1 Legal framework

1.1 Beyond general commercial and contract laws, what other specific laws and regulations govern project finance transactions in your jurisdiction?

- The Foreign Exchange Regulation Act, 1947, read with the Guideline for Foreign Exchange Transactions, 2018, regulates the foreign exchange aspects of foreign borrowing;

- The Transfer of Property Act regulates security creation and enforcement issues;

- The Registration Act relates to the perfection of security; and

- The Stamp Act relates to the stamp duty payable on all financial documents, including security.

1.2 Do any bilateral and/or multilateral international instruments have particular relevance for project finance transactions in your jurisdiction?

- The Washington Convention on the Settlement of Investment Disputes between States and Nationals of Other States; and

- The New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards.

1.3 Beyond normal governmental institutions, are there regulatory bodies that play a particular role in project finance in your jurisdiction? What powers do they have?

- The central bank has nominated the following authorities to process foreign borrowing approvals:

-

- the Bangladesh Investment Development Authority;

- the Bangladesh Export and Import Processing Zone Authority;

- the Bangladesh Economic Zone Authority; and

- the Hi-Tech Park Authority.

- The central bank is responsible for issuing allied approvals, such as in relation to the opening of foreign-exchange denominated accounts.

- The Office of the Registrar of Joint Stock Companies and Firms is responsible for the perfection of security.

- The Office of the Sub-Registrar is responsible for the perfection of security over immovable assets.

- The Executive Committee of the National Economic Council (ECNEC) is responsible for approving all development proposals. ECNEC consists of all members of the Cabinet and the prime minister as the chair. The Planning Division is the secretariat of ECNEC. Ministries will formulate their respective plans and programmes or projects as per their objectives, and then submit them to ECNEC for approval.

- The Economic Relations Division is a division of the government under the Ministry of Finance and mobilises external resources for socio-economic development and public sector projects. It also acts as an interface between the government and development partners, and coordinates all external assistance inflows into the country.

1.4 What is the government's general approach to project finance in your jurisdiction? Is PFI/PPP a preferred model in your jurisdiction?

The government of Bangladesh traditionally finances its projects through sovereign loans. However, where a project is implemented through a special project vehicle (SPV), it may also utilise non-recourse, semi-recourse or recourse financing, as it is allowed by regulation to issue sovereign guarantees to the extent of its shareholding in the SPV. A private finance initiative (PFI) model is adopted for most government projects.

The government has also started to encourage project implementation through the public-private partnership model, whereby the government transfers significant risk to a private company, which must secure recourse or semi-recourse project financing without the government committing to any sovereign obligation to repay the debt. In addition, in appropriate cases, the government also finances projects through either loans issued by government institutions, viability gap financing or transaction advisory assistance.

In the private sector, project finance takes the form of either recourse or non-recourse financing. However, in large projects, lenders will insist on recourse financing where they seek a guarantee from the sponsors.

2 Project finance market

2.1 How mature is the project finance market in your jurisdiction?

The local project finance market remains underdeveloped. On a number of occasions, local banks and government institutions such as the Infrastructure Development Company Limited and the Bangladesh Infrastructure Finance Fund Limited have provided debt financing under syndication; but the amounts provided are modest, ranging between $100 million and $200 million.

However, several multilateral development banks, foreign export-import banks and international commercial banks are active in providing project finance in Bangladesh.

2.2 On what types of project and in which industries is project finance typically utilised?

In Bangladesh, context project finance is frequently used to finance industrial and infrastructure projects, as these are the sectors in which project finance is most commonly used. While industrial projects are mostly concentrated in the private sector, infrastructure projects are generally carried out either by the government itself or under a public-private partnership (PPP) model. Most of the PPP infrastructure projects that make use of project finance are carried out under either a build-operate-transfer structure or a build-own-operate structure. There are also some projects that use quasi-project financing in conjunction with corporate and asset finance.

2.3 What significant project financings have commenced or concluded in your jurisdiction over the last 12 months?

- $1.3 billion equivalent export credit agency-backed financing facilities to Bangladesh Chemical Industries Corporation by HSBC and MUFG Bank;

- $1.8 billion equivalent financing facilities to Kalapara 2x662 Thermal Power Plant by a consortium led by China Exim Bank;

- $1.8 billion equivalent financing facilities to Paira II 2x662 Thermal Power Plant by a consortium led by China Exim Bank;

- $97 million debt financing in Summit LNG by Sumitomo Mitsui Banking Corporation;

- $350 million dual-tranche term loan facility Summit Meghnaghat II Power Company by the International Finance Corporation and Standard Chartered Bank; and

- $179 million senior debt facility to Nutan Bidyut Bangladesh Limited by the Asian Infrastructure Investment Bank, the Infrastructure Development Company and the Islamic Development Bank.

3 Finance structures

3.1 What project financing structures are most commonly used in your jurisdiction?

While equity finance is commonly used for small projects, debt financing is most commonly used for large projects; sometimes an interim bridging facility is provided by shareholders or local institutions until financial close is achieved. For non-manufacturing and non-industrial projects, financing through quasi-debt equity is also common.

In terms of recourse, lenders in almost cases seek recourse financing with guarantees from the sponsors; however, in certain cases non-recourse project financing is also used. For public projects, lenders seek sovereign guarantees to the extent allowed.

The following major types of debt financings are adopted in local project financings:

- Buyer's credit: Buyers of project infrastructure, machineries and construction services obtain the loan directly from a lender.

