In a world where technology advances daily, and companies and people must adapt accordingly, mobile payments have been an area that has undergone a global revolution, but nowhere is this transformation more evident than in China. The country has leapfrogged traditional banking systems, embracing mobile payment platforms with fervour. This shift has fundamentally altered how commerce is conducted in China, differentiating it from the Western countries in numerous ways.

In China, mobile payment platforms like Alipay and WeChat Pay are now ubiquitous, making cash use the exception rather than the norm. Unlike the West, where cash and credit cards still dominate, street vendors, taxi drivers, and small businesses all commonly accept mobile payments in China. This widespread adoption can be attributed to several factors.

WeChat and Alipay: the dominant players

To those less familiar with Chinese apps, WeChat and Alipay are online applications that serve multiple functions. WeChat, created by the tech company Tencent, was initially an online messaging app like WhatsApp. Today, it is also used to make mobile payments, hold-to-talk voice messaging, broadcast (one-to-many) content, video conferencing, video games, share photographs and videos, and share location, making it a mix of Facebook, WhatsApp, and Apple Pay.

Alipay, owned by Alibaba and founded by the famous Chinese billionaire Jack Ma, is an online mobile payment app that allows users to rent cars and bicycles, order food, pay bills, and perform many other functions. Alipay also tends to be more foreign user-friendly than WeChat, accepting foreign passports for registration with greater ease.

Key drivers of mobile payment adoption

One of the key drivers behind China's mobile payment dominance is the unparalleled convenience it offers. With just a smartphone, users can pay for anything from groceries to taxi rides, often with a simple QR code scan. This convenience extends beyond transactions, with mobile payment platforms integrated into various facets of daily life, from ordering food to paying utility bills.

Moreover, China's mobile payment ecosystem offers a seamless digital experience. Social media platforms like WeChat serve as multifunctional hubs, allowing users to chat with friends, shop online and transfer money within the same app. This integration enhances user engagement and promotes the ecosystem's stickiness.

Financial inclusion and economic growth

Furthermore, mobile payments in China have catalysed financial inclusion. Mobile payment solutions have empowered individuals to participate in the digital economy, even in remote rural areas where traditional banking infrastructure is lacking. This inclusivity has driven economic growth, particularly among the companies in the sector, reducing reliance on cash and creating a more efficient and transparent financial system.

Concerns

Data privacy and security

However, China's mobile payment landscape has drawbacks and controversies. One concern is data privacy and security, which has grown in the past few years, as China continuously improves its cyber security legal framework with the promotion of the Personal information Protection Law (PIPL), amongst many others. With vast amounts of personal and transactional data collected by these platforms, concerns about potential misuse or breaches raise questions about user privacy and data protection.

Monopolistic nature of the mobile payment market

Another issue is the monopolistic nature of China's mobile payment market. Alipay and WeChat Pay dominate the landscape, leading to limited competition and potential antitrust concerns. This dominance gives these platforms significant economic influence, raising questions about market fairness and consumer choice.

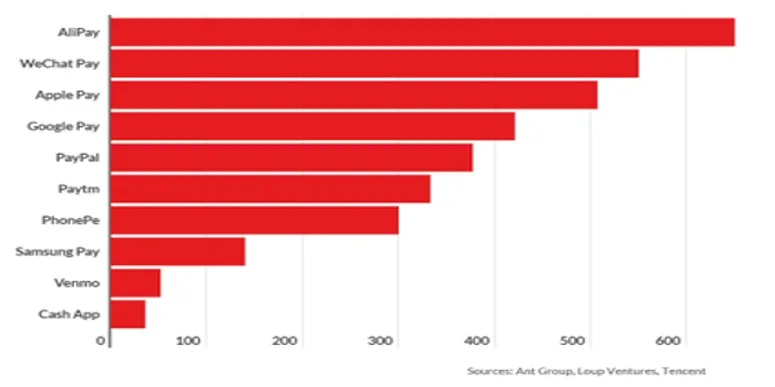

Below is a graphic of the most used mobile payments in the world, where Alipay and WeChat naturally rank first, surpassing 600 million users in the case of Alipay and 500 million in the case of WeChat pay.

