This article forms part of a series of articles examining the

opportunities Japan presents for investment managers. It focusses

on the opportunities presented by Japanese institutional and retail

investors.

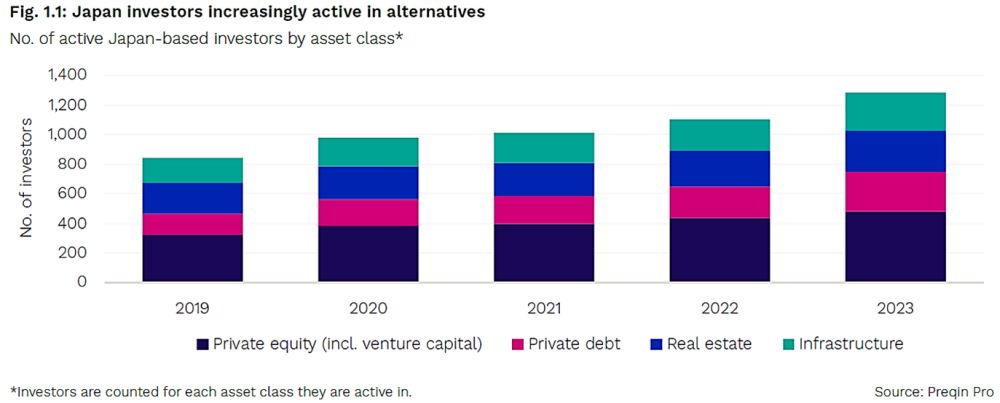

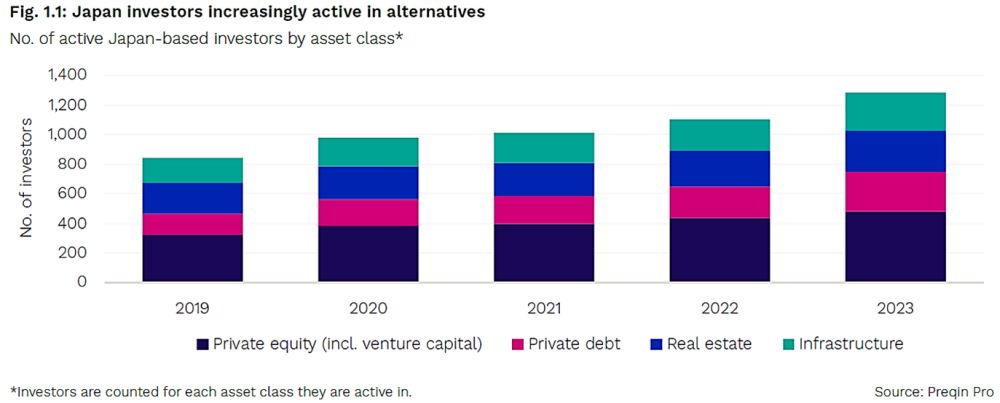

Japanese investors are progressively increasing their exposure

to private equity, private credit, infrastructure, real estate and

other alternative asset classes (collectively "Alternative

Investments").

The move towards Alternative Investments is influenced by a

combination of factors, including the reemergence of inflation to

Japan, the pursuit of higher yields and the implications of a

declining population.

Current Landscape and Challenges

As of June 2023, Japan-based private capital funds manage assets

totaling US$115 billion, according to Preqin data

1. This

figure includes foreign investments but represents only about 4% of

Japan's pension fund assets

2. This proportion is

insufficient to satisfy the investment needs of all Japan-based

investors, prompting them to allocate funds to international

managers in the US, EU, and beyond.

Retail Investors and Government Initiatives

Japanese households possess approximately US$14 trillion in

assets as of June 2023, with half of this amount held in cash and

deposits3. In stark contrast, US households keep a mere

13% in similar liquid forms.4

The Japanese government aims to double household investment

income and is actively promoting investment through the expansion

of the Nippon Individual Savings Account ("NISA"), a

tax-exempt investment scheme for individuals. The Japan Securities

Dealers Association reported a surge in new NISA accounts, with

over half a million opened in February 20245.

The recent authorisation for investment trusts to include

unlisted shares in NISA portfolios is anticipated to enhance retail

access to alternative assets. The Maples Group's Asia practice

has recently advised on the public offerings of several Cayman

Islands unit trusts in Japan that invest in Blackstone's

flagship funds, such as Blackstone Real Estate Income Trust

("BREIT"), Blackstone Private Credit Fund

("BCRED"), and Blackstone Private Equity Fund Strategies

("BXPE"). This substantial savings reserve offers a

considerable new prospect for both domestic and international asset

managers.