- Supplier's credit: The supplier either manages a loan to finance its credit sales or extends credit to the buyer itself. The buyer pays the supplier in periodic instalments with a certain mutually agreed mark-up.

- Lease finance: This is commonly used in the local market, where a leasing company leases machinery or similar under either a financial lease or an operational lease. However, this option is not directly available in case of foreign borrowing. As such, cross-border lease finance is structured in the form of a supplier credit.

- Islamic finance: Islamic financing is gaining popularity in Bangladesh, especially for the procurement of high-cost equipment and machinery.

3.2 What are the advantages and disadvantages of these different types of structures?

Debt finance enables the sponsors to share the project risks through a network of security arrangements, contractual agreements and other supplemental credit support, with other financially capable parties that are willing to assume these risks. It also empowers the lenders to decide how to manage the free cash flow that is left over after paying the operational and maintenance expenses and other statutory payments. In the long term, the cost of capital is lower than the cost of equity.

The only disadvantage arises from the complex structure of project financing in the form of debt. The complexity of project finance deals is due to the need to structure a set of contracts that must be negotiated by all parties to the project. This also leads to higher transaction costs, on account of the legal expenses involved in:

- designing the project structure;

- dealing with project-related tax and legal issues; and

- preparing the necessary project ownership, loan documentation and other contracts.

Equity financing is simple to structure, but is costlier than debt financing.

3.3 What other factors should parties bear in mind when deciding on a project financing structure?

- Invisible costs such as stamp duty and registration costs should be taken into account during structuring; and

- Foreign exchange regulations should be kept in mind when structuring a foreign borrowing.

4 Industry players and ownership requirements

4.1 Who are the key players in project financings in your jurisdiction? Do any restrictions apply in this regard (eg, foreign ownership)?

Funding is typically available from the following sources:

- State-owned commercial banks: There are six state-owned banks operating in Bangladesh.

- Specialised banks: These are also state-owned banks which have been set up to serve special sectors and areas.

- Private commercial banks: There are 40 local licensed banks operating in Bangladesh, along with nine licensed branches of foreign banks (eg, Standard Chartered, City, HSBC). Private commercial banks also have offshore banking units which can provide foreign currency loans.

- Non-bank financial institutions: There are 42 non-banking financial institutions operating in Bangladesh.

- Foreign multilateral finance institutions/development finance institutions: These are allowed to finance local projects.

- Foreign export-import banks: These generally act in import and export financings.

- Export credit agencies: These do not directly take part in the financing, but issues insurance to reduce the financing cost against a small insurance fee.

- Foreign commercial banks/financial institutions: These are allowed to finance local projects

- Government funds: The government maintains certain funds to finance public-private partnership (PPP) projects, such as Viability Gap Financing and the Bangladesh Infrastructure Finance Fund.

For foreign-controlled entities, local project financing cannot be obtained until the completion of three years of production. However, some infrastructure projects are exempt from this rule.

4.2 What role does the state play in project financings in your jurisdiction?

The state:

- controls the risk exposure of local banks in the form of limits on borrower and lender debt-to-equity ratios and singe debtor risk exposure;

- for foreign borrowing, scrutinises projects to permit foreign borrowing at reasonable cost only if the project has a reasonable forecast to pay;

- provides viability gap financing, transaction advice and similar to keep the financing proposal bankable for PPP projects in which the economic benefits fail to match the social benefits;

- controls the foreign borrowing framework to complement its strict foreign exchange-controlled economy; and

- for some projects, undertakes to make the requisite foreign currency available for repayment.

4.3 Does your jurisdiction have nationalisation or expropriation laws in place? If so, what are the implications in the project finance context?

Bangladesh has no nationalisation or expropriation laws in place. However, the government has the authority to nationalise or expropriate a business in Bangladesh. Under the Foreign Private Investment (Promotion and Protection) Act, 1980, foreign private investment must not be expropriated or nationalised or be subject to any measures that would have a similar effect, except for a public purpose against adequate compensation which must be paid expeditiously and be freely repatriated. Moreover, any nationalisation or expropriation must not affect the interests of the lenders, as the borrower will remain indebted to the lenders on the same terms.

5 Regulatory and documentary requirements

5.1 What regulatory approvals are typically required for project financings in your jurisdiction? How are these typically obtained and what fees are payable?

Local currency borrowing: No express approval from any regulator is required. The lender must maintain risk-based capital adequacy and single borrower exposure limits. The lender must conduct a search of the Credit Information Bureau to ensure that the borrower is not a loan defaulter.

Foreign currency borrowing: In the private sector, the borrower must obtain approval from one of the regulators nominated by the central bank based on the borrower's location, such as:

- the Bangladesh Investment Development Authority;

- the Bangladesh Export and Import Processing Zone Authority;

- the Bangladesh Economic Zone Authority; or

- the Hi-Tech Park Authority.

It takes about two months and $300 to secure such approval, which involves filing extensive documentation including:

- the project profile;

- the term sheet;

- the financial forecasts; and

- details of the borrower's indebtedness and credit rating.

The maximum debt-to-equity ratio allowed is 70:30. The standard interest ratio is accepted, which could be LIBOR/EURIBOR/ESTR+4%. The all-in cost ceiling is considered by determining the interest, which includes interest and other annualised fees and expenses. In addition, for supplier credit arrangements, the down-payment should not exceed 10% of the equipment price and a repayment term of seven years is recommended.

