The Financial Secretary of the Hong Kong SAR Government, the Honourable Mr. Paul Chan Mo-po delivered the 2021-22 Budget Speech in the Legislative Council on 24 February 2021. We have summarized the 2021- 22 Budget Speech with a focus on tax matters as follows:-

Tax Highlights of the Budget Speech

Profits Tax

A one-off tax reduction of 100% of profits tax for 2020- 21, subject to a ceiling of HK$10,000.

Salaries Tax

A one-off tax reduction of 100% of salaries tax and tax under personal assessment for 2020-21, subject to a ceiling of HK$10,000.

Stamp duty

Propose to raise the rate of advalorem Stamp Duty on stock transfers, from the current 0.1% to 0.13% of the consideration or value of each transaction payable by buyers and sellers respectively

Other Levies

- Rates for non-domestic properties to be waived for the four quarters of 2021-22, subject to a ceiling of HK$5,000 per quarter in the first two quarters and HK$2,000 per quarter in the last two quarters for each rateable non-domestic property.

- Rates for residential properties to be waived for the four quarters of 2021-22, subject to a ceiling of HK$1,500 per quarter in the first two quarters and HK$1,000 per quarter in the last two quarters for each rateable residential property.

- Business registration fees for 2021-22 to be waived.

- Increase the rates of each tax band for the first registration tax for private cars (including electric private cars) by 15% and the vehicle license fee by 30%.

Consumption Vouchers

Issue electronic consumption vouchers in instalments with a total value of HK$5,000 to each eligible Hong Kong permanent resident and new arrival aged 18 or above.

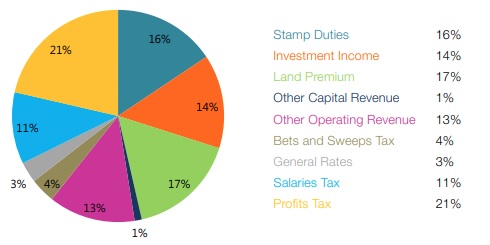

Analysis of Government Estimated Revenue for 2021-22

Economic performance of Hong Kong in 2020

In terms of economic performance, affected by the COVID-19 epidemic and international political tensions, the Hong Kong economy recorded a negative Gross Domestic Product growth ("GDP") of 6.1% for 2020. Meanwhile, the International Monetary Fund estimated that the global economy's GDP contracted by 3.5% for 2020.

The labour market deteriorated sharply, with the seasonally adjusted unemployment rate hiking from 3.3% in the fourth quarter of 2019 to 7% in the latest period, the highest in close to 17 years. Amid a lacklustre economy, pressures on consumer price inflation were modest. Netting out the effects of the Hong Kong SAR Government's one-off measures, the underlying inflation rate was 1.3% for 2020 as measured by the Composite Consumer Price Index, down 1.7% points from 2019 (3%).

Efforts to combat COVID-19

The Anti-epidemic Fund ("AEF") was set up in February 2020 to enhance Hong Kong's capability in combating COVID-19 and to provide relief for industries and members of the public hit hard by the epidemic. The Government had allocated a total of HK$197.9 billion to the AEF in 2020 via four rounds of relief measures, providing subsidies to the Hospital Authority ("HA") to assist in combating COVID-19, helping businesses stay afloat and keeping workers in employment (via the Employment Support Scheme), and relieving financial burdens of both individuals and businesses.

For 2021, the Government has allocated HK$4.7 billion from AEF to support the anti-epidemic work of the HA, ensuring sufficient support and protection for frontline healthcare staff. The Government has also earmarked over HK$8.4 billion for the procurement and administration of COVID-19 vaccines so as to have the majority of the population vaccinated for free within 2021. The measures launched under the AEF and the relief measures involve an accumulated total of over HK$300 billion, providing an expected support effect of more than 5% of GDP.

Estimates for 2021-22

The total Government revenue for 2021-22 is estimated to be HK$591.1 billion. The operating expenditure and capital expenditure for 2021-22 are estimated to be HK$611.9 billion and HK$115.9 billion respectively. The total Government expenditure for 2021-22 is estimated to be HK$727.8 billion, a decrease of 11.3% from the revised estimate for 2020-21. The Financial Secretary forecasts a deficit of HK$101.6 billion in the Consolidated Account in the coming year. The fiscal reserves are estimated to be HK$801.1 billion by the end of March 2022.

Potential tax-related developments

- Propose allowing foreign investment funds to re-domicile to Hong Kong for registration as Open-ended Fund Companies or Limited Partnership Funds

- Possible revision to Hong Kong rating system via: (i) introduction of a progressive element to the rating system and rates concession to owner-occupied properties on a regular basis; and (ii) shifting the primary liability for rates payment from the occupier to the owner of a property

- Review tax arrangements to enhance Hong Kong's attractiveness as a hub for family offices

- Active implementation of the new base erosion and profit shifting proposals (BEPS 2.0) drawn up by the Organisation for Economic Co-operation and Development (which include the introduction of a global minimum tax rate and a digital tax) according to international consensus, with efforts to minimise the impact on local small and medium enterprises and the compliance burden of affected corporations

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.