Ghana is actively participating in the retail boom experienced across Africa. Ghanaians spending and consumption have increased over the last few years attributed somewhat to the growing middle class with greater spending power. This has created several investment opportunities in Ghana for both local manufacturing and trading.

To take advantage of these opportunities, however, a new entrant or an existing business must have insights on spending and consumption patterns of consumers. Spending patterns are a defining factor in understanding demand and consumption levels within a country. Further, imports are a direct response to market demand and economic expansion. Hence over time, the spending and consumption patterns of Ghanaians inform the type of products imported into Ghana and also creates viable investment opportunities for prospective investors.

For the new market entrant starting a business in Ghana, wouldn't it be great to know exactly what product(s) to import or produce in the country based on the demand patterns? For the manufacturer or importer already operating in Ghana, how are you positioned to be relevant to consumers as well as be competitive in the market? Knowing what Ghanaians are spending on will certainly be a useful insight.

SO, WHAT ARE GHANAIANS SPENDING ON?

Ghanaians are spending on everything - from food products, healthcare products, apparels, electronics to building hardware.

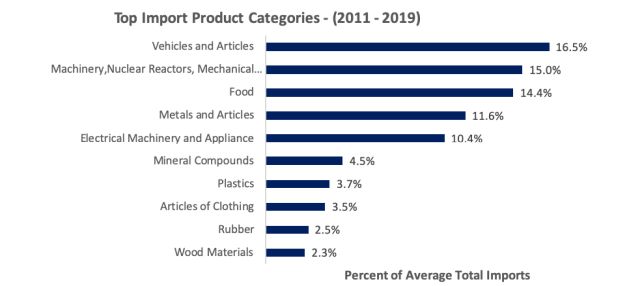

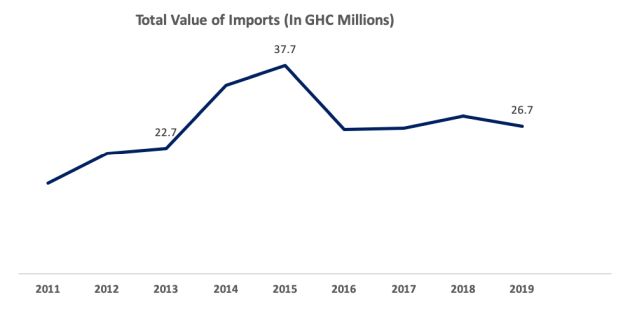

Analysis of trade data for the past 9 years (2011 -2019) reveal that food commodities, vehicles, machinery, electrical appliance, and plastics are among the leading imported products classes in Ghana. Actually, the top 10 imported products (excluding minerals and oil and gas) across the years constitute over 84% of the total imports, valued at an average of GHC 23 billion each year. The chart below highlights the top 10 import product categories and the percentage of total imports they constitute.

Source: Ghana Statistical Service

Vehicles, both used and new and all its articles, is the most dominant product category in Ghana's imports, constituting as high as 16.5% of total non-oil imports every year. This is followed by machinery, nuclear reactors, and mechanical appliance with 15% and food with 14.4%. For each of these top product categories, there are different items that are imported by individuals and businesses in Ghana. Details of the specific products imported for the top 3 product categories is further emphasized.

