MARKET OVERVIEW

Ghana's pharmaceutical market is one of the most promising sectors in Sub-Saharan Africa experiencing a noticeable evolution in the past three years. As of 2021, the market's value reached $433 million1 and it is projected to witness substantial growth in subsequent years. Approximately, 70% of the market is reliant on foreign medicines and raw materials 2. However, in recent times, local production of pharmaceuticals has seen a major boost owing to sector interventions as well as an improvement in domestic herbal medicine. Increasingly, new entrants are joining the pharmaceutical market in the areas of manufacturing and distribution. This has not only strengthened the local market but has also had a noticeable impact on the export market, marked by a significant increase in exports since 2020.

COMPETITIVE LANDSCAPE OF THE PHARMACEUTICAL MARKET

The pharmaceutical market comprises stakeholders that specialize in research, manufacturing, and distribution of pharmaceutical products. For the manufacturing segment, domestic production makes up about 30% of the market share. As of July 2022, there were 32 licensed local manufacturing facilities3 in the country specializing in the production of prescribed and over-the-counter drugs such as analgesics, anti-malarial, anti-biotics, antiretrovirals, antacids, antihistamines, dewormers, nutritional supplements, etc. catering to both the local and export markets. Notable manufacturers include Ayrton Drug Manufacturing Company, Letap Pharmaceutical Limited, M& G Pharmaceuticals, Kinapharma, Danadams, Entrance Pharmaceutical and Research Center, and Alhaji Yakubu Herbal Company. Some of these players have over 40 pharmaceutical product lines with several retail and distribution outlets nationwide. Aside from manufacturing, some of the local manufacturers are also involved in the importation of pharmaceutical products.

The import market plays a key role in supplementing the pharmaceutical market with varied brands of pharmaceutical products. In 2022, total import volumes for pharmaceuticals reached 21 million kg. India, China, the United Kingdom, France, and Germany are the top 5 import countries collectively controlling about 90% of total import volumes. Currently, the distribution of pharmaceutical products is facilitated by over 600 pharmaceutical importers including domestic manufacturers, public and private Institutions, Logistics and trading companies, and pharmacies. The charts below provide an overview of Ghana's pharmaceutical import market.

Source: Ministry of Trade and Industry (MOTI)

DISTRIBUTION CHAIN

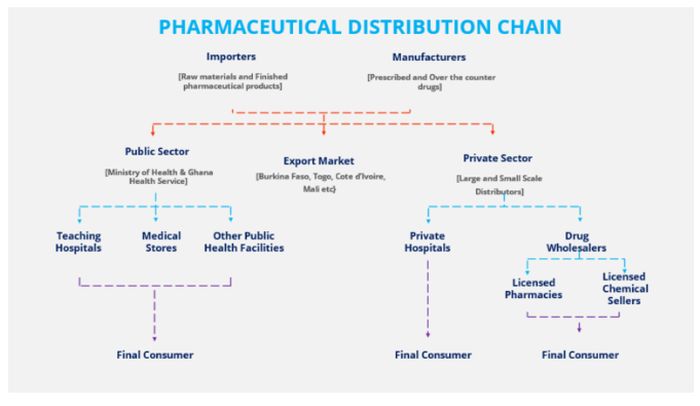

Distribution of pharmaceutical products is an important activity within the pharmaceutical market. There are appropriate guidelines to ensure the quality of pharmaceutical products from the premises of the manufacturer to the final consumer. The figure below represents an overview of the distribution landscape for the pharmaceutical market.

Figure 1: Pharmaceutical Distribution Chain

Footnotes

1. GCB Bank. 2022. "Pharmaceutical Industry". Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

2. GCB Bank. 2022. "Pharmaceutical Industry". Available at PHARMACEUTICAL INDUSTRY (gcbbank.com.gh)

3. Food and Drugs Authority. "List of Local Pharmaceutical Manufacturing Facilities as at July 2022". Available https://fdaghana.gov.gh/img/reports/LIST%20OF%20LICENSED%20LOCAL%20PHARMACEUTICAL%20MANUFACTURING%20FACILITIES.pdf

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.