The Full-Bench of Hon'ble Supreme Court comprising of Justice UU Lalit, S. Justice Ravindra Bhat and Justice PS Narasimha in the matter of Experion Developers Private Limited Vs. Sushma Ashok Shiroor1 have delivered a landmark judgement wherein it held that Consumer Protection Act and the RERA Act neither exclude nor contradict each other and are concurrent remedies operating independently and without primacy. The Court further observed that when Statutes provisioning judicial remedies fall for construction, the choice of the interpretative outcomes should also depend on the constitutional duty to create effective judicial remedies in furtherance of access to justice. The present case analysis aims to probe various modalities of the judgements and bring to fore the key facets of the facts, issues and ruling.

Facts in brief:

- Consumer booked an apartment measuring 3525 sq. ft. for a total consideration of Rs. 2,36,15,726/- in the Windchants and agreed for construction linked payment plan, which led to the execution of the Apartment Buyer's Agreement dated 26.12.2012 with M/s. Experion Developers Private Limited (Developer).

- As per Clause 10.1 of the Agreement, possession was to be given within 42 months from the date of approval of the building plan or the date of receipt of the approval of the Ministry of Environment and Forests, Government of India for the Project or date of the execution of the agreement whichever is later.

- Clause 13 of the Agreement provided for Delay Compensation. Under this clause, if the Developer did not offer possession within the period stipulated in the Agreement, it shall pay liquidated damages of Rs. 7.50 per square foot per month till possession is offered to the Consumer.

- Consumer approached the National Disputes Redressal Commission by filing an original complaint being, Consumer Case No. 2648/2017, alleging that he has paid a total consideration of Rs. 2,06,41,379/- and possession was not granted even till the filing of the complaint and sought for refund of Rs. 2,06,41,379/- along with interest @ 24% p.a.

- Developer filed its Written Statement stating that though the 42 months period expires on 26-6-20164, the purchaser will only be entitled to delay compensation under Clause 13, for a sum of Rs. 4,54,052/- and claimed that since possession can be handed over, the complaint must be dismissed.

- The Commission vide its judgement dated 19.06.2019 allowed the complaint by holding that Agreement is one-sided, heavily loaded against the allottee and entirely in favour of the Developer and directed refund the amount of Rs. 2,36,15,726/- with interest @ 9% p.a. The Commission it appears relied upon the judgement delivered by Hon'ble Supreme Court in the case of Pioneer Urban Land and Infrastructure Ltd. v. Govind Raghvan.

- Aggrieved by the same, both Developer and Consumer (challenging Commission's order granting limited extent of grant of enhanced interest) have filed the appeals.

Submissions:

- The Developer contended that decision of the Court in Pioneer has no application to the facts of the present case, as in Pioneer, the Court did not have to deal with Delay Compensation Clause like in the present case and argued that no prejudice would be caused to the Consumer if he is asked to take possession of the property. It was further contended that the Consumer has elected to proceed under the Consumer Protection Act, 1986 and therefore the provisions of RERA Act will not apply and the Pioneer cannot be followed as a precedent.

- The Consumer while supporting the decision of the Commission on all counts contended that the rate of interest granted by the Commission is far too low and urged for enhancement of the rate of interest to @ 24% p.a. as demanded by her in the petition before the Commission.

Issues framed:

- Whether the terms of the Apartment Buyers Agreement amount to an 'unfair trade practice' and whether the Commission is justified in not giving effect to the terms of Apartment Buyer's Agreement as laid down in the Pioneer case?

- Whether the Commission has the power under the Consumer Protection Act, 1986 to direct refund of the amount deposited by the Consumer with interest?

- Whether the relief granted by the Commission require any modification to serve ends of justice?

Findings of Hon'ble Supreme Court:

- The principle laid down in Pioneer's case has been followed consistently in many cases where the terms of the Apartment Buyer's Agreement were found to be one-sided and entirely loaded in favour of the Developer, and against the allottee at every step.

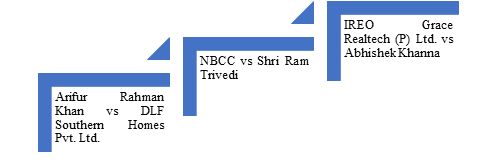

- The following cases were referred to where the terms of the

Apartment Buyer's Agreement were found to be oppressive,

constituting unfair trade practice and were not given effect to

such terms of the Agreement by the Hon'ble Supreme Court:

- The Hon'ble Supreme Court after referring to clauses 10.1 and 13.1 of the Agreement relating to project completion period and delay compensation observed that the trigger date for Clause 10.1 is 26.12.2012, which is the date of execution of the apartment buyer's agreement and the Commission calculated 42 months from this period, which turns out to be 26.06.2016. Further, adding the grace period of 180 days, the time for delivery would expire on 26.12.2016. The Supreme Court further noted that it is again an admitted fact that the occupancy certificate was obtained only on 23.07.2018 and notice for possession was issued to the Consumer on 24.07.2018 held that Developer cannot compel the apartment buyers to be bound by the one-sided contractual terms contained in the Agreement.

- The Developer raised on contention that the Consumer, having elected to proceed under the Act, the provisions of the RERA Act will have no application. The Hon'ble Supreme Court relying upon the judgements delivered in the matters of (i) IREO Grace and Imperia Structures Ltd. v. Anil Patni observed that Consumer Protection Act and the RERA Act neither exclude nor contradict each other. When Statutes provisioning judicial remedies fall for construction, the choice of the interpretative outcomes should also depend on the constitutional duty to create effective judicial remedies in furtherance of access to justice. A meaningful interpretation that effectuates access to justice is a constitutional imperative and it is this duty that must inform the interpretative criterion.

- The Hon'ble Supreme Court on addressing the issue of refund of amount observed that the power to direct refund of the amounts and to compensate a consumer for the deficiency in not delivering the apartment as per the terms of Agreement is within the jurisdiction of the Consumer Courts. The Supreme Court after referring to Section 14 and 2(g) of the Consumer Protection Act held that Commission is empowered to direct refund of the price or the charges paid by the consumer. The freedom to choose the necessary relief is of the Consumer and it is the duty of the Courts to honour it.

- The Hon'ble Supreme Court on the issue of claim of interest held that interest has to be paid from the date of the deposit of the amounts and not from the date of last deposit and accordingly allowed the appeal filed by the Consumer partly.

Conclusion:

This decision is going to have an impact on developers that rely on one-sided agreements to deprive buyers of certain remedies. It reflects the approach of Courts against the delays and defaults by various real estate developers and is a welcome step for saving the rights of buyers. It also recognized the right of the consumer to choose relief(s) against erring developers. In the wake of this decision, developers should (i) review existing standard form agreements and consider updating one-sided clauses to reflect more reasonable terms; and (ii) if using one-sided clauses, make sure that these clauses are unambiguous, clearly set out the implications of such clauses.

Footnote

1. Civil Appeal Nos. 6044 and 7149 of 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.