1. INTRODUCTION:

The Ministry of Corporate Affairs ('MCA') continues to reign supreme by barring Metec Electronics Private Limited (hereinafter referred to as 'Metec India' / the 'Company') from entering into any fresh agreements with Metec group of companies based in China and Hong Kong consequent upon its failure to disclose links with the Chinese group under Section 89 and 90 of the Companies Act, 2013.

MCA in its order dated 8 January 2024, has imposed a penalty totalling to more than Rs. 21,00,000/- (Rupees Twenty-One Lakhs) on Metec India and its officers in default, in exercise of powers conferred by Section 454(1) and 454(3) of the Companies Act, 2013 (hereinafter referred to as the '2013 Act') read with Companies (Adjudication of penalties) Rules, 2014. 2.

2. BACKGROUND:

Adjudication proceedings u/s 118 of the 2013 Act were already on-going against the Company.

During the course of hearings, it emanated that there exists a company that goes by the name Metec Electronics Co. Ltd. (hereinafter referred to as 'Metec China') incorporated under the laws of China / Hong Kong and the name closely resembles Metec India and is also dealing in the same business as Metec India.

Further, it was observed that Dongguan Meisen Electronics Limited and Shenzhen Beyear Appliance Co. Ltd., both the Companies incorporated under the laws of China, were one of the primary suppliers of the Company. However, the representatives of the Company did not admit to any direct relationship between the foreign companies and Metec India other than that of a supplier and buyer relationship.

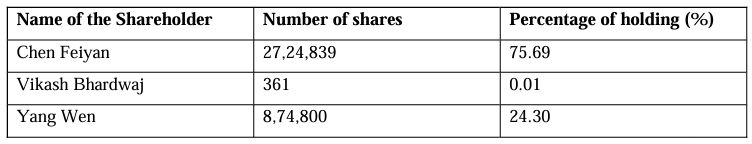

Shareholders of the Company: As per the Annual Return filed by the Company for FY 2021-22, the shareholders of the Company were the following individuals:

It is portrayed by Metec India that it is a standalone entity with a foreign shareholding by 2 (two) foreign nationals and 1 (one) Indian national.

However, as per the financial statements filed for FY 2021-22, the Company reported that the following entities are held under 'common control':

- Shenzen Beyear Appliances Co. Ltd.

- Shenzen Applesun Electronics Co. Ltd.

- Dongguan Meisen Electronics Co. Ltd.

(collectively referred to as 'Metec group of companies of China'), thereby failing to give proper disclosures about its shareholding or the manner in which the beneficial interest in the shares is being exercised.

Directors of the Company: The Directors of the Company include the following:

In one of the replies, the Company submitted its organization chart wherein Mr. Hu Jiangping was the Operation Director of the Company and Mr. Yang Wen was the Technical Director who reported to Mr. Hu Jiangping.

Mr. Subodh Kumar (the sole Indian Director) reported to Mr. Hemant Pandey – CEO who in turn reported to Mr. Hu Jiangping.

No role of Ms. Chen Feiyan, Director of the Company was mentioned anywhere.

It was also noted that the email ID of Ms. Chen Feiyan was manager@empireaudio.com. Upon research it revealed that the domain empireaudio.com was Alibaba Cloud Computing (Beijing) Co. Limited. Further, the website of Metec China shows the domain name as empireaudio.com. In the matter of CIRP proceedings of Metec China, the signature on an authorisation letter of representative matched with that of Ms. Chen Feiyan.

This gives a clear indication that Ms. Chen Feiyan was linked to Metec China

Upon thorough scrutiny of the documents including applications made for common trademark in India and China, CIRP proceeding documents by Metec China, websites and LinkedIn pages of the Metec group of companies of China, and information available on the registry of Companies of China, ROC found the Company's links to the Metec group of companies of China.

The Ultimate Beneficial Owner in the Metec group of companies of China was Mr. Hu Jiangping and Mr. Yang Wen was a supervisor in one of the Metec companies. Both these people were also associated with Metec India and are working as employees. As per the organisational chart it was clear that the significant beneficial owner in terms of Section 90 was Mr. Hu Jiangping.

The ROC had sufficient reason to believe that the registered owner and beneficial owner of the shares in the Company were different and the Company ought to have declared its Significant Beneficial Owner in terms of Section 89 and 90 of the 2013 Act.

Consequently, ROC issued show cause notices under Section 89 and 90 of the Companies Act, 2013 to the Company. The Company denied all non-compliances as reported in the show cause notices.

The Company stated that it is independently incorporated by individual shareholders and has no legal relationship with the Metec group of companies of China except for supply-purchase relationship.

The Company also denied the observation of ROC in relation to the role of the Director – Ms. Chen Feiyan. It submitted that Ms. Chen Feiyan discharges her due responsibilities as a Director and Shareholder of the Company. The observation made by ROC that the Board of the Company is not exercising any powers of the management was also denied by the Company. It further submitted that the employees of Company are senior operation managers of the Company looking into business operations of the Company and merely work reporting to any officer of a company does not mean that the senior officer has a control over the management and hence, reporting under Section 89 and Section 90 under 2013 Act is not required.

3. ANALYSIS:

Relying on the findings and proofs, the ROC noted that there is an apparent and undeniable link between the Indian and Chinese Company, while the shareholding details reflect a strong attempt to mask this linkage. It is not possible for Metec India to negate its own filings whereby it has declared the aspect of 'common control'.

The ROC concluded that Metec India has not correctly portrayed its shareholding in India, to suggest that it is standalone entity with only individual shareholders whereas it is entirely run and controlled by Metec Electronics Co. Ltd. [Hong Kong/China] and its group companies. Further, Mr. Hu Jiangping is the ultimate beneficial owner exercises actual control in the Metec group of companies of China and a clear linkage is established between Metec India and the Metec group of companies of China. While Mr. Hu Jiangping has no direct holdings in Metec India and neither holds any statutory directorship position in the Company, yet he exercises control in the functioning of the Company.

Metec India failed to undertake the necessary steps to identify individual(s) who is/are significant beneficial owners in relation to the Company. In view of the above facts and circumstances, the default under sections 89 and 90 were established, the ROC imposed the penalties on the Company and the officers in default aggregating Rs. 21,37,800/- (Rupees Twenty-One Lakhs Thirty-Seven Thousand Eight Hundred)

The parties to the default are debarred from entering into any fresh agreements with and making any payments to Shenzen Beyear Appliances Co. Ltd., Shenzen Applesun Electronic Co. Ltd. and Dongguan Meisen Electronics Co. Ltd. or any other entity or person of the Metec group of companies in China/Hong Kong, except in case of goods already received or goods in transit as on the date of order. This restriction is placed till Metec India has completed the necessary filings to declare the names of registered owner and beneficial owner of the shares of the Company.

The ROC has directed the Company to file BEN-2 with respect to all such individuals within a period of 60 (sixty) days from the date of the order.

The payment towards the penalty amount is to be made within 90 (ninety) days of receipt of the order along with a proof of penalty paid.

4. CONCLUSION:

MCA has time and again reinforced the significance of disclosures and high governance standards, this time by cracking down the undisclosed links with Chinese group and barring the Indian Company from entering into any sorts of fresh agreements or make payments to the said Chinese group. The order underscores the importance of full and complete disclosure in matters of ultimate beneficial ownership.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.