For public sector projects, approval application must be validated by the line ministry and then submitted by the line ministry to the Committee for the Sanction of Non-concessional Loan headed by the Economic Relations Division under the Ministry of Finance. If a sovereign guarantee is sought, the facility and guarantee agreement terms must be pre-approved by the Ministry of Law and Parliamentary Affairs. It takes between two and four months to secure such approval and there is no official fee mandated for such application.

5.2 What licences are typically required for project financings in your jurisdiction? How are these typically obtained and what fees are payable?

Project finance is generally allowed for industrial, manufacturing or infrastructure projects only; and the relevant project must be registered with the relevant regulator (see question 5.1) before lodging the application. This is effected by filing the relevant application along with corporate details. It takes around three weeks and a government fee of $300 for such registration.

5.3 What documentation is typically involved in a project financing in your jurisdiction?

- Term sheet;

- Facility agreements;

- Security agreements;

- Inter-creditor agreements;

- Account bank/escrow agreements;

- Cost over-run/sponsor support agreements; and

- Guarantees.

5.4 What registration or filing requirements apply for project financing documents to be valid and enforceable?

Except for security, no registration or filing requirements apply in order for project financing documents to be valid and enforceable. However, the foreign borrowing approval letter generally includes a condition that after execution, the relevant finance documents must be lodged with the approval issuer authority.

Any charge over assets of the borrower must be perfected with the Office of the Registrar of Joint Stock Companies and Firms within 21 days. In addition, any mortgage over any immovable and real assets must be registered with the Office of the Sub-registrar within 30 days.

5.5 Is force majeure understood as a legal concept in your jurisdiction?

In line with the principles of common law, force majeure is understood as a legal concept in Bangladesh. While the Contract Act does not expressly cover force majeure, it acknowledges the impossibility of performance of a contract. However, the public procurement laws and procurement drafts contain such force majeure considerations and terms. For contracts other than public procurement contracts, the parties mutually negotiate the scope, consequences and remedies to such force majeure events.

6 Security/guarantees

6.1 What types of security interests and guarantees are available in your jurisdiction? Which are most commonly used and which are recommended (if different)? In particular, is the concept of a security trustee recognised (and if not, how are guarantees or security taken for multiple lenders)?

- Mortgages: These are most commonly used for immovable assets such as land and buildings.

- Fixed and floating charges: Fixed charges grant control over the assets, whereas floating charges allow the charge creator to continue to deal with the assets until crystallisation. Floating charges may be created over a class of assets, including future receivables, inventories or bank accounts.

- Pledge: Movable items and especially shares of the company may be pledged by the shareholders in favour of the lenders.

- Corporate guarantees from shareholders and third parties: Approval from the central bank of Bangladesh is not required when these are issued against foreign borrowing approved by the Bangladesh Investment Development Authority.

- Bank guarantee: This requires separate approval from the central bank.

- Standby letter of credit: These are also issued as security in certain cases.

- Liens: Liens are stricti juris and are governed by relevant statutes and ratified conventions. A general lien comprises property of the debtor in the possession or under the control of the service provider without the right to sell or dispose of that property.

- Demand promissory note: This is an unconditional payment obligation upon demand.

- Assignment of contractual rights: This is very common with the assignment of concession rights.

Mortgages, charges, pledge, sponsor guarantees and assignment of contractual rights are common types of security in project financings in Bangladesh. A second-ranking mortgage can be created under Bangladesh law. The concept of a security trustee is recognised and is commonly adopted in case of syndicated financing involving multiple lenders.

6.2 What are the formal, documentary and procedural requirements for perfecting these different types of security interests?

- Mortgages: A local law governed mortgage agreement is executed with the appropriate stamp duty. Mortgages must be perfected by way of registration in the Office of the Sub-Registrar within 30 days of execution, followed by perfection at the Office of the Registrar of Joint Stock Companies within 21 days of execution.

- Fixed and floating charges: These are drawn in the form of a duly stamped, local law-governed deed of hypothecation by way of fixed and floating charges. They must be perfected with the Office of the Sub-Registrar within 30 days of execution, followed by perfection at the Office of the Registrar of Joint Stock Companies within 21 days of execution.

- Pledges: These are drawn in form of a duly stamped deed of pledge. No further perfection requirements apply, unless stipulated in the bylaws of the company.

- Corporate guarantees from shareholders and third parties: These are drawn on a duly stamped deed of guarantee. No further perfection requirements apply.

- Bank guarantees: These are drawn on a duly stamped deed of guarantee. No further perfection requirements apply.

- Liens: These are generally established under contractual agreements on nominal stamp papers.

- Demand promissory note: These must be drawn in a local law-governed format, with minimal stamp duty.

- Assignment of contractual rights: This is drawn in the form of a duly stamped deed of assignment. There are no perfection requirements; but if a notice is not issued to the contract owner or issuer, then any benefit granted to the assignor after execution of the deed cannot be invalidated.

6.3 Can security be taken over property, plant and equipment in your jurisdiction? If so, how?

Mortgages are adopted to grant security over immovable and real property. For other types of property, fixed and floating charges are created to grant security rights.

6.4 Can security be taken over cash (including bank accounts generally) and receivables in your jurisdiction? If so, how? In particular what types of notice and control (if any) are required?

