The fundamental principles of estate planning are seamless succession of assets and protection of assets from all legal & fiscal risks. Proper estate planning protects the property from unforeseen circumstances. Further, due to apprehensions of bringing "inheritance tax" or "estate duty" back in India, promoters of all the family-managed listed companies are moving towards protecting their listed shares by forming private trust for the benefit of their family members. A "Private Trust" provides a mechanism for promoters to retain the control and management of the listed company within the family members and devolving the management to the new generation efficiently Also, the legislative changes such as Insolvency and Bankruptcy Code, 2016, Fugitive Economic Offenders Act, 2018, Companies Act, 2013, Black Money Act, 2015, Income Tax Act, 2016 etc., has made imperative for the promoters to protect the ownership and management of the company. Forming a Private Trust offers the preservation of shares and safeguards from the credit risk.

Formulating trusts offers numerous advantages, including effective inheritance and tax planning, particularly for children in jurisdictions with inheritance tax, and maintaining the confidentiality of financial transactions. Trusts also provide a means for tax planning in anticipation of potential inheritance tax reintroduction in India and help ring-fence assets from various risks. They facilitate succession planning for operating companies, ensuring inter-generational family control over businesses, and allow for the staggered distribution of wealth or distribution based on specific events. Additionally, trusts grant control over the usage of funds beyond one's lifetime, ensure wealth is utilized in the event of incapacitation, and enable a portion of the estate to be distributed to a non-relative, who can challenge the distribution only after it has occurred.

Private Trust in India

In India, a Private Trust serves as an effective tool for succession planning, allowing the settlor to oversee its implementation during their lifetime and make timely corrective actions if necessary. A trust demonstrates family unity and enables joint control of family wealth through the trust deed, facilitating collective decision-making and reducing the likelihood of disputes and legal conflicts. Additionally, it can streamline the process of family separation, ensuring a smooth and well-defined transition.

Private trusts are straightforward to operate and are not subject to heavy regulation. Compliance with statutory formalities is minimal, as the Indian Trusts Act, 1882 is an enabling legislation that lacks stringent regulatory provisions. This flexibility allows for the necessary distribution and accumulation of assets and ensures ultimate succession or separation as intended. Unlike other entities regulated by laws, a trust is primarily governed by its trust deed.

Confidentiality is a key feature of private trusts, as information about them is not publicly accessible unless they are registered. This privacy has made private trusts a popular choice for succession planning over generations, especially in light of potential inheritance tax implications.

Typically, property settled into a private trust for succession planning purposes is transferred irrevocably. The settlor does not retain the power to reclaim the trust property or income, nor to transfer it back to themselves. Once assets are settled in an irrevocable trust, they no longer belong to the settlor but to the trust itself. This arrangement provides robust protection against creditor claims or issues arising from divorce. Under the erstwhile Estate Duty Act, 1953 ("ED Act") (abolished in 1985), if the settlor retained any rights, including becoming a beneficiary, the property could be considered as passing upon the settlor's death, thereby incurring estate duty. This is why irrevocable trusts are typically preferred for succession planning, except in special circumstances.

Private trusts can be classified based on their distribution pattern into specific (determinate) or discretionary (indeterminate) trusts. A specific trust identifies beneficiaries and their respective shares in the trust deed. Conversely, a discretionary trust does not specify beneficiaries' shares, granting trustees the authority to determine these shares. This discretion can be either absolute or qualified. Under the ED Act, specific trusts, where beneficiaries' interests were identified, would be subject to estate duty upon the death of a beneficiary. However, discretionary trusts, where no specific interests were assigned, avoided estate duty as no property was deemed to pass upon a beneficiary's death. This made discretionary trusts a common mechanism for estate duty planning. Depending on the requirements, a combination of specific and discretionary trusts (both irrevocable) may be employed for effective succession planning and potential estate duty mitigation.

Further, when structuring a trust that seeks to house promoter/promoter group shares of public companies, one has to be mindful of the various Securities and Exchange Board of India ("SEBI") regulations/orders governing the subject.