Vehicles and Articles

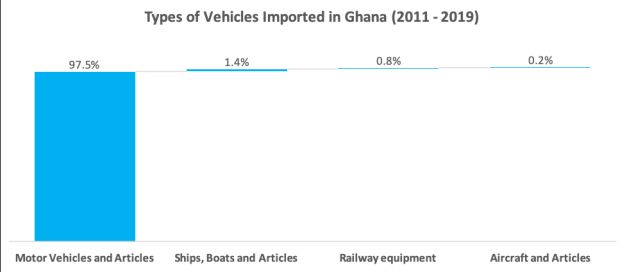

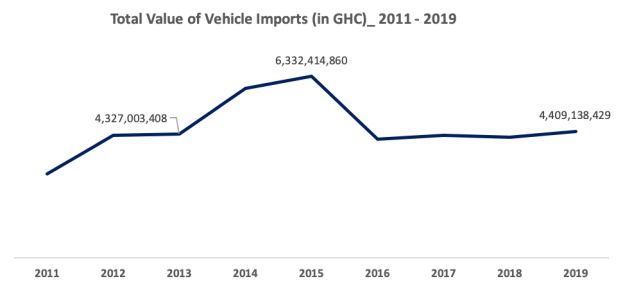

As seen in the chart above, vehicle imports top the list of primary products imported into Ghana. Between 2011 and 2019, an annual average of GHC 4.54 billion worth of different vehicles and its articles were imported into the country. Given that road transport is the primary means of transportation for passengers and goods in Ghana, motor vehicles and its articles (spare parts and accessories) tops vehicle imports, constituting about 97.5% of total vehicle imports. The remaining 2.5% is split between ship and boats (1.4%), railway equipment (0.8%) and aircraft and articles (0.2%). The government of Ghana through the Ghana Automotive Development Policy (GADP) seeks to develop a local automobile industry by given incentives (including restrictive incentives) to attract global Original Equipment Manufacturers (OEMs) and other component manufacturers into the country. Already, top OEMs like Volkswagen and Toyota has set up assembling plants in the country.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

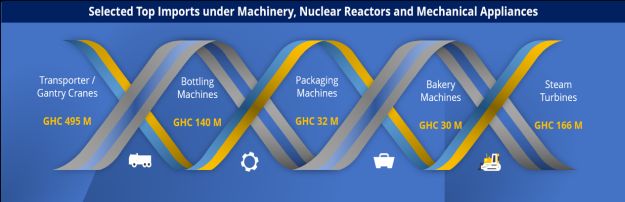

Machinery, Nuclear Reactors and Mechanical Appliances

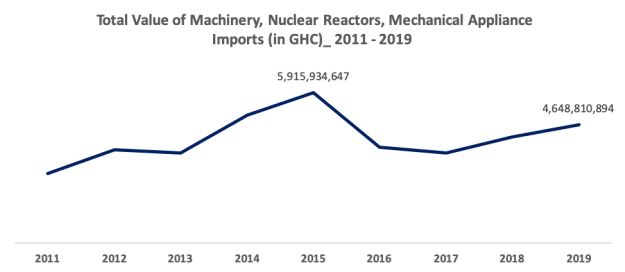

The next category of items imported most into Ghana are machinery, nuclear reactors and mechanical appliances. On average, the country imports machines and appliances worth GHC 4.3 billion each year. It includes both industrial and agricultural machines as well as nuclear reactors and other heavy machinery used in constructions.

Some top imported items under this category are transporter cranes or gantry cranes, team turbines for marine propulsion, machinery for filling and closing bottles, packaging or wrapping machines, bakery machines and other agriculture machines such as harvesting machines. The charts below provide more details.

Source: Ghana Statistical Service

Food

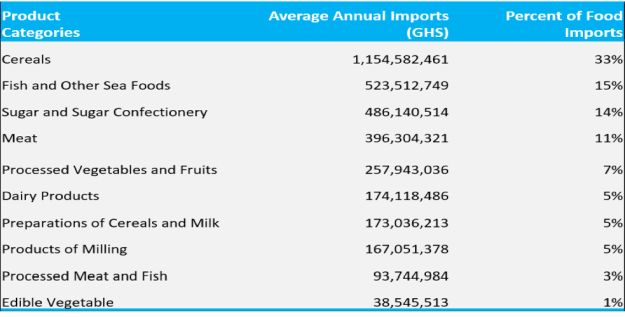

The third category of items imported most into Ghana is food (excluding beverages). Over 16 sub-categories of food are imported into the country including cereals, meat, fish, spices and fruits among others. Cereal is the primary food category imported with an average value of GHC 1.15 billion of different types of cereals imported annually. The most common cereals imported are maize, wheat, rice, oats and millet.

Ghanaians spending is also skewed towards other categories of food items imported that include fish and other sea foods, which constitute about 15% of total food imports.