Such security is granted in the form of a floating charge over such assets (eg, cash, bank accounts, receivables). Once an event of default is triggered, the security agent must send an event of default notice to the account bank and the borrower; at that point, the floating charge crystallises and is converted into a fixed charge. Thereafter, self-help remedies may be exercised if granted in the finance agreements or if enforcement must be undertaken.

6.5 Is it possible to take security over major licences (particularly in the extractive industry sector)?

In particular in the extractive industry, it is possible to take security over major licences or concession agreements by way of an assignment of rights agreement. Generally, such licences and concessions incorporate the lenders' ability to assume such security and contracting authority/concession authority consent requirements apply.

6.6 What charges, fees and taxes (including notary and similar fees) arise from the perfection of a security interest or the taking of a guarantee?

Notary fees are nominal. A guarantee must be printed on a nominal stamp duty of BDT 300 and a demand promissory note on a stamp duty of BDT 50. With the exception of pledges, all other types of security granted in favour of a financial institution against project finance must be stamped at a rate of 0.1% of the secured amount. Pledges must be stamped at 0.5% of the secured amount; however, share pledges enjoy certain exemptions.

In addition, to register a mortgage with the Office of the Sub-registrar, the registration fee is 0.1% of the secured amount (if this is higher than BDT 2 million). To register charges at the Office of the Registrar of Joint Stock Companies, the maximum registration fee is as follows:

- Secured value up to BDT 500,000: BDT 250.

- For every additional BDT 500,000 or part thereof thereafter, up to BDT 5 million: BDT 200.

- For every BDT 5 million or part thereof thereafter: BDT 100.

6.7 What are the respective obligations and liabilities of the parties under security documents?

The respective obligations and liabilities of the parties under security documents are generally negotiated and incorporated in the relevant security deed. However, the following is a common framework that can be used as a base:

- Security grantor:

- Perfect the security and pay all stamp duties/taxes;

- Possess and maintain the secured property and exercise duty of care;

- Keep the security agent and the beneficiary informed about the condition of the security and allow any audits by them;

- Notify the other parties of any event of default;

- Upon the occurrence of an event of default, assist with foreclosure of the security;

- Hold any benefit gained from the security in trust of the beneficiary as per the security deed; and

- Keep the beneficiary indemnified of any costs of enforcement.

- Assume the security interest over the property through the security agent;

- Acknowledge a sale of the secured asset to the extent not prohibited under the security deed;

- Properly notify any occurrence of an event of default to the other parties; and

- Instruct, guide and assist the security agent in exercising self-help remedies and enforcement.

- Act as the custodian of any title documents or deeds deposited;

- Hold the security and perfect the same in its own name;

- Periodically perform audits of the secured property and keep the beneficiaries updated; and

- Perform enforcement when instructed by the beneficiary.

6.8 In the event of default, what options are available to enforce a security interest or guarantee? Is self-help available in your jurisdiction in connection with the enforcement of security or must enforcement action be pursued through the courts?

Self-help remedies may be exercised in the following cases:

- The mortgagee (beneficiary) has the power to sell the mortgaged property where the mortgage is an English mortgage (ie, where the title is transferred as security with a provision to buy back);

- A power of sale without court intervention is expressly conferred on the mortgagee by the mortgage deed and the mortgagee is the government or a scheduled bank; or

- A power of sale without court intervention is expressly conferred on the mortgagee by the mortgage deed and the mortgaged property.

In addition, as a contingency plan, lenders obtain an irrevocable power of attorney from the borrower to take possession over the secured asset on default without court intervention. Some of these rights are granted to banks and thus banks are frequently engaged as security agents to enforce such securities.

The mortgagee or chargee may, at a time after the mortgage money has become due, exercise a foreclosure right to obtain from the court a decree for foreclosure. In addition, the mortgagee may sue the mortgagor if:

- the mortgaged property is wholly or partially destroyed; or

- the security is rendered insufficient and the mortgagee has given the mortgagor a reasonable opportunity to provide further security sufficient to render the whole security sufficient, and the mortgagor has failed to do so.

Banks and some multilateral development banks may also file claims with the money loan courts for the swifter resolution of suits. For guarantees there are no self-help remedies and to recover, the debt demand notice is required to be issued followed by recovery suits.

6.9 What other considerations should be borne in mind when perfecting a security interest or taking the benefit of a guarantee in your jurisdiction?

- The security provision must be properly incorporated in the foreign borrowing approval or, if not addressed there, in the application;

- Proper stamp duty must be paid and the securities must have been duly perfected;

- In appropriate cases, a security agent must have been duly appointed; and

- Except for guarantees, the governing law of the security should be Bangladesh law in order for those types of security to be treated as statutory security to have priority at insolvency and to be enforceable as security.

6.10 What other protections are available to a lender to safeguard its position in connection with security or guarantees?

Lenders can appoint local banks as security agents, for the following reasons:

- In some cases, local banks enjoy exemptions from taxes and stamp duties when perfecting the security;

- Local banks enjoy certain self-help remedies; and

- Local banks have access to summary proceedings at the money loan courts.

Lenders may have step-in rights to take control of a project and cure any default of the project company in executing a concession agreement.

6.11 Are direct agreements with contractual counterparties well understood in your jurisdiction?

Direct agreements with contractual counterparties are well understood in Bangladesh and are frequently used in large public-private partnership projects.

