On February 17, 2023, the New Filing Rules was released by the China Securities Regulatory Commission ("CSRC"), which will come into force on March 31, 2023. In the meantime, the Notice of the State Council on Further Strengthening the Administration of Overseas Stock Issuance and Listing (State Council Announcement [1997] No. 21) (the "97 Red Chip Guidelines") will be repealed on the effective date of the New Filing Rules. The New Filing Rules remove the distinction between overseas listings with a large red-chip structure and overseas listings with a small red-chip structure, as well as the distinction between Chinese authorities' regulatory administration over overseas listings with a red-chip structure and over direct overseas listings of Domestic Enterprises (such as H shares). This will unfold a new era of unified filing-based regulatory system for the overseas offerings and listings by Domestic Enterprises (as defined below).

As the second episode of the series of New Era of Filing-based System for Overseas Offerings and Listings, this article will sort out the key points of filing for the indirect overseas initial offerings and listings by Domestic Enterprises from the perspective of issuers.

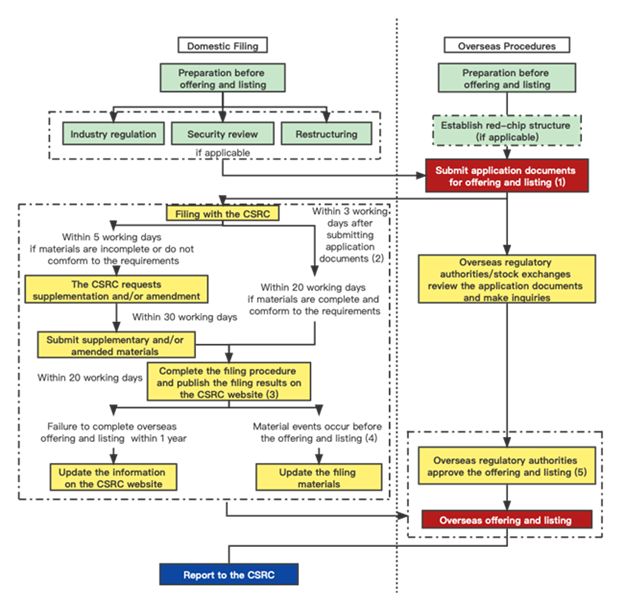

Flow chart of filing procedures for overseas offering and listing

The chart below briefly summarizes the filing procedures and steps required for the indirect overseas offering and listing by a Domestic Enterprise after the implementation of the New Filing Rules:

Note 1: Including the initial submission of the application documents for offering and listing to the Hong Kong Stock Exchange, the New York Stock Exchange, the NASDAQ Stock Market and other overseas stock exchanges; if the issuers apply for confidential filing, an explanation may be submitted at the time of filing to apply for deferred disclosure of the filing information. See below for more details.

Note 2: In particular, where a Domestic Enterprise intends to achieve overseas listing through an overseas special purpose acquisition company, it shall submit the filing materials within three (3) working days after the announcement by the overseas special purpose acquisition company of the specific arrangements for the M&A transaction.

Note 3: During the filing procedures, if the issuer falls under any circumstances specified in Article 8 of the Trial Measures, the CSRC may seek opinions from the relevant competent authority of the State Council. The time spent on submitting supplementary materials and seeking opinions shall not be counted in the time limit of filing.

Note 4: If any material event occurs to the issuer after the filing with the CSRC and before the overseas offering and listing, the issuer shall report to the CSRC in a timely manner and shall update the filing materials within three (3) working days of the occurrence of such event.

Note 5: Such as the hearing for the Hong Kong market, the declaration of registration statement effective for the U.S. market, etc. This depends on whether the overseas regulatory authority considers the issuance of the filing notice from the CSRC as a precondition.