Mobile payment in China vs. the West

To provide context and establish a contrast between China and the rest of the world, below we enumerate the top mobile payments apps in the world as well as a brief summarised description of them:

Top mobile payments apps

| TITLE | DESCRIPTION |

|---|---|

| Apple Pay | Apple Pay has the largest transaction volume of any mobile payment service outside of China. |

| Google Pay | Android's default mobile payments solution, with an annual run rate of USD 110 billion transaction value in 2019. |

| PayPal | Online payments stalwart which recently launched a payments super-app, combining savings, crypto, and deals. |

| Cash App | Square's payments super-app, which began life as an easy way to send friends money on mobile. |

| Venmo | When mobile payments were non-existent in the US, Venmo paved the way with its mobile app. |

| Zelle | A collaborative effort by the major US banks to curtail Venmo and Cash App's growth. |

| Samsung Pay | It is a distant third in comparison to Apple and Google Pay, but it is relatively popular with Samsung mobile owners, especially in South Korea. |

| AliPay | China's largest mobile payment platform, widely used for a variety of online and offline transactions. |

| WeChat Pay | The second largest payment platform in China, which is the default payment method on WeChat. |

| Wise | Money transfer service Wise has flipped the market on its head with super-cheap international transfers. |

| Paytm | India's most popular payments platform is responsible for 75% of mobile transactions in the country. |

| PhonePe | Flipkart-backed mobile payments service has over 300 million users in India. |

In contrast to Western countries, where mobile payment adoption has been slower due to factors like entrenched banking infrastructure and consumer habits, China's rapid embrace of mobile payments offers valuable insights. It demonstrates the transformative power of technology in surpassing traditional barriers and reshaping societal norms.

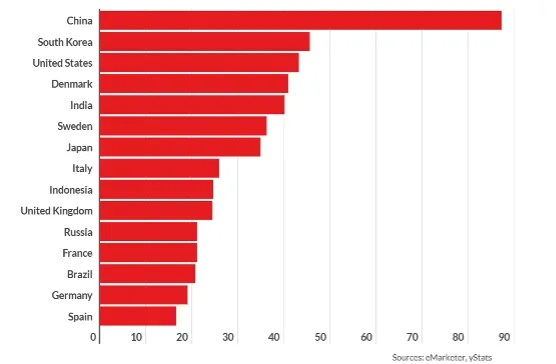

This is reflected clearly in the graphic below. China has by far the highest adoption rate for mobile payments, with buskers, street food vendors and taxis all offering QR codes to pay. India is seeing a surge in adoption, with the same QR code usage. Germany and France have much lower adoption rates, partly due to the hesitation of banks and customers regarding mobile payments.

Facilitating mobile payments for foreign visitors

Also, in recent news, to further ease payments in China by foreign visitors who do not possess a Chinese bank account, both WeChat and Alipay now allow users to link their WeChat and Alipay accounts with their international bank cards, something that until very recently was impossible, rendering short-term business and tourism visits to China highly challenging and making foreigners solely reliant on cash as a means of performing payments. These measures signal a promising return to the embrace of tourism and visitors of all kinds to China.

Conclusion

China's mobile payment revolution represents a major shift in how transactions are conducted. It is much further ahead of Western countries in the size of its user base and breadth and depth of functionalities, offering unparalleled convenience, financial inclusion of different strata of Chinese society, and reshaping consumer behaviour.

However, it also raises important considerations regarding privacy, security and market competition, as it processes many terabytes of sensitive data that, if mishandled, may hurt its users financially and personally and is dominated by WeChat and Alipay. As the world looks to the future of finance, China's experience with mobile payments serves as both a model and a cautionary tale, highlighting the opportunities and challenges of embracing digital innovation on a massive scale.

It is hard to predict the next steps and whether China's mobile payment apps will make an incursion into the West, like TikTok has achieved. We will continue to monitor these developments and share them with you when relevant.

Source

Mobile Payments App Revenue and Usage Statistics (2024) (businessofapps.com)