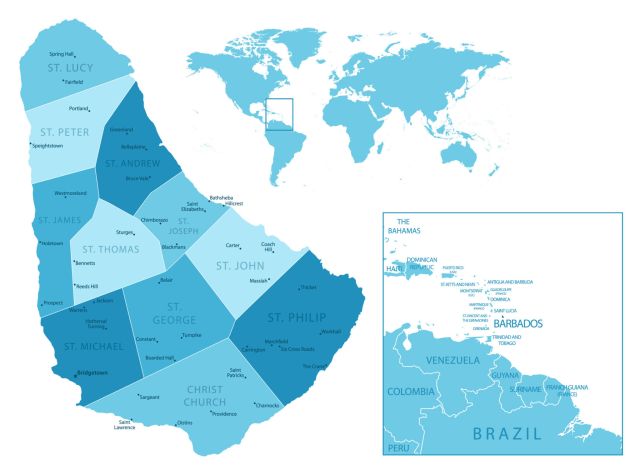

The Barbados Domicile

Seeking a reputable location to establish or expand your business for the management of global activities in the extractive sector?

Consider Barbados!

For decades, Barbados has been regarded as a compliant,

well-regulated and transparent international financial centre that

provides the welcoming investment environment that investors seek.

If you desire an attractive and compelling jurisdiction for the

establishment of global businesses of substance, look no

further.

Barbados offers a strategic office location for companies directly engaged in global mineral exploration and development, as well as for companies that provide supporting products and services. The range of global activities that can be managed from a Barbados office include, but are not limited to:

|

|

Why Barbados ?

|

✓ Business friendly environment ✓ Long history of political, economic and social stability ✓ Educated English-speaking workforce and an available pool of qualified, competent industry professionals ✓ Excellent physical infrastructure with an international airport and a modern seaport |

✓ Sound ICT infrastructure with island-wide 4G LTE and fibre optic high-speed internet. ✓ Expanding treaty network – Companies engaged specifically in the extractive sector stand to enhance their global competitive advantage by facilitating business with other countries in Barbados' treaty network, e.g., the Barbados/Canada DTA ✓ Excellent quality of life |

The Barbados/Canada Effect

Canadian companies continue to use Barbados structures to administer their international operations, manage wealth, mitigate risks and several other back-office functions.

Through these structures they can reduce their operating costs and expand their global footprint while generating

wealth, not only for themselves and their employees, but also for the Canadian economy.

Dividends paid to a Canadian company out of income earned from an active business in Barbados may be considered as exempt surplus for Canadian tax purposes and therefore not subject to tax in Canada.

Doing Business in Barbados

Other Incentives

No restrictions on ownership or repatriation of profits

Companies may be 100% foreign owned and there is no restriction on the ownership of property by expatriates. International business entities enjoy full and unrestricted repatriation of capital, profits and dividends.

Competitive Tax Regime

The general tax rate in Barbados is 9%. Visit www.investbarbados.org for more information.

Foreign Currency Permit

All entities that earn 100% of their income in foreign currency, are entitled to receive a Foreign Currency Permit. These entities benefit from:

- Exemption from exchange control

- Exemptions from property transfer taxes on transfers of shares or quotas

- and other concessions for specially qualified individuals.

Foreign Tax Credit

Taxes paid to a foreign country may be credited against tax payable in Barbados, provided that the credit does not reduce the tax payable in Barbados to a rate less than 1% of the taxable income for the particular income year. The foreign tax credit reduces the impact of having the same income taxed twice, by the foreign country and the local one where the income was earned.

Capital Gains

Capital gains either on property or securities are not subject to tax in Barbados.

Other Business Opportunities

Barbados supports the operation of global businesses of substance across several industries.

The jurisdiction offers a range of traditional and new

investment opportunities including financial services;

international sales and marketing; business

process outsourcing; medicinal cannabis; information communication

technology; fintech; agri-business; medical tourism and global

education.

Global banks, trusts, financial institutions and captive

insurance entities offering wealth generating and protection

options, find Barbados an attractive place to

conduct business. Barbados is a mature captive insurance domicile,

ranking among the top 10 worldwide for decades. Licensed branches

of a number of significant international insurance and reinsurance

companies offer the suite of services to international clients

Company Formation Requirements

in Barbados

A company must first be incorporated or registered in Barbados under the Companies Act. The following information will be required to complete the incorporation process

- A maximum of three (3) corporate names (in order of preference)

- The minimum and maximum number of directors (a company can have a minimum of one director)

- The full name (including the middle name) and residential address of each of the proposed directors of the company

- Details of the particular business that the company proposes to carry on

- The classes of shares (if more than one) that the company is authorised to issue

- The full name (including the middle name) and residential address of each shareholder of the company

At least two (2) references for each director, shareholder or other management personnel, including banker's reference and certified copy of passports of signatories on bank accounts

Quick facts

General Information

| Size: 166 sq. miles/430 sq. km. Capital: Bridgetown Government: Parliamentary Republic Language: English Time Zone: GMT – 4 hours Population: 267,800 (2022) Workforce: 136,300 (2022) |

Literacy Rate: 99.6% Climate: Air Temperature 22-30°C/70-90°F Relative Humidity: 60-70% Currency: Barbados Dollars (BDS$) BDS$ 2.00 – US$ 1.00 Major Trading Partners: CARICOM, USA, UK, Canada, Germany, Japan |

Key Economic Indicators 2022 Gross Domestic Product US$5.6B (P) |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.