Becoming a contractor for the US Army in Poland presents significant opportunities for businesses. As a contractor, you gain access to a vast market, increase your company's credibility, and enhance your competitive edge in the global arena.

The US government is one of the world's largest buyers of goods and services, offering lucrative contracts and fostering long-term partnerships. By aligning with the US Army, your business can tap into a stable and consistent source of revenue while contributing to international defense efforts.

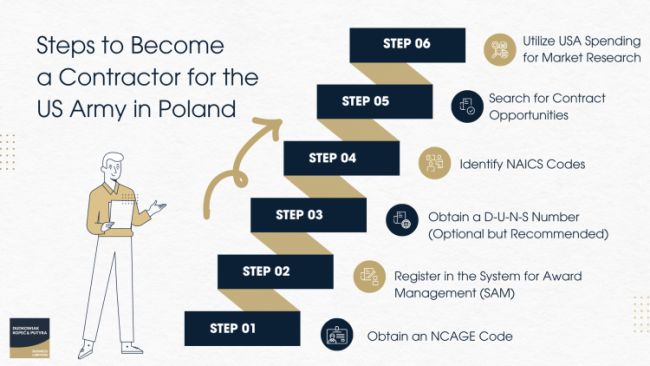

Steps to become a contractor for the U.S. army in Poland

Step 1: Obtain an NCAGE Code

- Visit the WCNJiK website: Go to the website of the Wojskowe Centrum Normalizacji, Jakości i Kodyfikacji (WCNJiK).

- Fill out the NCAGE registration form: Complete the form available on the WCNJiK website or use the form provided in the document

- Prepare required documents: Gather the necessary documents, including:

- A scanned copy of the filled-out NCAGE registration form.

- A scanned copy of the certificate of assignment of the REGON number.

- An up-to-date extract from KRS or CEIDG, depending on the type of business.

- Submit the documents: Send the scanned copies to wcnjk@ron.mil.pl.

- Wait for the NCAGE code: You will receive the NCAGE code within 14 working days via email.

Step 2: Register in the System for Award Management (SAM)

- Ensure you have an NCAGE Code: Registration in SAM requires an NCAGE code.

- Register in SAM: Visit the SAM website at https://sam.gov.

- Complete the registration: Provide the required information, including company size, financial status, and other relevant details.

Step 3: Obtain a D-U-N-S Number (Optional but recommended)

- Visit the Bisnode website: Go to the Bisnode registration page for a D-U-N-S Number at https://www.bisnode.pl/numer-d-u-n-s-wypelnij-formularz/.

- Complete the online form: Fill out the form with your company's name, address, and business details.

- Receive the D-U-N-S Number: You will receive the D-U-N-S Number within a maximum of 5 working days.

Step 4: Identify NAICS Codes

- Determine applicable NAICS codes: Identify the North American Industry Classification System (NAICS) codes that match your business activities.

- Include NAICS Codes in SAM registration: Enter the relevant NAICS codes during your SAM registration.

Step 5: Search for Contract Opportunities

- Use the SAM Portal: After registering, you can use the SAM portal to search for contract opportunities by visiting https://sam.gov.

- Understand Departmental Procedures: Familiarize yourself with the specific procurement procedures of the US Department of Defense and other relevant departments.

Step 6: Utilize USA Spending for Market Research

- Access USA Spending Portal: Visit the USA Spending website to track government spending and gather information on previous contracts and potential business partners.

- Conduct Research: Use the data to identify potential contracts and understand the spending patterns of the US government.

Tax Exemptions for US army contractors in Poland

Becoming a contractor for the US Army in Poland comes with several tax benefits under the Enhanced Defense Cooperation Agreement (EDCA) between the United States and Poland.

Key tax exemptions include:

- Corporate and Personal Income Tax Exemptions: Income earned from US Government employment by members of the force, civilian components, and their dependents is exempt from Polish taxation. This also applies to income from specified non-commercial organizations and sources outside Poland.

- VAT and Excise Tax Exemptions: Goods imported by or for US forces, as well as goods and services acquired for their use, are exempt from VAT and excise taxes. These exemptions apply at the point of importation or purchase, supported by proper documentation.

- Exemptions on Personal Property and Motor Vehicles: US military personnel and their dependents are exempt from taxes on the purchase, ownership, and use of personal property and motor vehicles, including VAT and other related taxes.

- Exemption on Imported Goods: Goods imported by or for US forces for exclusive use or supporting their military activities are exempt from VAT and excise tax, provided they are declared on the specified NATO SOFA certificate (Form 302).

- Exemption on Acquired Goods and Services: Goods and services acquired by or for US forces are exempt from VAT and excise taxes at the time of purchase if confirmed by documentation from US forces.

- Certification for Exemptions: Polish authorities receive appropriate documentation from US forces certifying the goods and services consigned to or acquired by US forces for their use.

- Income Tax Exemption for Deliveries and Services: From January 1, 2022, Polish companies and subcontractors supplying goods, services, or construction work to the US Army stationed in Poland are exempt from corporate income tax (CIT) and personal income tax (PIT).

- VAT Exemption for Deliveries to US Army: Contractors or subcontractors in tenders for the US government are entitled to a VAT exemption for contracts executed within Poland, requiring a VAT exemption certificate signed by a US military representative and the base commander.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.