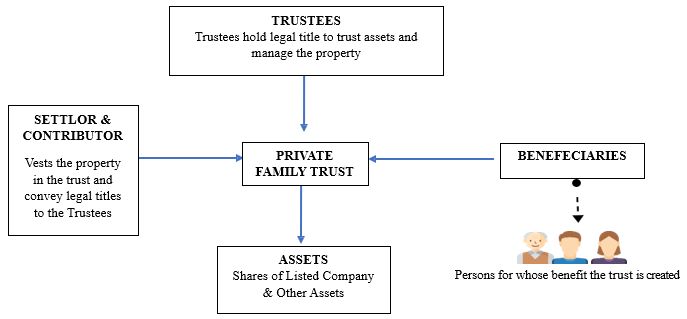

Formation of Private Trust

Trust vehicles are used for administering and controlling assets, guarding the interests of the beneficiaries through asset protection, devolving the assets, retaining the control of the company among family members and ensuring the distribution of income and assets as per the desires of the settlor.

Taxability of Contribution to Private Family Trust

Section 56(2)(x) of the Income Tax Act, 1961 governs the taxability of gifts. It provides that any person (donee/recipient) receiving a sum of money, or an immovable property or any other specified property from any other person (donor) without consideration or for an inadequate consideration i.e. less than the fair market value of the property or stamp duty value in case of an immovable property, is liable to be taxed on the value of such gift.

Exemption provided under section 56(2)(x) of the Income Tax Act, 1961:

Clause (X) of the proviso to section 56(2)(x) states that "This clause shall not apply to receipt of property or money from an individual by a trust created or established solely for the benefit of relative of the individual." Clause (X) of the proviso to section 56(2)(x) states that receipt by a trust from an individual would be exempt if the beneficiaries are the relatives of the individual.

Implication of Takeover Code

When a promoter settles shares of a listed entity into a Private Trust created for the benefit of his family members, the settlement entails an open offer obligation on the acquirer trust since the substantial acquisition of shares is involved in the settlement. SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 ("Takeover Code") compels the 'Acquirer' to give a mandatory open offer as soon as the trigger point is nudged as mentioned in Regulation 3, 4 and 5 of the Takeover Code.

Major professionals opine that this acquisition doesn't entail a mandatory open offer requirement on the acquirer trust as the control of management and ownership of shares vest with the family members only post settlement too. Also, the shareholding post-settlement would remain the same in substance and mirror of promoter's shareholding.

Since the settlement in the trust would require the acquirer trust to give a mandatory open offer, it would be necessary for the acquirer trust to take an exemption order from SEBI for the proposed acquisition under Regulation 11 of the Takeover Code.

Triggers to Open Offer

Initial Trigger: As per Regulation 3(1) of the Takeover Code, an acquirer along with Persons Acting in Concert (PACs) acquiring shares or voting rights resulting in entitlement of 25% or more voting rights of the target company is required to give mandatory open offer.

Creeping Acquisition: As per Regulation 3(2) of the Takeover Code, any acquirer who, along with PACs, holds 25% or more of the shares or voting rights but less than the maximum permissible non-public shareholding limit in a target company, is required to make a mandatory open offer on the additional gross acquisition, in a financial year, of more than 5% of the shares or voting rights of such target company.

Transfer of Control Trigger: As per Regulation 4 of the Takeover Code, irrespective of the acquisition or holding of shares or voting rights in a target company, an open offer is mandated for direct or indirect acquisition of control by an acquirer.

Indirect Acquisition Trigger: As per Regulation 5 of the Takeover Code, the acquisition of shares or voting rights in, or control over any company or entity which triggers the thresholds set in Initial Trigger, Creeping Acquisition and Control Trigger. Such indirect acquisition would be deemed to be a direct acquisition if the proportionate net asset value/sales turnover/market capitalization of the target company is in excess of 80% of the business entity being acquired.

Open Offer Requirement for Settlement in Trusts

In the case of listed companies, open offer obligations are triggered when there is the transfer of shares or voting rights in excess of certain prescribed limits under the Takeover Code.

