In steps to further liberalise and simplify the foreign direct investment ("FDI") regime in India and with the objective of providing major impetus to employment and job creation in India, the Government of India has announced sweeping changes to the FDI policy. It is stated that most of the sectors would now be under the automatic approval route except for a small negative list. The last 2 years have witnessed major FDI policy reforms in a number of sectors including in defence, insurance, broadcasting, single brand retail trading, manufacturing, civil aviation and asset reconstruction companies. Changes now introduced include increase in sectoral caps, bringing more activities under automatic route and easing of conditionalities for foreign investment. Brief details of the changes are as follows:

(a) Food products manufactured/produced in India – 100% FDI is now permitted under the Government approval route for trading including through e-commerce.

(b) Foreign Investment in Defence Sector up to 100% – The following changes have been made:

- FDI beyond 49% is now permitted through the Government approval route in cases resulting in access to modern technology in the country or for other reasons to be recorded. The condition of access to 'state-of-art' technology has been done away with.

- FDI limits for defence sector is applicable to manufacturing of small arms and ammunitions covered under the Arms Act 1959.

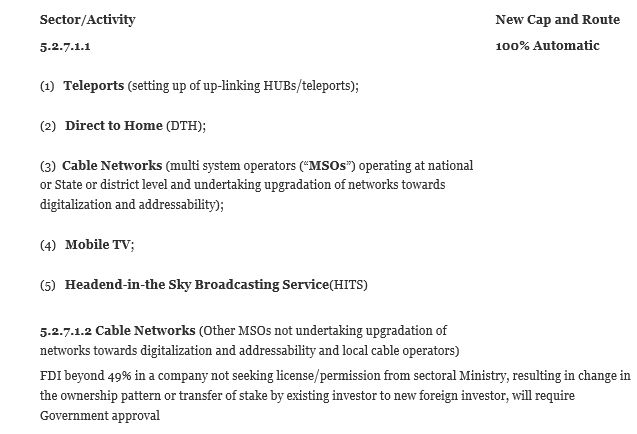

(c) Broadcasting Carriage Services –New sectoral caps and entry routes on broadcasting carriage services are as under:

(d) Pharmaceuticals – The existing FDI policy already allows 100% FDI under the automatic route in greenfield pharmaceuticals and up to 100% FDI under the Government approval in brownfield pharmaceuticals. Upto 74% FDI is now permitted under the automatic route in brownfield pharmaceuticals – beyond 74% FDI, Government approval is required.

(e) Civil Aviation

| Existing FDI policy | New FDI Policy | |

| Airports (Greenfield projects) | Upto 100% under the automatic route | No change |

| Airports (Brownfield projects) | Upto 74% under the automatic route and beyond 74% require Government approval | Upto 100% under the automatic route |

| Scheduled air transport service/ Domestic scheduled passenger airline and regional air transport service | Upto 49% under the automatic route | Upto 100% – with upto 49% under the automatic route; beyond 49% require Government approval |

(f) Private Security Agencies – Upto 49% FDI is now allowed under the automatic route, beyond 49% FDI and up to 74% FDI would be permitted with Government approval.

(g) Establishment of branch office, liaison office or project office – If the principal business of the applicant is defence, telecom, private security or information and broadcasting and where Government approval or license/permission from the concerned Ministry/Regulator has already been granted, approval of the Reserve Bank of India or separate security clearances would not be required.

(h) Animal Husbandry – The requirement of "controlled conditions" specified for FDI in animal husbandry (including breeding of dogs), pisciculture, aquaculture and apiculture, has been done away with.

(i) Single Brand Retail Trading – Local sourcing norms relaxed for upto 3 years and a relaxed sourcing regime for another 5 years for entities undertaking single brand retail trading of products having 'state-of-art' and 'cutting edge' technology.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.