Indian State Governments offer varied incentives under their respective state industrial development corporation policies to promote the set-up of new manufacturing units in the state. Such incentives are in the form of capital subsidies, interest subsidies, subsidized electricity tariffs, and more. The purpose of such incentive schemes is to attract investment thereby enabling infrastructure development, generating employment, developing focus sectors, and largely facilitating the overall economic development of the state.

To enable the availability of a quick summary of such general incentives offered by various Indian states, Nexdigm is releasing a series of documents focusing on providing a brief overview of such incentives offered by respective State Governments in India. This document covers information about incentives offered by Punjab under the 'Punjab Industrial and Business Development Policy 2022'.

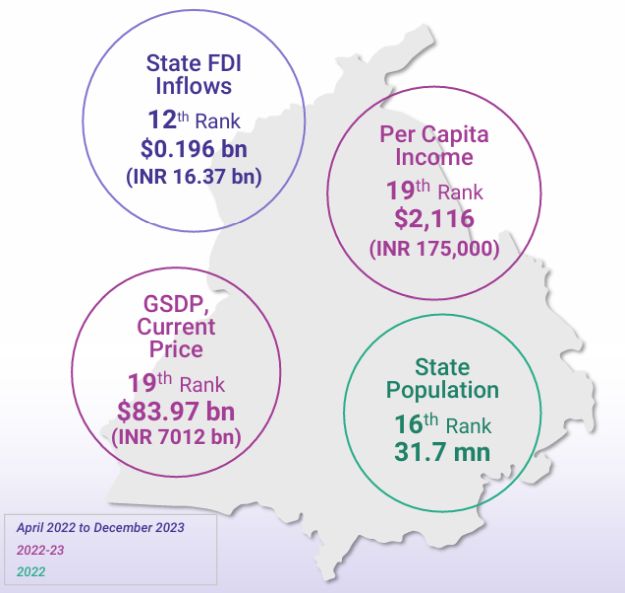

KEY STATISTICS | PUNJAB

POLICY OVERVIEW

Punjab, located in the northwest region of India, stands out as an economic powerhouse by contributing 2.5% to the nation's GDP. Recognized as a 'Top Achiever' in the 2020 Business Reforms Action Plan (BRAP) ranking, Punjab is committed to enhancing its appeal as the preferred investment destination.

To this end, the Punjab State Government has introduced the 'Punjab Industrial and Business Development Policy 2022,' effective from 17 October 2022 to 16 October 2027. This policy is geared towards accelerating industrial growth and fostering job creation within the state.

NEXDIGM RATINGS AND OBSERVATIONS

- Net SGST Reimbursement and Electricity Duty Exemption are the two major incentives outlined in this policy.

- Unlike other states, there is no specific regional classification. These incentives are available to all eligible units, regardless of their location.

- Punjab offers special incentives to start-up units when compared to other states.

- Incentives are also available to eligible service sectors within MSME and 'Large Units' (Appendix 1), with seven service activities identified as priority sectors.

- Enterprises engaged in manufacturing activities (as outlined in Appendix 2) will not be eligible for incentives.

Note: The information/data used for the ratings is

subjective based on our assessment of the policy, the experience of

Nexdigm professionals in dealing with State Authorities,

digitization of select statutory requirements, etc.

POLICY HIGHLIGHTS

Industry Classification

Manufacturing enterprises, for the purpose of the scheme, are classified under different categories based on the quantum of investment in Eligible Fixed Assets (EFA), which have been briefly tabulated below:

| Industry | Investment in Eligible Fixed Assets (EFA) |

|---|---|

| Start-up Units | Units registered for no more than 10 years with an annual turnover not exceeding INR 1,000 million in any previous financial year that are dedicated to innovating, developing, or enhancing products, processes, or services. |

| MSME Units | Minimum investment in plant & machinery up to INR 500 mn and turnover up to INR 2,500 mn |

| Large | Units not falling within the definition of MSME units |

| Mega | Minimum Fixed Capital Investment (FCI) between INR 15,000 mn and INR 25,000 mn, and minimum contract demand of 20 MVA |

| Ultra-Mega | Minimum FCI above INR 25,000 mn and minimum contract demand of 30 MVA |

Thrust Sectors

Every state encourages select sectors based on their competitive strength and advantage such as geographical location, available resources, raw material availability, existing manufacturing practices, and growth potential. This policy recognizes 25 thrust sectors across manufacturing, services, and the circular economy.

Manufacturing

- NRSE Equipment, Energy Storage Devices, Industry 4.0-based Manufacturing

- Textiles

- Agri & Food Processing Industries

- Electronics

- Aerospace & Defense

- Biotechnology, Pharmaceutical, & Lifesciences

- Processing of Agro Waste

- Bicycle & Bicycle Components

- Alloys & Steel

- Auto & Auto Components

- Sport Goods (including fitness equipment)

- Hand Tools

- Agricultural Machinery & Equipment

- Paper-based Packaging Units

Service

- IT & ITeS

- Skill Development Centers, Incubation Centres, & Accelerators

- Healthcare

- Tourism & Hospitality

- Media & Entertainment

- Logistics

- Maintenance, Repair, and Overhaul (MRO) for Aviation & Defense

Circular Economy

- Shredding Units (for auto vehicles and parts)

- Manufacturing of Bio-diesel

- Processing of Plastic Waste

- Waste Management Units

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.