Settlement of substantial shares of a listed company to a private trust (created by promoter for his family members) would necessitate the acquirer trust to give a mandatory open offer since the transaction of settlement may fall under Regulations 3, 4 & 5 of the Takeover Code.

Though the control and ownership are not getting transferred since the trust created by promoters and promoters are mirror of the substance, but the law requires the acquirer trust to give an open offer.

Regulation 10 (general exemptions) of the Takeover Code provides exemptions when an open offer is triggered. Regulation 10 is especially relevant to this topic as it exempts acquisitions pursuant to (i) inter se transfer amongst qualifying persons (promoters, related parties); (ii) acquisitions in the ordinary course of business by merchant banker, stock broker, scheduled commercial bank, underwriter etc; (iii) subsequent acquisition pursuant to the agreement of disinvestment for which public offer has been made; (iv) acquisitions under corporate debt restructuring scheme or strategic debt restructuring scheme of Reserve Bank of India ("RBI"); (v) acquisition by way of transmission, inheritance or succession; (vi) acquisition pursuant to the scheme of amalgamation, merger, demerger pursuant to the order of National Company Law Tribunal ("NCLT") & other specified authorities; (vii) acquisitions pursuant to the delisting in accordance with delisting regulations (viii) acquisition pursuant to rights issue, buy-back of shares; and (ix) acquisition as per resolution plan sanctioned under Insolvency and Bankruptcy Code, 2016. Acquisition in accordance with the will of the testator is exempted under Entry no. 5. It is to be noted that any transaction which is not mentioned above require specific exemption under Regulation 11 of the Takeover Code from SEBI. Hence, in this Regulation 10 of the Takeover Code the settlement in trust is not covered in the list. Hence, promoters have to seek an exemption route given under Regulation 11 of the Takeover Code from SEBI.

Exemptions by SEBI under Regulation 11 of the Takeover Code

Regulation 11 (Exemptions by the Board) of the Takeover Code empowers SEBI to grant exemption(s) from the mandatory open offer on a case-to-case basis by passing an order subject to such conditions which it deems fit to impose in the interest of investors in securities and securities market. The order is passed by assessing the exemption application submitted by the proposed acquirer.

Hence, the acquirer trust has to apply to SEBI before the proposed acquisition. For claiming exemption under Regulation 11 of the Takeover Code, the acquirer trust has to file an application with SEBI along with a duly signed/notarised affidavit and a non-refundable fee, giving details of the target company and the proposed acquisition and the grounds on which exemption has been sought, along with a copy of the board resolution authorizing such application where the acquirer is a body corporate. Soft copies are also to be emailed to an email ID mentioned in the Exemption Circular.

The question of "transfer of control" is debatable for the settlement of shares as the control & ownership are not getting transferred to the third party, hence, no open offer requirement should be triggered. As per the Takeover Code, acquirer trust file application with SEBI under Regulation 11 of the Takeover Code with SEBI for claiming exemption.

SEBI Exemption Circular

An increase in exemption applications under Regulation 11 of the Takeover Code more specifically with respect to transactions involving trust was observed in past. With a view to streamline the process of filing SEBI came out with a circular no. SEBI/HO/CFD/DCR1/CIR/P/2017/131 dated December 22 ("Exemption Circular"), 2017 providing for a standard format containing the guidelines and conditions along with undertakings to be given by the acquirer trust whilst applying for exemption under the Takeover Code. SEBI clarified their position on "settlement of trust" and made a standard operating procedure for application under Regulation 11 of the Takeover Code. The Exemption Circular has been made in accordance with the SEBI orders imposing conditions as imposed by SEBI in past numerous exemption orders. The Exemption Circular now finds a place in the "Master Circular" for the Takeover Code dated 16 February 2023.

Basic Contents for Exemption Application

- Application must be filed by the acquirer trust or person authorized by the acquirer trust in the format prescribed in the Exemption Circular.