Institutional Investors and Market Dynamics

The growing interest in Alternative Investments among Japanese

institutional investors has been providing substantial

opportunities for managers for some time. The diversity of Japanese

institutional investors and asset classes has expanded in recent

years, drawing increased attention from international managers.

Prominent US firms, including Blackstone, Brookfield, Apollo, and

KKR, have already established a presence in Japan.

Japan's rapidly aging population is likely to further

drive institutional investors, such as pension funds and life

insurers, toward Alternative Investments. Currently, 29.1% of

Japan's population is aged 65 or older, a figure projected to

exceed 34.8% by 20406.

Types of Investment Vehicles Used by Japanese

investors

Japanese investors utilise a diverse array of investment

vehicles across various jurisdictions, with the Cayman Islands

commanding a market share of over two-thirds (67.3%) of Japanese

investments in overseas investment funds7. The unit

trust and the exempted limited partnership ("ELP") are

the investment structures of choice for Japanese investors in the

Cayman Islands. The different structures offer distinct advantages

that suit different needs. The ELP is established as a contractual

arrangement between the general partner who conducts the business

of the ELP and passive investor limited partners and is

particularly well-suited for situations where contractual

flexibility and tax transparency are paramount. The development of

the law in this area has been informed by the demands of the

private equity market and are generally flexible enough to

accommodate variation in a range of terms as negotiated between the

general partner and the limited partners. Further, the general

partner is often a special purpose vehicle established by the asset

manager thereby permitting the asset manager to manage the ELP

without the need to involve a third-party operator. The surge in

interest in Alternative Investments has led to the development of a

novel unit trust investment vehicle which has become very popular

in the market with certain institutional investors, the Private

Equity Type Unit Trust, the details of which are provided below.

Often, a Private Equity Type Unit Trust will channel investments

into an international manager's limited partnership investment

fund, creating a layered investment strategy that leverages the

strengths of both vehicles.

Japan is also a significant user of Luxembourg and Ireland for

publicly offered funds, especially UCITS. This trend is expected to

grow as the population ages. Japanese institutional investors,

diversifying into Alternative Investments in Europe, are

increasingly favoring fund structures in Luxembourg, Ireland, and

Jersey. Many large Japanese institutional investors have

established fund vehicles in these jurisdictions, a trend that is

expected to continue.

The Rise of the Private Equity Type Unit

Trust

The burgeoning interest in Alternative Investments by

institutional investors has led to the swift adoption of the

'private equity type' unit trust (the "PE Type Unit

Trust"). This Cayman Islands unit trust, favoured by many

Japanese institutional investors, embodies certain private equity

fund features, such as capital call provisions and defaulting

investor clauses. The PE Type Unit Trust structure offers several

benefits for investors seeking exposure to Alternative Investments,

including but not limited to:

- Investor Familiarity: The Cayman Islands unit trust is a

well-established and popular vehicle among Japanese investors for

accessing complex investment strategies;

- Tax Advantages: Investors can often achieve securities

investment trust tax status in Japan with this structure;

- Off-Balance Sheet Accounting: For accounting purposes, the PE

Type Unit Trust is considered an off-balance sheet entity,

eliminating the need for account consolidation; and

- JPY Hedging: Many Japanese investors prefer to hedge against

non-JPY currency exposure from non-JPY denominated Alternative

Investments. The PE Type Unit Trust structure facilitates this by

allowing for the distribution of both realised and unrealised gains

and providing a current net asset value for hedging purposes. This

contrasts with the limited partnership structure, where gains or

losses are not recognised until the investment is realised,

potentially delaying hedging activities.

Conclusion

The Maples Group's Japanese Funds practice advises and

provides funds services to the industry's heavyweights, as well

as new entrants to the market, on the structuring and establishment

of Cayman Islands, Luxembourg, Irish and Jersey funds targeted at

Japanese investors. For those considering establishing such funds,

please contact your usual Maples Group contact or one of the

contacts listed in this update.

This article is not intended to constitute, nor should it be

relied upon, as individual legal or tax advice. The choice of

structure will often be determined by many factors, including the

investor's circumstances.

Footnotes

1. Fundraising from Japan 2024: A guide to raising

capital

2. https://www.boj.or.jp/en/statistics/sj/index.htm

3. https://asia.nikkei.com/Economy/Japan-households-financial-assets-hit-record-14tn-on-stock-rally

4. Financial Times article dated 14 December 2023

"Can Japan's Legendary Savers Spark a Stock Market

Boom".

5. Financial Times article dated 8 April 2024, "Is

Japan finally becoming a 'normal'

economy?"

6. National Institute of Population and Social Security

Research

7. Japan Ministry of Finance, Regional portfolio

investment positions, end of 2022

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.