7 Bankruptcy

7.1 How (if at all) do bankruptcy proceedings impact on the enforcement of security by a creditor?

Upon the commencement of insolvency and/or reorganisation proceedings, the court will appoint an interim receiver, which will immediately take possession of all movable, immovable and secured property of the enterprise. After the order of adjudication of bankruptcy, the receiver will determine the secured creditors' claims and satisfy them accordingly. If the value of the security is higher than the secured claim, the remaining part of the sale proceeds will be added to the estate. Any debt portion of the secured creditor which remains unsettled will be considered as an unsecured debt and will be settled according to the following preferential payment structure:

- administrative costs and expenses of the receiver, liquidator and administrator;

- taxes and other similar debts due to the government of Bangladesh;

- wages and salaries due to any clerks, servants, labourers or workers;

- debts of onshore banks and financial institutions; and

- other unsecured debts.

For unsecured claims, the priority ranking among local bank claims and other unsecured claims will be at a 2:1 ratio, with the claims having equal ranking within their classes. However, for banks, the preferential payment structure from the residual funds is as follows:

- depositors;

- revenue, taxes, cesses and rates to government authorities;

- wages and salaries due to any clerks, servants, labourers or workers;

- compensation payable under the Workmen's Compensation Act, 1923;

- the expenses of any investigation conducted by an inspector appointed by the court;

- secured claims;

- any unsettled deposits by depositors remaining from the first item in the list; and

- unsecured claims.

7.2 In what circumstances can antecedent transactions be unwound for preference? What other similar measures apply in this regard?

The receiver can claw back payments made in the fifteen years prior to the adjudication of bankruptcy under Bangladeshi law, on the sole ground that the transfer was made to defeat a debt owed by the debtor. However, in general winding-ups, such clawbacks are allowed for transactions that took place in the preceding six and twelve months, based on different scenarios.

8 Project contracts

8.1 Are project contracts in your jurisdiction typically governed by local law?

Contracts in general are governed by local law; however, where one of the parties to the contract is non-resident, English law is frequently mandated.

8.2 What remedies are available to a project company for breach of the project contract?

Contracts and especially concessions incorporate detailed remedies and options to address breach by any party under the contract. However, in general, Bangladesh law affords the following remedies to the non-breaching party:

- specific performance of the contract;

- termination without obligation;

- rescission of contract; and

- compensation for breach.

8.3 Are liquidated damages provisions in project contracts enforceable?

Under Bangladesh law, liquidated damages provisions in project contracts are enforceable unless, rather than addressing proper damage, such provisions are devised to impose an unreasonable penalty on the breaching party. However, this should also be considered in light of the governing law.

8.4 Are there any public policy considerations which need to be taken into account when assessing the enforceability of project contracts?

For commercial contracts, it is not essential to be take public policies into account when assessing the enforceability of project contracts.

9 Project risk

9.1 What risks typically arise in project financings in your jurisdiction and how are these best mitigated?

- The contracting authority's acknowledgement of the lenders' rights, especially assignment acknowledgement, is a significant risk. This can be mitigated by incorporating proper steps in the rights of the lenders and the contracting authority in the project, unless a direct agreement can be executed.

- Cash flow for the project and foreign exchange availability are other risk factors for such projects. Proper foreign currency risk hedging can mitigate this risk.

- For other types of risks – such as force majeure, political events or change of law – appropriate remedial measures may be considered and incorporated in the project contract.

- For project financing, it is also important to consider the continuous flow of raw materials for production and to pass certain risks relating to supply shortfalls to the contracting authority.

- Attention should also be paid to project permits. Risks should be passed to the off-taker, to some extent, for failure to obtain any permit without any fault on the part of the contractor; if this cannot be attributed to the contracting authority's default, then it may be proposed to constitute a political event or similar.

- Land is a very sensitive issue and appropriate indemnities should be sought from the vendor for any undisclosed liability.

9.2 How significant is political risk in project financings in your jurisdiction? How is this best mitigated?

Political risk in project financing in Bangladesh is not that high, as new governments tend to respect ongoing projects and fulfil their commitments accordingly. Furthermore, public-private partnership contracts are highly bankable with appropriate risk mitigation and remedies incorporated in such contracts.

10 Insurance

10.1 What types of insurance arrangements are typically put in place for project financings in your jurisdiction?

The following types of insurance are common in industrial projects:

- all-risk;

- burglary;

- natural disaster; and

- fire.

For infrastructure projects, the following types of insurance are common:

- During the construction period:

-

- in respect of the engineering, procurement and construction contract, all-risks insurance;

- third-party liability insurance;

- employer's liability insurance; and

- insurance necessary to mitigate the risks that may develop for the grantor as a consequence of any act or omission of the concessionaire.

- During the partial operation period and the operation period:

-

- property and casualty insurance;

- third-party liability insurance; and

- employer's liability insurance.

Under the finance agreements, lenders generally assume the status of the first beneficiary in the insurance proceeds by way of direct incorporation in the policy or by assignment of the insurance proceeds rights. Where an export credit agency (ECA) is involved in the project to issue lending risk insurance, the lenders are generally the beneficiaries to such insurance proceeds and upon payment of the insurance proceeds, the ECA assumes a step-in right as granted to the lenders.

10.2 If local insurance is required, can local insurers assign offshore reinsurance contracts in your jurisdiction?

Local insurance is mandatory, but reinsurance may be availed of from foreign insurers. Local insurers can assign offshore reinsurance contracts in Bangladesh.