- Executed trust deed to be submitted with the application.

- The application should contain basic information about the acquirer or the person authorized by the acquirer such as name and Permanent Account Number ("PAN") details.

- Details about filing fees, other exemption applications along with any direction by SEBI against the acquirer or PAC or pending proceedings against them is to be provided.

The Exemption Circular prescribes the conditions, compliances and undertakings which need to be captured in the trust deed/application in order to be eligible for an exemption.

- Compliance with the Following Conditions in the Trust Deed

The following compliance and undertaking need to be followed in the trust deed:

- The trust shall only be a mirror image of the promoter's holdings i.e. there is no change of ownership or control of the shares or voting rights in the target company.

- Only individual promoters or their immediate relatives or lineal descendants are the trustees and beneficiaries of the trust.

- Beneficiaries beneficial interest is not and will not be transferred, assigned or encumbered.

- Distribution of assets of the trust among the beneficiaries or their legal heirs only upon dissolution of trust.

- The trustee is not empowered to transfer or delegate their powers except among themselves.

- Compliance with the Following Conditions in the Application

The following compliance and undertaking need to be followed in the trust deed:

- Requirement to disclose change in trustees / beneficiaries /change in ownership or control of shares or voting rights held by trust.

- Disclosure regarding the same shall be made to SEBI or stock exchanges within two (2) days of such change.

- The ownership or control of shares or voting rights vests with the trustees and also the beneficiaries indirectly.

- The liabilities and obligations of individual transferors will not change or get diluted due to transfers to the Trust.

- The Trust shall confirm, on an annual basis, that it is in compliance with the exemption order passed by SEBI.

The above shall be disclosed to stock exchanges under disclosure requirements, following certification from an auditor along with a copy endorsed to SEBI for its records.

Further, exemptions are granted when the following additional conditions are complied when:

- The proposed acquisition is in accordance with the provisions of the Companies Act, 2013 and other applicable laws;

- The transferors are disclosed as promoters in the shareholding pattern filed with the stock exchanges for a period of at least three (3) years prior to transfer (except for holding on account of inheritance);

- There is no layering in terms of trustees / beneficiaries in case of trusts; and

- The trust deed agreement does not contain any limitation of liability of the trustees / beneficiaries in relation to the provisions of the SEBI Act, 1992 and all regulations framed thereunder.

Pre-Exemption Circular Case Study in which SEBI Granted Exemption Under Regulation 11 of the Takeover Code

In the matter of NIIT Technologies Limited (Order No. SEBI/WTM/SR/CFD–DCR/10/03/201 dated March 07, 2017)

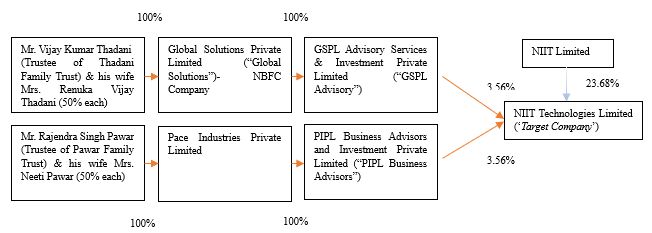

An application was made by the Thadani Family Trust and Pawar Family Trust (collectively referred as 'Acquirers Trusts' in this matter) seeking exemption from the applicability of Regulation 3(1), Regulation 4 and Regulation 5 of the Takeover Code in the matter of proposed acquisitions of shares and voting rights in NIIT Technologies Limited ('Target Company') by Acquirer Trusts.

