QuickTake

On 31 March 2022, the Official Journal of the European Union published Decision (EU) 2022/514 of the European Central Bank (ECB) on the total amount of annual supervisory fees levied under the single supervisory mechanism (SSM) for 20211. The Decision enters into force on 5 April 2022.

The Annex to the Decision breaks down the calculation of the total amount of supervisory fees for 2021, which weigh in at EUR 577.5 million in total – albeit almost 3% less than originally estimated. For those Banking Union supervised institutions (BUSIs) that are categorised as significant credit institutions as well as significant groups (collectively SCIs)2 and thus subject to direct ECB-SSM supervision, the amount of annual supervisory fees stands at EUR 546 million. The remaining ca. EUR 32 million are to be paid by those BUSIs that are categorised as less significant institutions and less significant supervised groups (collectively LSIs)3 and thus subject to indirect ECB-SSM supervision.

These ECB-SSM fees are in addition to the range of supervisory fees that BUSIs may have to pay to other national competent authorities (NCAs) in the Banking Union, the EU and elsewhere. Given that the ECB-SSM fees are calculated according to fee factors based on balance sheet activity and perceived riskiness some BUSIs may want to proactively assess how to improve their risk systems and controls so as to possibly reduce further fee pressures. This Client Alert looks at issues BUSIs will want to consider.

A focus on fees

The ECB-SSM's Regulation on supervisory fees4 sets out the methodology and procedure for calculation and collection of the annual supervisory fees and is, in addition to the ECB-SSM Decision on fee factors5 complemented by guidance on a dedicated ECB-SSM website.6 A key driver in setting the fees, and one that precedes the publication of this latest annual Decision, is the publication of fee factors for all fee debtors. This was completed in January 2022 and following the publication of the Decision, BUSIs (large and small) will receive individual fee notices during May 2022 with a payment deadline in June 2022.

The way fees were calculated for SCIs and LSIs changed in 2019 – the first major reform since the ECB-SSM's commencement of operations in November 20147. The ECB-SSM's annual supervisory fees to be levied in 2022 are comprised of:

- A minimum fee component – based on a fixed percentage of the total amount of annual fees for SCIs and LSIs; and

- A variable fee component – measured by (i) total assets and (ii) total risk exposure – both as calculated at the highest level of consolidation in the Banking Union.

BUSIs must notify the ECB-SSM of their intention to exclude assets, risk exposure amounts or both using an online process by 30 September of the previous year (i.e., for 2022 this was 30 September 2021). If such an intention is not notified, the ECB-SSM and NCAs will assume that regulatory data it receives from common reporting (COREP) and financial reporting (FINREP) submissions can and should be used. Fee debtors are required to submit annual fee factors to NCAs by 11 November of the previous year having used data for 31 December of the preceding year. This means that for the 2022 annual supervisory fees, data being used, subject to adjustments, will be from the financial year ending 31 December 2020.

Why so high?

The average level of annual supervisory fees of the ECB-SSM has grown steadily since it began operations in 2014. So too has the ECB's budget in order to accommodate broader tasks of who and what it is expected to supervise and how it does this. Other events, such as COVID-19 have added to fee pressures but also driven moves for cost savings, as the ECB-SSM has increasingly digitised processes whilst moving to a new organisational set-up operationalised during 2020 and 2021. Chapter 1 of the ECB's Annual Report on Supervisory Tasks, which was adopted by the Governing Council on 31 March 20228 sets out what the ECB-SSM has achieved against its supervisory priorities it set itself for 2021. The Annual Report also provides details on supervisory decisions issued and Chapter 6 provides an outlook for ECB-SSM fees and the framework. In many respects the Annual Report acts as a scorecard on the performance of the SSM and its supervisory tasks as well as an additional indicator on future priorities and delivery on the supervisory priorities for 2022 that it sets itself annually in the previous year.

Notably on supervisory decisions, the Annual Report confirms that, despite the pandemic, 2021 remained a busy year with the Supervisory Board taking 2,362 decisions. Most of these i.e., 49.2% related to fit and proper assessments (NB the ECB-SSM's rules were further reformed 1 January 2022 – see our standalone Thought Leadership on this), 11.2% concerned internal model approvals, 9.5% pertained to own funds, 9.5% pertained to national powers in the context of national options and discretions (NB the ECB-SSM also in 2022 reformed its rules in this area – see our standalone Thought Leadership on this) and the remaining 3.8% related to qualifying holdings assessment procedures. Notably, 329 of the 115 SCIs, asked to received formal ECB decisions in an EU official language other than English.

Chapter 6 of the Annual Report confirmed that:

"...on core supervisory tasks continued at lower than normal levels in 2021. The 7.9% increase in expenditure compared with 2020 mainly reflects the onboarding of new IT systems dedicated to banking supervision, which are included in the horizontal tasks and specialised services category."

Specifically, the Annual Report states that:

"With respect to the developments in IT systems, the increases in expenditure seen in the policy, advisory and regulatory functions as well as macroprudential tasks relate to the SSM information management system (IMAS) and the Stress Test Account Reporting platform (STAR). The main increase in expenditure in the Supervisory Board, secretariat and supervisory law section resulted from significant investment in 2021 in supervisory technologies (suptech), which exploit the potential of artificial intelligence and other pioneering suptech in the context of banking supervision, for internal and external stakeholders."