10.3 What other forms of insurance feature in the project finance market in your jurisdiction?

The types of insurance that are commonly availed of in Bangladesh are set out in question 10.1.

11 Tax

11.1 What taxes, royalties and similar charges are levied in the project finance context in your jurisdiction?

In general, insurance payments are subject to withholding tax at the highest rate applicable to a company in Bangladesh (ie, 32.5%). However, under the 36 double tax agreements in force in Bangladesh, lenders from the relevant countries are entitled to a reduced tax rate of 10%.

11.2 Are any exemptions or incentives available to encourage project finance in your jurisdiction?

The interest of lenders in manufacturing project financings is tax exempt. Furthermore, the interest of lenders in public-private partnership (PPP) and power project financings is also tax exempt. To reduce the cost of project finance, the government also provides certain income tax exemptions for:

- PPP projects;

- power projects;

- thrust sector manufacturing projects;

- economic zone development; and

- projects in economic zones, export processing zones and hi-tech parks.

11.3 What strategies might parties consider to mitigate their tax liabilities in the project finance context?

Tax exemptions apply in most cases where project finance is allowed.

12 Governing law and jurisdiction

12.1 What law typically governs project finance agreements in your jurisdiction? Do any specific requirements apply in this regard?

Contracts in general are governed by local law; however, if one of the parties to the contract is a non-resident, English law is frequently mandated. While the parties are generally free to choose the governing law, for government contracts, the governing law can be either Bangladesh law or English law.

12.2 Is a choice of foreign law or jurisdiction valid and enforceable? In the case of a choice of foreign law of jurisdiction, will any provisions of local law have mandatory application? Are submission to jurisdiction provisions that operate in favour of one party only enforceable?

The Bangladesh courts will uphold the choice of foreign law and party autonomy as agreed among the parties when entering into the contract. It was decided in PLD 1964 Dacca 637 that where the intention of the parties to a contract regarding the governing law is expressed verbally, this expressed intention will determine the proper law of the contract and in general will override any other presumption.

The Bangladesh courts will not exercise jurisdiction over a contractual dispute where the contract states that a foreign court has exclusive/non-exclusive jurisdiction over it, unless all parties to the dispute agree to submit to the jurisdiction of the Bangladeshi courts to resolve the dispute. However, the Bangladesh courts will assume jurisdiction in special cases where they have exclusive jurisdiction (eg, labour disputes). According to recent case law, the courts will always recognise the parties' submission to a foreign tribunal, but reserve the right to issue an interlocutory order to preserve the subject matter of the case until a final adjudication has been issued by the foreign tribunal.

Submission to jurisdiction provisions that operate in favour of one party only are enforceable as long as they are agreed and both parties can access the same tribunal.

12.3 Are waivers of immunity enforceable in your jurisdiction?

A waiver of sovereign immunity will be upheld in the Bangladesh courts with respect to a contract which is not against any local policy, and which is otherwise valid and binding. In addition, for disputes arising from contracts of a commercial nature, the Bangladesh courts accept the common law doctrine of restrictive immunity adopted by the English courts in 1981.

12.4 Will foreign judgments or arbitral awards be enforced in your jurisdiction? If so, how?

A foreign money judgment from a court with reciprocal arrangements may be enforced in Bangladesh within six years of the date of the judgment (or longer with leave of the court), by lodging it with the court of first instance subject to the following requirements:

- The foreign judgment must be conclusive and have been given on the merits of the case;

- The judgment must have been pronounced by a court of competent jurisdiction, such as an English court;

- The judgment must be capable of enforcement in the original court;

- The judgment debtor, if it was the defendant in the original proceedings, must have been duly served with the process of the original court;

- The judgment may not have been obtained by fraud or be in respect of a cause of action;

- The judgment must not be contrary to public policy or the laws of Bangladesh, where applicable;

- The judgment may not sustain a claim founded on a breach of a law in force in Bangladesh; and

- There must be no pending or possible appeal against the judgment of the original court.

An arbitral award may also be enforced in same way. The court may decline to enforce a foreign arbitral award if the party against which it is invoked furnishes proof to the court that:

- a party to the arbitration agreement was under some incapacity;

- the arbitration agreement is not valid under the law to which the parties have subjected it;

- the party against which the award is invoked was not given proper notice of the appointment of the arbitrator or of the arbitral proceedings, or was otherwise unable, due to some reasonable cause, to present its case;

- the arbitral award contains decisions on matters beyond the scope of the submission to arbitration; however, if the decisions on matters submitted to arbitration can be separated from those not so submitted, that part of the award which contains decisions on matters submitted to arbitration may be recognised and enforced;

- the composition of the arbitral tribunal or the arbitral procedure was not in accordance with the agreement of the parties or, in the absence of such agreement, was not in accordance with the law of the country where the arbitration took place; or

- the award has not yet become binding on the parties, or has been set aside or suspended by a competent authority of the country in which, or under the law of which, that award was made.

Enforcement of award also may be denied if the court in which recognition or execution of the foreign arbitral award is sought finds that:

- the subject matter of the dispute is not capable of settlement by arbitration under the law for the time being in force in Bangladesh; or

- recognition and execution of the foreign arbitral award would conflict with public policy.

13 Foreign investment

13.1 What taxes and other charges are levied on foreign investors in the project finance context in your jurisdiction?

In addition to the taxes discussed in question 11, stamp duties and levies, companies must pay tax at the rate of 32.5% on their profits, with the exception of listed companies, financial institutions, mobile operators and tobacco product manufacturers.