The exemption was sought from SEBI for the below acquisition:

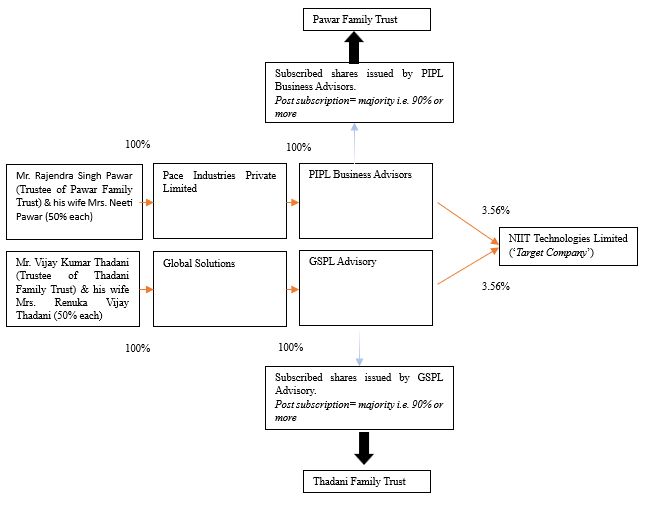

STEP 1: Mrs. Renuka Vijay Thandani, as art of the succession planning, wife of Mr. Vijay Kumar Thadani will transfer shares of Global Solutions i.e., 50% to her husband. As Global Solutions is a registered NBFC, an application was filed with the Reserve Bank of India seeking approval for the aforementioned transfer. The above transfer will be exempted under Regulation 10(1)(a) of the Takeover Code as they both are declared promoters of the Target Company.

STEP-2: Thadani Family Trust ("TFT") intends to subscribe to such number of shares of GSPL Advisory such that post subscription, TFT would hold majority i.e. 90% or more, of GSPL Advisory and thereby, indirectly acquire ownership and control over 21,75,911 shares (3.56%) of the Target Company. Similarly, Pawar Family Trust ("PFT") intends to subscribe to such number of shares of PIPL Business Advisors such that post subscription, PFT hold majority i.e. 90% or more, of PIPL Business Advisors and thereby, indirectly acquire ownership and control over 21,75,911 shares (3.56%) of the Target Company. Exemption application under Regulation 11 of the Takeover Code was filed for taking exemption for Step-2 only. Step-1 is exempted under Regulation 10 of the Takeover Code i.e. inter-se transfer between qualifying person.

Thus, pursuant to the above-mentioned subscription of shares of GSPL Advisory and PIPL Business Advisors, Thadani Family Trust and Pawar Family Trust will acquire ownership and control (i.e. proposed indirect acquisition) over 43,51,822 shares (7.12%) in the Target Company.

Major issues was the proposed transactions of the Acquirers along with PAC would acquire indirect control over the Target Company thus triggering Regulation 5 of the Takeover Code. Exemption from open offer obligation was sought.

In the aforesaid matter, Hon'ble Whole Time Member Shri G. Mahalingam granted exemption to the Proposed Acquirer, as there will be no change in control & management of the target company. The Target Company's equity share capital held by GSPL Advisory and PIPL Business Advisors (7.12%) will be transferred to Thadani Family Trust and Pawar Family Trust respectively, wherein the Promoters Mr. Vijay Kumar Thadani and Mr. Rajendra Singh Pawar of the Target Company are one of the Trustees in the respective Family Trusts.

Pictorial representation of the case:

Following the issuance of the Exemption Circular by SEBI, numerous applications for exemption were filed under Regulation 11 of the Takeover Code, which were subsequently granted by SEBI. These exemptions were contingent upon compliance with the conditions outlined in the Exemption Circular. Although these conditions are indicative, SEBI has consistently adhered to them when granting exemptions. For example, a corporate shareholder or promoter is prohibited from becoming a beneficiary or trustee of a trust. Consequently, promoters must carefully assess and structure private trusts to meet their specific needs while ensuring compliance with SEBI's regulations.

Conclusion

It is important to note that the aforementioned guidelines specifically apply to shareholders who are part of the promoter or promoter group when settling their shares into a trust. These guidelines do not extend to other categories of shareholders engaging in similar actions. Further, we recommend conducting a thorough analysis of the exemption orders issued by SEBI to date before approaching SEBI under Regulation 11 of the Takeover Code. This analysis will help in evaluating the likelihood of a favourable outcome, understanding the typical timeframe for SEBI to issue an order, and preparing exemption applications that are more closely aligned with regulatory expectations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.