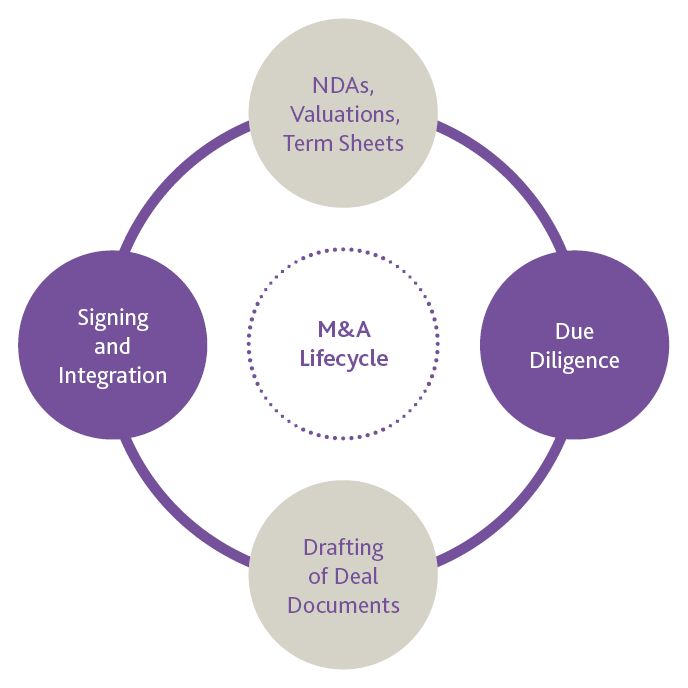

Our M&A lifecycle series delves into the intricate details of an M&A deal. So far, we have looked at the particulars of NDAs and valuations, to highlighting the importance of due diligence and risks.

The third part of our M&A Lifecycle series focuses on the key documents required for a typical M&A deal and the drafting of them, namely the Share Purchase Agreement ("SPA") and Disclosure Letter.

The SPA

The crucial document. The SPA will cover what shares in the target company ("Target") are being sold, the price payable by the buyer (including how that is structured), risk apportionment between the seller and the buyer and when / how completion of the sale and purchase will occur. In M&A transactions between unrelated parties, the SPA is usually heavily negotiated in light of the protective provisions both buyer and seller seek (to mitigate their risk of being liable for often significant claim amounts). The key touch points include:

- Consideration – Whilst an indicative

price (or enterprise value) is likely to have been negotiated at an

early stage between the parties (and their financial advisors), the

SPA documents the

details of this and will consider whether and how pricing is

structured and how any adjustments to such price, which is based on

certain assumptions, will be made. As the valuation of a business

is subjective, this helps manage price and performance risk for a

buyer. The common mechanisms used to do this include:

- Price adjustments: These may involve the use of Locked Box Accounts or Completion Accounts. When using Locked Box Accounts, a price is fixed pre-completion for the Target based on a set of accounts (the Locked Box Accounts), with provisions included within the SPA to prevent monies being taken out of the business prior to completion (leakage). Where Completion Accounts are used, a provisional price will be listed for the Target in the SPA, but special purpose accounts (i.e. Completion Accounts) are prepared post-completion to show what the Target was actually worth at the completion date. Adjustments are then made accordingly to the purchase price.

- Deferred payments (including earn-outs): These are usually structured as further payments to the seller to align with the performance of the business over a period of time post-completion. Deferred consideration allows buyers to bridge any valuation gap by offering a smaller initial payment and also (subject to performance related targets being agreed) protects the buyer from business-related risks (underperformance and/or unknown liabilities). Earn-out structures are frequently used where founder or management sellers are retained to ensure such sellers are incentivised to continue to grow the business through the promise of target-related payments.

- Risk apportionment – Buyers will seek to mitigate their risk when acquiring a business with all its assets and liabilities by including warranties (statements of fact, which the seller must disclose against if untrue prior to completion) and indemnities (these cover known/material issues for which the buyer may recover monetary compensation for the extent of any loss suffered) in the SPA. Warranties will cover all relevant areas of the business and run up to several pages long. Indemnities are usually only sought for key issues identified in the due diligence or disclosure process. The seller will conversely seek to mitigate their risk by limiting (in time and monetary value) the claims that can be made by the buyer. Warranty and indemnity insurance is increasingly utilised (and affordable) in the GCC region as a risk-management tool and can provide flexible coverage depending on the parties' requirements. This is particularly pertinent for buyers where the seller remains in the business and the buyer would feel less comfortable bringing a claim against them directly, or where there is significant covenant strength risk attached to the seller.

- Pre-completion and completion matters – In any given transaction, parties may identify certain conditions which need to be satisfied pre-completion for the transaction to go ahead. These may require the seller to rectify certain material issues identified through due diligence or may require the parties to obtain regulatory or other approvals for the transaction. Sellers will want to carefully review any proposed conditions to ensure they are reasonably achievable (and within their control). In the period between signing the SPA and completion, the buyer is also likely to seek protection to ensure the Target's business will continue to be run in the ordinary course. The SPA will also deal with completion deliverables (usually documents to be delivered to the other party at completion) and post-completion obligations (usually business-related matters the buyer would like the seller to deal with after completion where the seller is remaining as a shareholder). Timing for completion will also need to be addressed, and the parties will need to consider any jurisdiction-specific requirements to finalise the transfer (such as any requirement for notarised, legalised and attested documents).

The above is by no means a complete guide to provisions in an SPA but does give an overview of some of the key provisions parties may come across.

Disclosure letter

Alongside the SPA, the disclosure letter plays an important part in the transaction in giving a seller the opportunity to tell the buyer about risks in purchasing the business and so reduce any potential liabilities post-transaction. The disclosure letter is used to provide the seller an opportunity to make specific statements against the warranties in the SPA where they have knowledge that makes these statements untrue. Whilst this can be a time-consuming process, it is fundamental to reduce or avoid the risk of a warranty claim by the buyer.

Takeaways

The typical M&A transaction relies on a multitude of detailed legal documents including both the SPA and disclosure letter to ensure a negotiated risk apportionment position between seller and buyer is reached. Although this process is carried out countless of times by M&A lawyers, it involves absolute attention to detail and careful consideration and preparation. Comprehensive and well-drafted deal documents serve as a foundation for a successful M&A transaction from both parties' perspective.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.