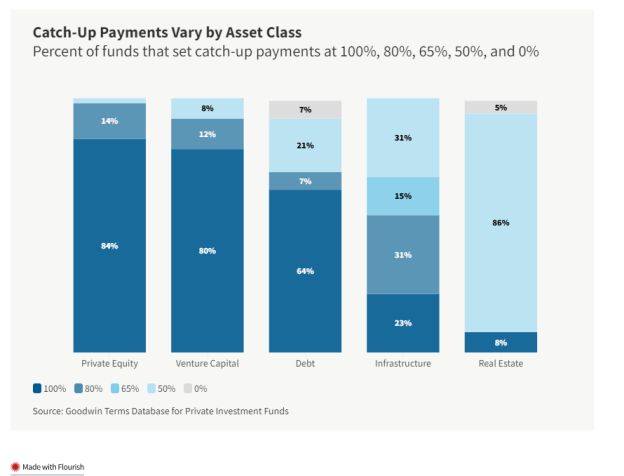

For a majority of PE, VC, and debt funds, catch-ups are 100%, but they are likely to be less than 100% for a majority of real estate and infrastructure funds.

In a previous article, we showed that hurdle rates set by private investment funds vary by asset class. An analysis of the Goodwin Terms Database for Private Investment Funds shows that approaches to catch-up payments also vary significantly across asset classes.

As shown in the chart, the majority of private equity (84%), venture capital (80%), and debt (64%) funds have 100% catch-ups.

The vast majority of real estate funds (86%) have 50% catch-ups.

Infrastructure funds show the greatest variability: about a quarter have 100% catch-ups, one-third have 80% catch-ups, and one-third have 50% catch-ups.

Some debt and real estate funds have 0% catch-ups. In these cases, the preferred return is considered a "hard hurdle," and only remaining profits above the hurdle are shared between investors and sponsors based on the agreed profit split (see "Catch-up Basics," below, for details).

Many venture capital funds (especially in the United States) do not have hurdle rates and therefore do not have catch-ups. The dataset used for the graph above includes only venture capital funds that do have hurdle rates, all of which also have catch-ups.

Differences Across Asset Classes May Track Hurdle Rates

There may be multiple reasons for differences across asset classes, but it is likely that some of the differences are related to how funds set hurdle rates. Our previous article showed that real estate funds were more likely than other funds to set hurdle rates at 7% or lower (generally for core, core+, or value-add strategies). Given the lower hurdle, investors may be more likely to negotiate for a 50% catch-up.

For funds with a higher hurdle of 8%, such as private equity or opportunistic real estate, it is more likely that the catch-up will be higher.

Catch-up Basics

Catch-up payments kick in only after investors recoup their original investment plus a minimum return, known as the "preferred return" or "hurdle rate." Only then do sponsors begin to participate in returns, typically starting with a catch-up phase that continues until the sponsor receives an amount based on the carried interest rate stipulated in the fund's governing document.

For private equity and venture capital funds, carried interest is usually 20%. During the catch-up phase, that means a sponsor receives distributions up to an amount that is equal to 20% of the total profits distributed to both investors and the sponsor.

The payment is called a catch-up because sponsors begin to catch up with investors in this phase, at least in the sense that they start to participate in the profits.

However, the "speed" at which carried interest is paid in the catch-up phase can vary. As the chart shows, sponsors can receive 100% of the payments in this phase. Or they can receive a smaller percentage of the payments (e.g., 50%), while the investor also receives payments (e.g., 50%). Whatever the arrangement, the catch-up phase continues until the sponsor receives the full amount it is entitled to receive based on the carried interest rate or until there are no further amounts available for distribution.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.