Requirements on documents for filing of overseas offering and listing

Prior to the implementation of the New Filing Rules, small red-chip structures for overseas offering and listing are not heavily supervised by Chinese domestic authorities directly. The implementation of the New Filing Rules will strengthen the insufficiency of the original overseas offering and listing system and promote a "full-coverage supervision". After the implementation of the New Filing Rules, a Domestic Enterprise shall submit a series of filing materials to the CSRC for an indirect overseas initial offering and listing, which are briefly summarized in the table below. Please refer to the Guideline No.2 for details.

|

Filing materials |

Key points |

|

|

1. |

Filing report |

|

|

Commitments of the issuer |

See the Guideline No.2 |

|

|

Commitments of the securities company |

Where any relevant securities company acts as a joint sponsor or joint lead underwriter, the securities company shall submit its commitments as part of the filing materials. |

|

|

Resolutions of the issuer's general meeting of the shareholders and board of directors |

||

|

Chart of the complete shareholding structure and control structure of the issuer |

The chart shall include the information on the issuer's main shareholders, ultimate controlling persons, holding subsidiaries and main domestic operating entities, etc. |

|

|

List and contact information of the issuer's and the intermediaries' project team members |

The issuer shall submit a complete list of the members of the intermediaries' project team. The list of the members of the issuer shall include the ultimate controlling persons, chairman, general manager and person in charge of securities affairs. |

|

|

2. |

Regulatory opinions, filing or approval documents issued by the competent authorities of the industry concerned (if applicable) |

If not applicable, explanations in writing shall be submitted. |

|

3. |

Opinions on the security assessment and review issued by the relevant competent department of the State Council (if applicable) |

If not applicable, explanations in writing shall be submitted. |

|

4. |

Legal opinions and commitments issued by PRC law firm(s) |

The legal opinions include the legal opinion (the "Main Legal Opinion") and special legal opinion. The main contents of the Main Legal Opinion shall include: (1) basic information of the issuer; (2) information of the domestic enterprises' assets and equities acquired by the issuer; (3) information of the domestic operating entities of the issuer (including information on each major operating entity); (4) overall conclusive opinions. Special legal opinion shall be issued in respect of the review points for this offering and listing, confidentiality and archive management, shareholding structure and control structure, and other specific applicable matters, etc. |

|

5. |

Prospectus or listing documents |

|

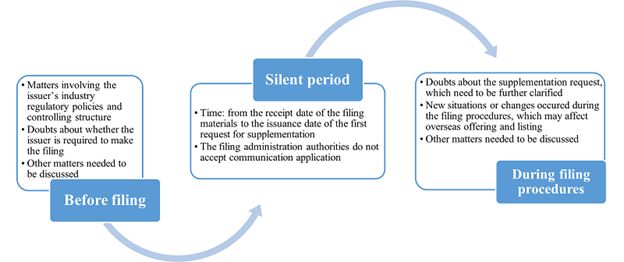

After the implementation of the New Filing Rules, issuers and their

securities service providers are allowed to communicate with the

filing administration authorities by means of written

communication, telephone calls, video conferences, on-site

communication, etc. In particular:

Key points of the New Filing Rules from the perspective of issuers

I. The principle of "Substance over Form" in the determination of a domestic enterprise

Compared with the Provisions of the State Council on the Administration of Overseas Securities Offerings and Listings by Domestic Enterprises (Draft for Comments) and the Administrative Measures for the Filing of Overseas Securities Offerings and Listings by Domestic Enterprises (Draft for Comment) (collectively, the "Filing Measures (Draft for Comment)") released by the CSRC on December 24, 2021, the determination standard for "Domestic Enterprises" in the context of "indirect overseas offering and listing by Domestic Enterprises" needs to be concluded comprehensively by taking into account the profit percentage of domestic assets, composition of senior management personnel, business operation and other factors. Furthermore, Section 1, Article 15 of the Trial Measures further specifies that to be identified as a Domestic Enterprise, the following criteria shall be met at the same time:

- 50% or more of the issuer's operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic enterprises; and

- the main parts of the issuer's business activities are conducted in China, or its main places of business are located in China, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in China.

The Trial Measures also emphasize that the determination of "Domestic Enterprises" shall comply with the principle of "substance over form". The Trial Measures further clarify by the Guideline No. 1 that if the issuer does not fall within the circumstances stipulated in Section 1, Article 15 of the Trial Measures but the risk factors disclosed in the submitted listing application documents pursuant to the relevant overseas market regulations are mainly related to China, the securities companies and the issuer's PRC counsels shall conduct comprehensive demonstration and identification with regard to whether the issuer falls within the scope of filing.