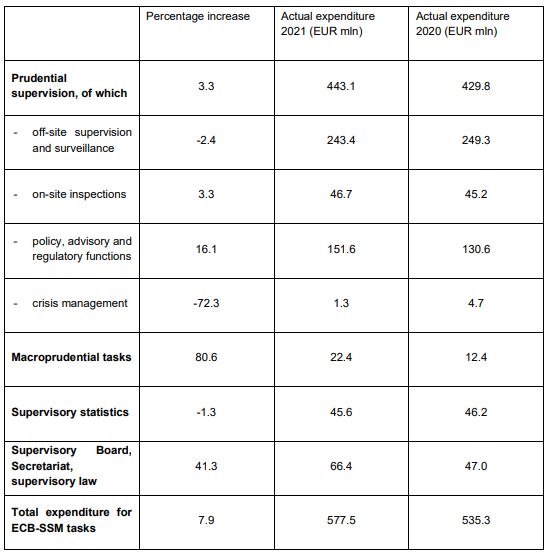

The Annual Report clarified, in Table 9 (as replicated for ease below) that the ECB's actual expenditure in 2021 increased in a number of areas. This indicates a growing trend as it continues to pursue work in new thematic areas (notably climate change) as well as supervise new firms due to changes in CRR II/CRD V as well as IFR/IFD.

Welcomingly, commentary to Table 10 of the 2021 Annual Report sets out that for the proposed 2023 budget and fee levels, which will only be known at the end of 2022, a period of normalisation is expected to return. The Annual Report frames this as follows:

"Based on the lower level of actual costs for supervisory tasks as seen in the last two years, the ECB has continued its conservative approach to estimating expenditure for 2022, resulting in an estimated supervisory fee for 2022 of €624.1 million. The ECB's full planned expenditure on supervisory tasks for 2022 is €678.9 million. This takes into consideration the expected return to more normal levels of activity, ongoing investment in the development of information technology systems related to banking supervision, including the internalisation of consultancy costs related to STAR, as well as higher staff costs."

Anticipated expenditure for direct supervision of SCIs in 2022 was estimated for 2022 at EUR 306.4 million. In terms of activity conducted by the ECB-SSM for indirect supervision of LSIs this was estimated at EUR 14 million and expenditure for the ECB-SSM's "horizontal tasks and specialised services", this was estimated for 2022 as EUR 303.7 million. Conversely, the ECB-SSM estimated (Table 11 of the Annual Report) that it would collect a total of EUR 596.9 in annual supervisory fees for SCIs and EUR 27.2 million from LSIs.

The ECB-SSM equally confirmed that, during 2021, its income arising from penalties imposed on BUSIs amounted to EUR 0.6 million, which is a rather small amount when compared to the number of fines it has issued. However, the Annual Report also refers to the ECB-SSM reimbursing BUSIs in the event that a court annuls administrative penalties that have been imposed by the ECB-SSM on BUSIs in previous supervisory cycles.10 Following a partial annulment of administrative penalties imposed by the ECB-SSM on three BUSIs within the same group, the ECB-SSM reimbursed EUR 4.8 million in penalties previously collected.

Outlook

There are a number of areas under ECB-SSM supervisory scrutiny in the remainder of the 2022 and pending 2023 supervisory cycle. These are in addition to the Banking Union authorities' supervisory priorities that have been set to run to end of 2024 as well as supervisory responses to ad hoc developments. Despite the ECB-SSM warning the market that it is returning to a more normalised and thus stricter supervisory tone for the remainder of 2022 and 2023, many BUSIs have an ability to set themselves apart from their peers and tackle identified deficiencies so as to reduce further adverse supervisory actions including in respect of fees and penalties. This includes targeted improvements to governance, risk, compliance and other control functions leading on setting and taking ownership of what the SSM would like to see continued efforts on embedding a more robust and resilient "risk culture" including applying lessons learned during the prolonged pandemic to a whole new set of risk factors that have arisen at the start of 2022 that the ECB-SSM has repeatedly warned on.

More broadly, BUSIs should step-up efforts to ensure that their specific policies and procedures, especially those that are required or expected by the ECB-SSM, are best in class. Furthermore, they should ensure that consistency across functions but also physical locations from which business but also control functions operate (in particular in longer-term remote and/or hybrid working arrangements) do so in a consistent manner. Based on the developments and activities of the ECB-SSM following thematic reviews and other on-site inspections, there is a greater supervisory scrutiny on BUSI's relevant staff being able to demonstrate a depth of understanding of material rules and principles as they apply to the relevant firm and risk appetite overall as opposed to just their business line or physical location.

Footnotes

1. Available here. The ECB-SSM had originally published this Decision (ECB/2022/7) on 1 March 2022.

2. Borne by 112 SCIs as fee debtors – NB the number of fee debtors is different to the number of SCIs for supervision purposes.

3. Borne by 2,318 LSIs as fee debtors – NB the number of fee debtors is different to the number of SCIs for supervision purposes.

4. Available here.

5. Available here.

6. Available here.

7. During 2019 the ECB-SSM had proposed and then implemented amendments to its Regulation on Supervisory Fees. These coincided with concurrent changes to the ECB-SSM's methodology and use of the Supervisory Review and Evaluation Process (SREP) a key tool for how it monitors BUSIs. The change in 2019 moved to the ECB-SSM calculating fees based on supervisory costs it actually incurred as a well as a host of changes that meant 50 percent of LSIs would see an effective fee reductio of between 7 to 50 percent. For those that would not receive a fee reduction, their annual supervisory fees would increase by three percent.

8. Available here

9. One less than in 2020.

10. Details available here.

Originally published March 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.