Sugar and sugar confectionery also follows with an annual average value of GHC 486 million, constituting 14% of total food imports. Other important food imports are meat (11% of total food imports), processed vegetables and fruits (7% of total food imports), dairy products (5% of total food imports), preparations for cereals and milk (5% of total food imports) and food products for milling ((5% of total food imports). Preparations of cereals and milk include processed cereal items such as biscuits, waffles and pasta, while products of milling include various types of flour such as wheat flour, and maize flour. The table and chart below provides more details.

Source: Ghana Statistical Service

Source: Ghana Statistical Service

Market Entry Insights for New Businesses

Ghanaians are generally open to trying new brands, if the pricing is right and quality is good. There are three fundamental factors that a new market entrant should consider;

1. Consumers in Ghana are very price sensitive.

You should support the pricing strategy for your business or products with independent research.

2. Have a strategy for credit for your B2B clients.

Distributors or Agents love to have some form of credit from importers.

3. Have a strong budget for marketing and promotion in the initial 3 years especially in the consumer and retail space.

food, beverage, home and personal care segment.

Majority of Ghanaians fall within the low to lower-middle income class and so price comes first in deciding what to buy. There is a market for premium products, however, products targeting low to middle income consumers should consider price as a key factor in the market entry stage. Hence your ability to source the products (which must be of relatively good quality) at competitive prices and have a long-term strategy will determine your market success.

Ghana engages in a substantial amount of trading in consumable goods on a credit basis. Most medium to large distributors/wholesalers with good distribution channels will want to trade with you, but on credit, especially at the market entry stage. Whatever you do, have a strategy for credit.

However, as customers get to know your brand and you gain market share, you may tighten up your credit policy and even be able to have distributors/wholesales make advance deposits for their goods.

You definitely need to have a budget for marketing and promotions in order to penetrate the market. There is an influx of imported products on the Ghanaian market across all segments. There equally exist very strong local brands doing well in key segments like food, beverage and home and personal care. The Ghanaian consumer therefore has a lot of options, making achieving product visibility through effective marketing and promotion, a defining factor to success.

LOOKING FORWARD

Total Import expected to decline further

We expect the downward trend in total imports to continue as the new local factories expand capacity and demand for local products increases. This is coupled with the fact that 3 global giants in the automobile industry are establishing assembly plants in Ghana and Government is expected to institute some restrictive measures on vehicle imports (which is the topmost product category imported into the country). Again, we expect the Government's One-District-One-Factory program to commission other new factories. Overall, we expect the import volume to further decline.

Source: Ghana Statistical Service

Have a long-term plan to add value

As a new market entrant, you may start with trading through some agents or distributors in Ghana to gain some market share. However, for long-term success and growth, have a plan to set up some processing, assembling or manufacturing plant in Ghana. Local production picking up could erode your market share. This trend is evident in several sectors such as the production of ceramic tiles, baby diapers, biscuits, tomato paste, and the ongoing development in the automobile industry in Ghana.

The Retail space is expected to continue growing

Ghana anticipates that the retail sector will maintain its growth trajectory. E-retail is catching up with the growing middle class. We expect this sector to grow as lifestyles continue to change and the working class keeps exploring more convenient ways of shopping.

CONCLUSION

In trying to explore innovative ways of reaching out to the Ghanaian consumer, it is important to consider, through research, the following market dynamics:

New entrant/investor:

- What product (brand, fragrance, flavour, packaging, design etc.) should you focus on?

- What is the price sensitivity, competition and demographic analysis for your product?

- Where can you find your target market, and how do you reach them?

- What are the import duties, taxes etc. for your products and how does your final price compare with existing market prices for same products offered by competitors?

Existing business:

- How well do you understand your brand's health?

- What will be the best approach to grow your market share?

- What is the competition doing differently and what marketing channels should you adopt?

With your knowledge of what Ghanaians are spending on, it's time to dig further into these product segments, to carve out your own product and market entry strategy to drive success.

To view the article in full click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.