II. Scope and mode of overseas offerings and listings

Whether in the context of direct or indirect overseas offerings and listings by Domestic Enterprises, "Securities" offered and listed overseas under the New Filing Rules not only refer to stocks in the common sense, but also include depository receipts, corporate convertible bonds and other securities with the nature of equity offered and listed overseas directly or indirectly by Domestic Enterprises, which shall also be regulated under the New Filing Rules.

In addition, the New Filing Rules provide that the direct or indirect overseas listings of the assets of Domestic Enterprises through one or more acquisitions, share swaps, transfers or other transaction arrangements shall be subject to filing procedures in accordance with the Trial Measures. This means that various forms of market-oriented offering and listing modes such as IPO, DPO, RTO, SPAC, etc., will all be subject to the supervision of the CSRC under the New Filing Rules.

III. Negative list related to the prohibition of offering and listing

The New Filing Rules adopts the Negative List system. Article 8 of the Trial Measures provides that under the following circumstances, the overseas offering and listing shall be prohibited: (i) if such securities offering and listing is explicitly prohibited by laws, administrative regulations and relevant national rules; (ii) if such securities offering and listing may endanger the national security; (iii) if the issuer has any illegal or criminal acts; (iv) if the issuer is suspected of committing any crimes or serious violations of laws and regulations, and is under investigation according to law, and no conclusion has yet been made thereof, or (v) if there are material disputes with regard to the issuer's ownership. Further, the Guideline No. 1 provides detailed guidelines on the specific circumstances under which such securities offering and listing is explicitly prohibited by provisions in laws, administrative regulations and relevant national rules, the criteria for determining whether the circumstance falls into the Negative List if the acquiree is guilty of a criminal act, the starting point for criminal acts, the determination criteria for serious violations of laws and regulations, and the specific circumstances of material ownership disputes.

IV. Coordinated regulatory mechanism

In addition to improving the regulatory system, the New Filing Rules also strengthen the regulation coordination, clarify regulatory responsibilities and implement a coordinated regulatory mechanism. In answering the questions from the media on February 17, 2023 (the "CSRC Answers to Reporters' Questions"), the CSRC official stated that, the security review and industry regulatory procedures refer to procedures explicitly stipulated in rules of relevant industry regulatory authorities, which provide relatively clear scopes and requirements for application standards. The security review and industry regulatory procedures are regulatory steps relatively independent from the filing requirements of overseas offerings and listings. Only when the current systems and rules explicitly require security review and industry regulatory pre-procedures, the issuer shall submit relevant regulatory documents when applying for filing.

As listed in the Guideline No. 2, the documents attached to the filing materials for the overseas securities offerings and listings shall include regulatory opinions, filing or approval documents issued by industry regulatory authorities; if not applicable, a written explanation shall be submitted.

Article 9 of the Trial Measures specifies that, where the security review is involved, the issuer shall perform relevant security review procedures before submitting the application for offering and listing to the overseas securities regulatory authorities or stock exchanges. Consistent with the Trial Measures, the Guideline No. 2 provides that the documents attached to the filing materials for the overseas securities offering and listing shall include security assessment and review opinions issued by relevant authorities of the State Council; if not applicable, a written explanation shall be submitted. This is in line with a series of policies and regulations promulgated by the internet and data security authorities in the past few years, including the Cybersecurity Law, Data Security Law and the Cybersecurity Review Measures, which require that the overseas securities offerings and listings shall not threaten or endanger the national security.

V. Connection with the overseas listing system

1. Deferred publication

Where an issuer submits overseas offering and listing application in a confidential or non-public manner, it may submit an explanation at the time of filing for overseas securities offering and listing with the CSRC and apply for deferred disclosure of the filing information, and shall report to the CSRC within three (3) working days after the overseas offering and listing application documents are published.

2. Filing mode for shelf offering

Where an issuer issues securities in installments within the authorized scope, it shall file with the CSRC within three (3) working days after the completion of the initial offering and state the total number of securities to be issued. After the completion of all the remaining offerings, it shall submit a report to the CSRC of the consolidated offering information.

