effective option, even if the company is listed on a foreign stock exchange and its operations are based overseas.

A Bermuda scheme of arrangement is a court-approved arrangement between a company and a class or classes of its creditors and/or shareholders, most commonly used for effecting insolvent restructurings by way of a debt-for-equity swap or other debt-reduction strategy. Such a scheme is typically less expensive than reorganisation procedures such as Chapter 11 bankruptcy and can generally be completed in around 6-8 weeks.

The Bermuda Supreme Court has very wide jurisdiction in respect of schemes of arrangement, allowing it to facilitate the restructuring of companies with complex cross-border operations. The statutory regime allows Bermuda companies listed on the NYSE, Nasdaq, or the Oslo Børs, for example, to restructure their financial liabilities without duplicating proceedings in other jurisdictions where their operations or creditors are based.

For a scheme to be approved, it requires the support of a majority in number representing 75% in value of those voting in each class. If this majority has been obtained and the Bermuda Court has sanctioned the scheme, it will be binding on all affected stakeholders within the same class and there is relatively little which can be done by dissenting stakeholders to prevent a scheme from taking effect.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.