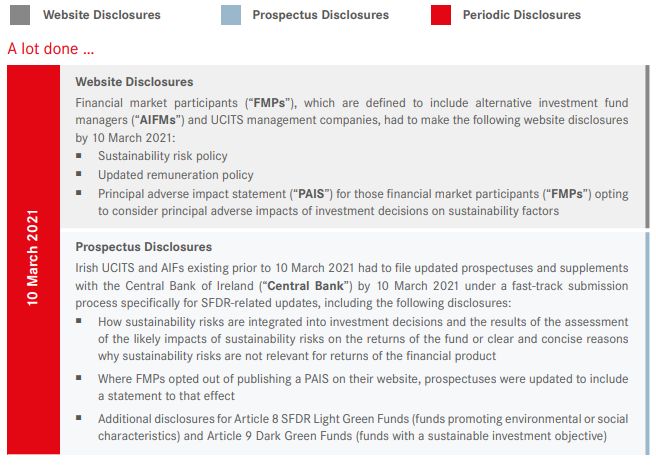

With the passing of the 10 March 2021 deadline for compliance with the Level 1 requirements under the EU Sustainable Finance Disclosure Regulation ("SFDR"), investment funds and fund management companies are now in the next phase of preparing for compliance with both the SFDR requirements and the EU Taxonomy Regulation by the next key date of 1 January 2022. The tables below set out the key steps that have been taken so far and the next steps in implementing these new requirements.

Download >> Sustainable Finance – Next Steps For Investment Funds (PDF)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.