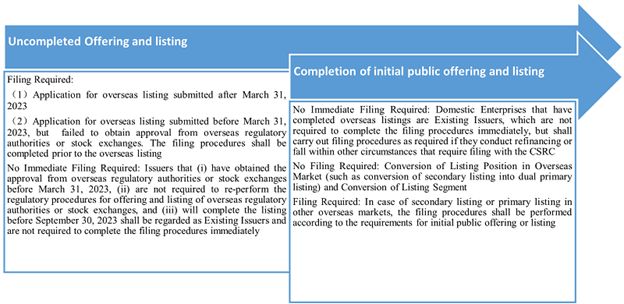

3. Diversified filing requirements for issuers at different stages

With March 31, 2023 as an important watershed and the listing stage of an issuer as the benchmark, the following different filing requirements shall apply:

4. Filing application for issuers with variable interest entity arrangement

According to the New Filing Rules, especially the guidelines in the Guideline No. 2 on Variable Interest Agreements (VIE) Structure, and combined with the clarification in the CSRC Answers to Reporters' Questions that "the CSRC will seek opinions from relevant regulatory authorities and approve the filing for the overseas offerings and listings of enterprises with VIE arrangements that satisfy the compliance requirements", as well as precedent cases of domestic issuance of CDRs by a red chip company with VIE structure, we understand that under the New Filing Rules, Domestic Enterprises adopting VIE structure are allowed to carry out overseas offerings and listings, but at the same time, the New Filing Rules emphasize the examination and verification requirements for the listing of the Domestic Enterprises with VIE structure.

With respect to filing application of issuers with VIE structure, the Guideline No. 2 requests the issuer's PRC counsel to issue a special legal opinion, and such special legal opinion shall include verification statements on the status of overseas investors' participation in the issuer's operation and management, whether there are circumstances under which controlling the business, licenses and/or qualifications through contractual arrangements is explicitly prohibited by the PRC laws, administrative regulations and relevant provisions, whether the domestic operating entity controlled by contractual arrangements falls within the scope of foreign investment security review, and whether any sector(s) subject to restriction or prohibition for foreign investment are involved.

5. Legal liabilities

The Trial Measures specify that the primary responsible party for the compliance of overseas offering and listing is the Domestic Enterprise itself. If the Domestic Enterprise fails to fulfill the filing procedures under the Trial Measures, or conducts overseas securities offering and listing in violation of the Trial Measures, the CSRC shall order rectification, issue warnings to such Domestic Enterprise, and impose a fine ranging from RMB 1,000,000 to RMB 10,000,000. Directly liable persons-in-charge and other directly liable persons shall be warned and each shall be imposed a fine ranging from RMB 500,000 to RMB 5,000,000. If the materials submitted by the Domestic Enterprise have misrepresentation, misleading statement or material omission, the CSRC shall issue rectification orders or warnings, and impose a fine ranging from RMB 1,000,000 to RMB 10,000,000. Directly liable persons-in-charge and other directly liable persons shall be warned and each shall be imposed a fine ranging from RMB 500,000 to RMB 5,000,000.

If the controlling shareholders or the ultimate controlling persons of the Domestic Enterprise organize or instruct the violations, or indulge the violations by concealing relevant facts, the controlling shareholders or the ultimate controlling persons of the Domestic Enterprise shall be imposed a fine ranging from RMB 1,000,000 to RMB 10,000,000. Directly liable persons-in-charge and other directly liable persons each shall be imposed a fine ranging from RMB 500,000 to RMB 5,000,000.

In addition, the CSRC shall incorporate the compliance status of relevant market participants with the Trial Measures into the Securities Market Integrity Archives and upload the record to the National Credit Information Sharing Platform, with a view to strengthening cross-agency information sharing through concerted efforts with competent authorities, and enforcing punishment and deterrence in accordance with the laws and regulations.

Conclusion

The reform and adjustment of the regulatory system for indirect overseas offerings and listings by Domestic Enterprises, including the repeal of the 97 Red Chip Guidelines and the effectiveness of the New Filing Rules, not only constitutes an update of system design to match and comply with the provisions of the higher-level laws, but also meets the demand for opening-up on a higher standard and the international development of Chinese companies and further pushes forward the institutional high-level opening-up. A new era for overseas listings by Domestic Enterprises has arrived. We will continue to share our interpretation on the New Filing Rules from other perspectives and keep you posted.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.