Outbound investments made by Indian resident individuals and entities into foreign funds such as alternative investment funds, venture capital funds, etc., are regulated by the foreign exchange laws in India. While such law seeks to primarily regulate inward and outward fund flows in India, the interplay between the commercial exigencies to make investments and the legal regime presents a difficult and confusing terrain. This article seeks to simplify and summarize the legal provisions and their implications on such fund investments.

Introduction

Investments made into foreign funds by Indian resident individuals and entities are governed by the provisions of the Foreign Exchange Management Act, 1999 ('FEMA') and the Overseas Investment Rules, 2022 and the regulations and master directions issued along with such rules (collectively referred to as 'OI Rules').

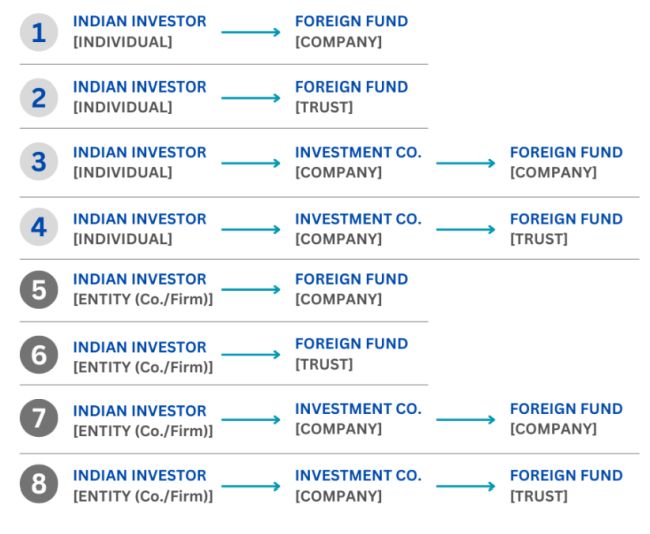

As noted above, the investments could be made either by resident individuals or by entities (including companies, partnership firms, LLPs, etc.). Additionally, the investee fund could be constituted either as a foreign company or a foreign trust. Further, the investment could be made indirectly into funds, i.e., investment in a foreign company which would in turn invest in the foreign fund.

These multiple investment scenarios can be tabulated as follows, and the implications under FEMA and OI Rules are being discussed thereafter.

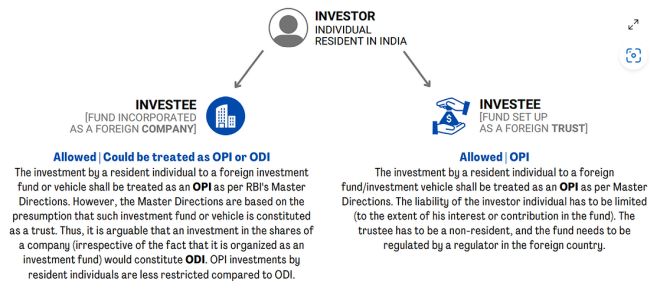

I. Investments by Resident Individuals

Resident individuals may make investments in foreign funds organized as a company or a trust. As per the OI Rules, such investment may be treated as an Overseas Portfolio Investment ('OPI'). The implications under FEMA and OI Rules, in cases where the resident individual directly invests in the fund, have been diagrammed as follows:

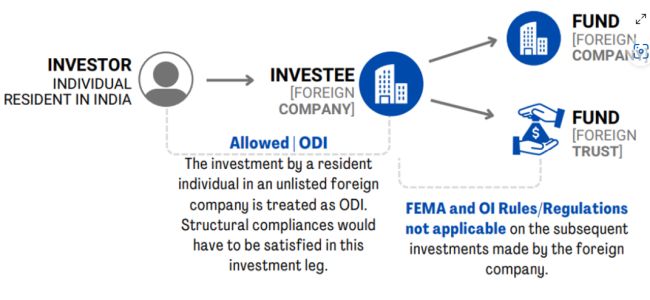

Investments, on the other hand, made by the resident individual through another foreign company (e.g., an investment company promoted by such individual), involve the following conclusions and implications under FEMA and OI Rules.

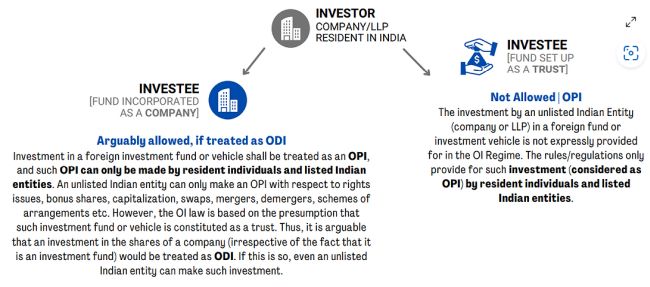

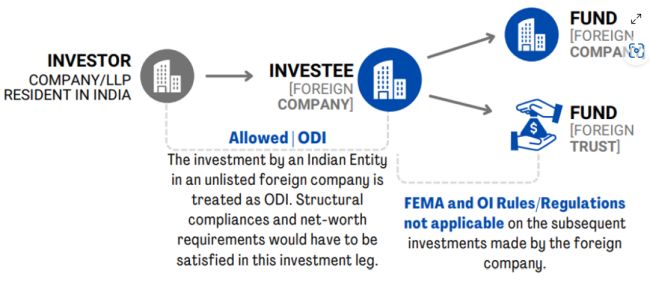

II. Investments by Indian entities (companies/partnership firms / LLPs)

Indian entities, including companies, partnership firms, and LLPs, may also make investments into foreign funds organized as a company. However, as per the OI Rules, investments made by an Indian entity into a foreign fund organized as a trust are not allowed. The implications under FEMA and OI Rules, in cases where the resident entity directly invests in the fund, have been diagrammed as follows:

In cases where the investment is made indirectly through a foreign company, the investment is allowed under FEMA and OI Rules. The implications are as follows.

Conclusion

While the FEMA and OI Rules lay down a comprehensive regime for outbound investments made by resident individuals and entities, direct investments by Indian entities into foreign trusts have been restricted. This is primarily due to a lack of transparency in foreign trust structures and the absence of proper formal instruments signifying the ownership and beneficial interests of the parties.

The resident investors, individuals, and entities alike, would need to conform to reporting and other regulatory requirements such as net-worth criteria, limitation of liability and other structural conditions laid down in the OI Rules to remain fully compliant with Indian laws. The absence of such compliance would result in making the structure vulnerable to scrutiny by the Reserve Bank of India and the Directorate of Enforcement, wherein the remedial measures (including litigation, compounding, late submission fees etc.) could be time-consuming and costly and attract directions to wind up the structure resulting in greater economic losses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.