13.2 Are any incentives available to encourage foreign investment in the project finance context?

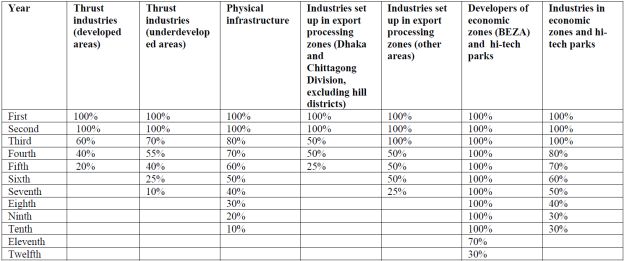

Tax holidays are allowed for industrial undertakings and physical infrastructure facilities established between 1 July 2019 and 30 June 2024 in the ‘thrust' sector. The thrust sector comprises industries and industrial sub-sectors that contribute to the country's industrialisation. In Bangladesh, it is based on developed and underdeveloped areas (see Table 1). Industries set up in export processing zones are also eligible for tax holidays.

Examples of industrial sectors that are subject to tax exemptions include:

- radiopharmaceuticals;

- automobile manufacturing;

- barrier contraceptives;

- rubber latex;

- chemicals and dyes;

- computer hardware;

- energy-efficient appliances; and

- petro-chemicals.

Examples of physical infrastructure that are subject to tax exemptions include:

- deep sea ports;

- hi-tech parks;

- elevated expressways;

- flyovers; and

- waste treatment plants.

Table: Tax holidays

Coal-fired independent power producers (IPPs) awarded before 30 June 2020 and achieving a commercial operation date before 30 June 2023 will enjoy a 100% tax exemption for the first 15 years. For other IPPs that commence generation before 31 December 2022, a tax exemption on income tax is available for 15 years. For those that commence operations after 1 January 2023, the following incentives are available:

- a 100% tax exemption for the first five years;

- a 50% tax reduction for the next three years; and

- a 25% tax reduction for the next two years.

For public-private partnership projects, there is a 10-year tax holiday in certain sectors, such as national highways, expressways, bridges, tunnels, ports, subways and monorails.

13.3 What restrictions and requirements apply with regard to the remission of foreign exchange? Are local companies permitted to maintain offshore bank accounts?

Foreign investments in Bangladesh must be made in foreign currency through banks.

Foreign investors are free to sell and purchase their shares in local companies at fair value. However, share transfers from foreign shareholders to local shareholders must follow strict valuation guidelines issued by the central bank as the repatriation of fund is involved. The banks arrange approvals from the central bank for the repatriation of sales proceeds of foreign investors' equity investments. Banks arrange summary approvals from the central bank for the repatriation of dividends to non-resident shareholders. Profits, liquidation proceeds and share transfer proceeds are freely repatriable.

Repayment and interest payments are permitted for parties which have secured foreign borrowing approval from security. Shareholder loans to meet working capital requirements are allowed for a term of six years, with a maximum interest rate of 3% permitted. Subject to central bank approval, onshore foreign-denominated bank accounts may be opened. However, offshore bank accounts cannot be opened in general.

Technical assistance is also repatriable, but cannot exceed 6% of the revenues for the preceding years or imported machinery from offshore.

13.4 What restrictions and requirements apply with regard to the import of plant and machinery?

There are no restrictions in general, but certain procedures must be followed. Capital machinery can be imported subject to recommendations from the Bangladesh Investment Development Authority with the approval of the chief controller of imports and exports. For other imports, such as spares, an import registration certificate must be obtained from the chief controller of imports and exports. Imports must be executed through banks by way of the issue of a letter of credit or on a fully prepaid basis.

13.5 What restrictions and requirements apply with regard to foreign workers and experts?

The requirements are as follows:

- Nationals of countries recognised by Bangladesh will be considered for a work permit.

- Permits are available only for jobs for which local experts/technicians are not available.

- The expatriate to local employee ratio cannot exceed 1:20 for companies in the industrial sector and 1:5 for companies in the commercial sector.

- Persons below the age of 18 are not eligible.

- Initial employment is for two years, which may be extended on a case-by-case basis.

- Permits are subject to security clearance from the Ministry of Home Affairs.

- The employer must have a minimum paid-up capital/initial remittance of $50,000.

- The employee must first obtain an e-visa and then apply for a work permit.

13.6 Is your jurisdiction party to bilateral investment and withholding tax treaties which might facilitate foreign investment?

Bangladesh has bilateral investment treaties with 30 countries: Cambodia, Turkey, the United Arab Emirates, Denmark, India, Vietnam, Singapore, Thailand, Iran, Austria, Switzerland, Uzbekistan, Korea, Japan, Indonesia, the Philippines, Poland, China, Pakistan, the Netherlands, Malaysia, Italy, Turkey, Romania, the United States, France, BLEU (Belgium-Luxembourg Economic Union), Germany and the United Kingdom.

Bangladesh also has double tax avoidance agreement with 36 countries: Belgium, Canada, China, Denmark, France, Germany, India, Italy, Japan, Malaysia, Pakistan, Poland, Romania, Singapore, the Republic of Korea, Sri Lanka, Sweden, Thailand, the Netherlands, the United Kingdom, the United States, Norway, Turkey, Vietnam, Philippines, Indonesia, Switzerland, Oman, Saudi Arabia, Mauritius, the United Arab Emirates, Myanmar, Belarus, Kuwait, Nepal and Bhutan.

