REGULATORY UPDATES

GST LAW

NOTIFICATIONS

- Notification No. 16/2021 – CT, dated 01.06.2021. The CBIC has appointed 01.06.2021 on which Section 50 of CGST Act, 2017, which mandates the payment of interest on net cash liability, will come into force with retrospective effect from 01.07.20217.

- Notification No. 17/2021 – CT, dated 01.06.2021. The CBIC has extended the due date for furnishing GSTR-1 from 11.06.2021 to 26.06.2021 for the month of May, 2021.

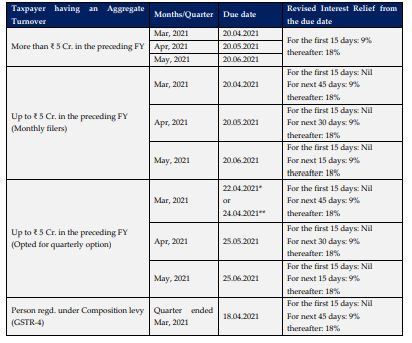

- Notification No. 18/2021 – CT, dated 01.06.2021. The CBIC has provided the relief to the taxpayers w.r.t. the interest payable on the output tax liability if paid after the due dates for the respective period, as represented below. The same shall come into force w.e.f. 18.05.2021.

*Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Pondicherry, Andaman and Nicobar Islands, Telangana, and Andhra Pradesh.

**Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, and Odisha

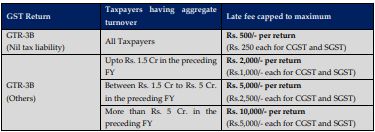

- Notification No. 19/2021 – CT, dated 01.06.2021. The CBIC has rationalized the late fee for the taxpayers who delays in furnishing GSTR-3B, as represented below. The same shall come into force w.e.f. 20.05.2021.

This has been a substantial reduction from the earlier capping of the total of Rs. 10,000/- per return (Rs. 5,000/- each for CGST and SGST).

Under the amnesty scheme, the relief provided to taxpayers by reducing the rate of late fee for pending return.

At present, section 47 provides for late fee wherein the maximum late fee capping stands at Rs. 10,000 per return (Rs. 5,000/- each for CGST and SGST), which has been reduced substantially for the benefit of defaulting taxpayers.

Reduced late fee capping applies only if the pending returns are furnished between 01.06.2021 and 31.08.2021.

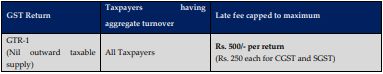

- Notification No. 20/2021 – CT, dated 01.06.2021. The CBIC has reduced/waived the late fee for the taxpayer who delays in furnishing GSTR-1, as represented below. The same shall come into force w.e.f. 01.06.2021.

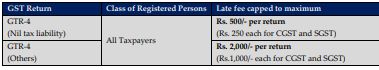

- Notification No. 21/2021 – CT, dated 01.06.2021. The CBIC has reduced/waived the late fee for the taxpayers who delay in furnishing GSTR-4, as represented below. The same shall come into force w.e.f. 01.06.2021.

- Notification No. 22/2021 – CT, dated 01.06.2021. The CBIC has capped the maximum late fee to Rs. 2,000/- per return (Rs. 1,000 each for CGST and SGST) and reduced to Rs. 50/- per day (Rs. 25 CGST + Rs. 25 SGST) for taxpayers who delay in furnishing the GSTR-7. The same shall come into force w.e.f. 01.06.2021.

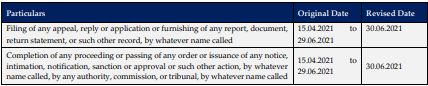

- Notification No. 24/2021 – CT, dated 01.06.2021. The CBIC has provided the relaxation of the time limit for compliance (which falls during the period from 15.04.2021 to 29.06.2021 till 30.06.2021) under GST Law as follows:

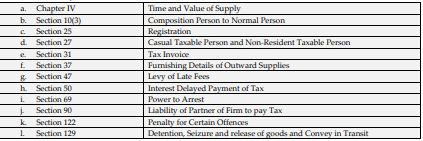

However, such extension of time shall not be applicable for the compliances of the following provisions of the said Act, namely: -

Provided that where any time limit for completion of any action by any authority or by any person, specified in or prescribed or notified under rule 9 of the Central Goods and Services Tax Rules, 2017 falls during the period from 01.05.2021 to 30.06.2021, and where completion of such action has not been made within such time, then the time limit for completion of the action shall be extended upto the 15.07.2021.

Also, in cases where a notice has been issued for rejection of refund claim, in full or in part and where the time limit for issuance of an order in terms of the provisions of sub-section (5), read with sub-section (7) of section 54 of the said Act falls during the period from 15.04.2021 to 29.06.2021, the time limit for issuance of the said order shall be extended to fifteen days after the receipt of the reply to the notice from the registered person or 30.06.2021, whichever is later.

- Notification No. 25/2021 – CT, dated 01.06.2021. The CBIC has extended the due date from 30.04.2021 to 31.07.2021 for furnishing the GSTR-4 for the F.Y. 2020-21. The same shall come into force w.e.f. 31.05.2021.

- Notification No. 26/2021 – CT, dated 01.06.2021. The CBIC has extended the due date from 25.04.2021 to 30.06.2021 for furnishing ITC-04 for Jan-Mar, 2021. The same shall come into force w.e.f. 31.05.2021.

- Notification No. 27/2021 – CT, dated 01.06.2021. In addition to the above-captioned reliefs, the CBIC has provided few more reliefs to the taxpayers, as represented below. The same shall come into force w.e.f. 01.06.2021.

- Companies are allowed to file GSTR-3B and GSTR-1 (including IFF) by using the electronic verified code (EVC) till 31.08.2021.

- Rule 36(4) of CGST Rule, 2017 restricts the availment of input tax credit beyond 5% of the ITC reflected in Form GSTR 2A/2B. However, the said restriction will not apply in individual months of Apr, May and Jun, 2021 but will apply cumulatively for the period Apr, May and Jun, 2021 and the return in FORM GSTR-3B for the month of Jun, 2021 is to be furnished with the cumulative adjustment of input tax credit for those months.

- Registered person may furnish details of outward supplies using Invoice Furnishing Facility (IFF) for the month of May, 2021 between the period 01.06.2021 to 28.06.2021.

ADVISORY/INSTRUCTIONS

- Rule 60(7) of CGST Rules 2017 prescribes for generation of the auto-drafted statement containing the details of input tax credit in FORM GSTR-2B for counter-party recipients. As per Rule 60(8) of CGST Rules 2017, FORM GSTR-2B shall be made available to the recipients after the due date of filing GSTR-1/IFF by the suppliers. Notification No. 12/2021-CT and 13/2021-CT, both dated 01.05.2021 extend the due date of GSTR-1 and IFF for April 2021, to 26.05.2021 and 28.05.2021, respectively.

Consequently, GSTR-2B for April 2021 will be generated on 29.05.2021, after the due date of filing GSTR-1/IFF. Taxpayers willing to file FORM GSTR-3B for April 2021 before GSTR-2B generation may do so on a self-assessment basis. Notification No. 13/2021-CT dated 01.05.2021 prescribes a cumulative limit under Rule 36(4) for ITC claimed in periods April and May 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.