14 Environmental, social and ethical issues

14.1 What is the applicable environmental regime in your jurisdiction and what specific implications does this have for project financings?

The environmental laws of Bangladesh consist of the Environmental Policy, 1992 and the Bangladesh Environment Conservation Act, 1995, read in conjunction with the Environment Conservation Rules, 1997.

Various government authorities are involved in overseeing the material environmental, health and safety laws and regulations pertaining to projects based on the nature of the project and the industry. The principal regulator for environmental matters in Bangladesh is the Department of Environment (DOE). The DOE is empowered to:

- formulate environmental quality standards and pollutant discharge standards; and

- issue environmental clearance certificates.

The DOE will grant permission to commence land development if no objection certificate has been issued by the local government. Thereafter, construction is permitted on the basis of the environmental impact assessment report and the environment management programme. Various other organisations – such as the Water Authority, the Inland Water Transport Authority, Department of Forest and the Civil Aviation Authority – are responsible for granting permission for, among other things:

- the use of river water;

- the dredging of rivers;

- deforestation and tree cutting and

- the construction of a bypass or exhaust stack at the site.

The DOE also has the power to:

- impose fines;

- order compensation for environmental pollution, improper discharge or failure to take measures as negotiated with the DOE; and

- at its discretion, shut down any facility that fails to comply with the environmental protection laws and regulations.

However, the DOE must provide reasonable notice before exercising such discretion. It also has the discretionary power to assess any environmental damage by third-party consultants at the cost of the project owner before instituting any claim.

In addition to the above, there are certain lines of finance channelled to Bangladeshi projects by institutions like World Bank in the form of Investment Promotion and Financing Facility (IPFF) Fund etc. which require stringent social responsibility and rehabilitation requirements over acquisition of lands.

14.2 What is the applicable health and safety regime in your jurisdiction and what specific implications does this have for project financings?

Under the Labour Act, employers and employees are also subject to various requirements relating to occupational safety and hygiene in the workplace, concerning matters such as:

- conducting periodic testing of machinery, equipment and materials, with strict requirements on occupational safety;

- securing personal protective equipment for employees;

- providing training on occupational safety and hygiene; and

- conducting periodic health checks.

These are set out in the Labour Act in detail. Specific compensation must be paid for specific injuries as outlined in the Labour Act.

The Labour Act is the principal law that governs the health, safety and welfare of workers in factories and other industrial establishments. It requires that certain facilities be provided for the welfare of workers, depending on factors such as:

- number of employees;

- first-aid appliances;

- canteens;

- shelters;

- childcare facilities; and

- recreational, educational and housing facilities in tea plantations.

Group medical insurance is mandatory for companies that employ over 100 workers.

14.3 What social and ethical issues should be borne in mind in the project finance context?

Statutorily, other than the regulations and underlying requirements discussed elsewhere in question 14, there are no additional obligations imposed on project companies in Bangladesh. However, lenders generally require compliance with International Finance Corporation (IFC) guidelines, the Equator Principles, environmental and social requirements and other environmental laws as a condition in the term financing term sheet. Adherence with the following IFC performance standards is incorporated in facility agreements as a contractual obligation:

- Performance Standard (PS) 1 on Assessment and Management of Environmental and Social Risks and Impacts;

- PS 2 on Labour and Working Conditions;

- PS 3 on Resource Efficiency and Pollution Prevention; and

- PS 4 On Community Health, Safety and Security.

One major challenge for the project company is procuring land for the project, as the following issues are of interest to multilateral financial institutions and development finance institutions in financing a project:

- the purchase of land at a fair price; and

- the rehabilitation of indigenous people.

The usual measures to mitigate the risk of protests against the project include:

- conducting rigorous environment and social impact assessments;

- making factual data publicly available;

- establishing and implementing a rigorous environment management plan; and

- for emergency support, maintaining an industrial police unit to help control protests in the field.

15 Trends and predictions

15.1 How would you describe the current project finance landscape and prevailing trends in your jurisdiction? Are any new developments anticipated in the next 12 months, including any proposed legislative reforms?

Currently, most foreign direct investment is targeted at power and infrastructure projects. Infrastructure development is now at its peak as Bangladesh transitions towards becoming a developing economy. This means that increasing numbers of investment and project finance opportunities should become available in the market.

The local regulatory regime is quite lender friendly and the trends show an increase in the number and value of transactions. No new developments are anticipated in the next 12 months.

16 Tips and traps

16.1 What are your top tips for the smooth conclusion of a project financing in your jurisdiction and what potential sticking points would you highlight?

Before embarking on a project financing, parties should consider the following issues:

- Prepare an appropriate risk matrix and risk allocation plan.

- Consider all permit requirements, especially those stipulated by the foreign exchange regulations.

- Many options for structuring the transaction may be available, but a tax-efficient structure should be emphasised. Tax evasion should not be considered as an option.

- With regard to real estate, rather than demanding the disclosure of all chronological title transfers, indemnities and guarantees should be sought instead, in order to increase the chances of successful close. This is the major bottleneck in most deals.

- If a financier will be involved, it should be involved from the beginning.

- Environmental requirements should be considered from the outset, to avoid any surprises later on.

- Project development costs should be allocated transparently to avoid further scrutiny by the financier.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.