Welcome to Walkers' 2021 Fundamentals White Paper Series, in which we discuss certain trends identifiable among the hedge funds and private equity funds that we helped our clients launch over the last twelve months.

One of the early journalistic clichés to emerge in 2020 was the idea of 'new normals': changes to work, family life and society that, it was suggested, would remain a part of life long after the pandemic subsided. As an industry founded on a talent for identifying and capitalising on these trends, it should come as no surprise that the investment funds industry has itself undergone some fundamental shifts in the way it operates.

Part 1 - Hedge Funds

Strategy: Find Your Niche

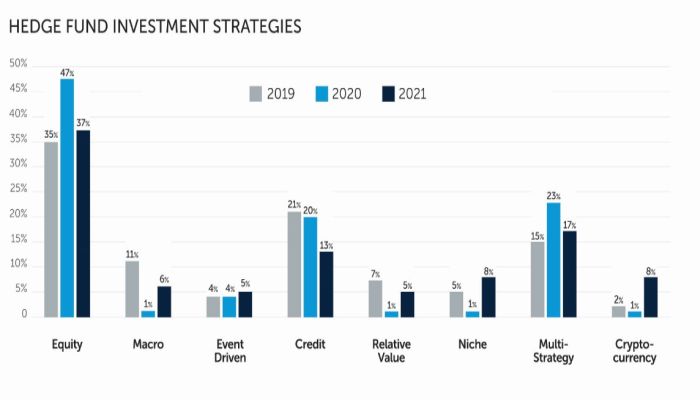

Looking first at questions of strategy, the traditional equity,

credit and multi-strategy funds continue to represent the majority

of our clients' new launches in 2021. However, looking at the

growth of strategies tells a different story: the year saw a return

of cryptocurrency and other digital asset funds as valuations in

that asset class attracted new inflows, and funds with a specific

focus on ESG investments. The significant volume of SPACs also saw

clients raising new funds specifically to invest in those

opportunities.

Focus on Fees

In prior years we have reported the slow but steady decline of the traditional 2% headline management fee, and this year was no different: the median management fee was approximately 1.25%, although this year also saw a small resurgence of funds launching with the full 2% fee. These statistics represent a more complex picture: today's 'median fund' often incorporates multiple management fee classes, as well as individually negotiated fee arrangements with significant investors.

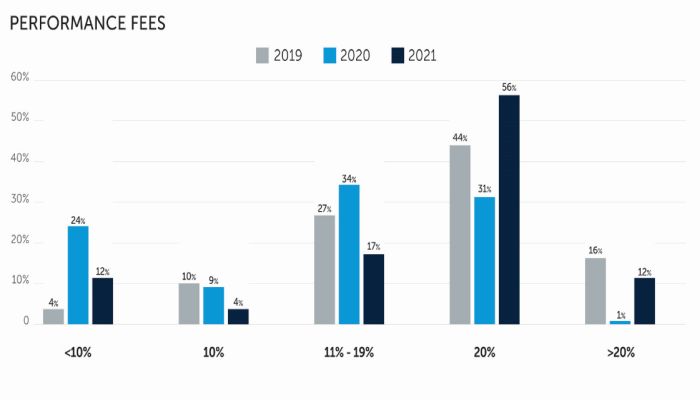

For several years, we have observed the trend of fewer funds

launching with a 20% headline performance fee rate, and the rise of

funds subject to a 11-19% rate. This year, managers appear to have

resisted this trend: of those funds that charged a performance fee

at all, nearly two-thirds had a 20% performance or incentive fee.

While we will need to keep this under review in future surveys to

see if this represents a more permanent (and positive) shift for

managers, it provides some early evidence of the industry's

longstanding response to passive funds: investors are content to

pay for genuine outperformance. This finding has been echoed by

several onshore counsel who have observed a similar pattern.

Redemption Terms

The wider variety of fund strategies launched this year saw a more diverse array of redemption terms. These figures represent the current state of the balance between managers and investors in the competing priorities of ensuring a stable capital base, and that portfolio liquidity and fund liquidity remain aligned. While these priorities are present on virtually all hedge funds, exactly where the balance is found shifts as new strategies become popular, or the industry transitions through periods of stress.

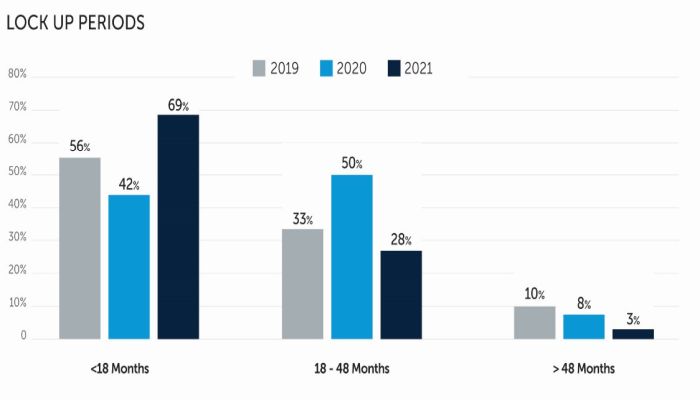

In prior years, we have reported an increasing use of lock-ups,

with those lock-ups getting longer in duration. This year, lock-ups

remained popular (about 40% of funds we helped to launch used them)

but slightly less so than in prior years. As in prior years,

lock-ups tend to be implemented as 'hard' lock-ups (a

complete restriction on redemption) rather than soft (redemptions

during the lock-up period are possible, subject to an early

redemption fee).

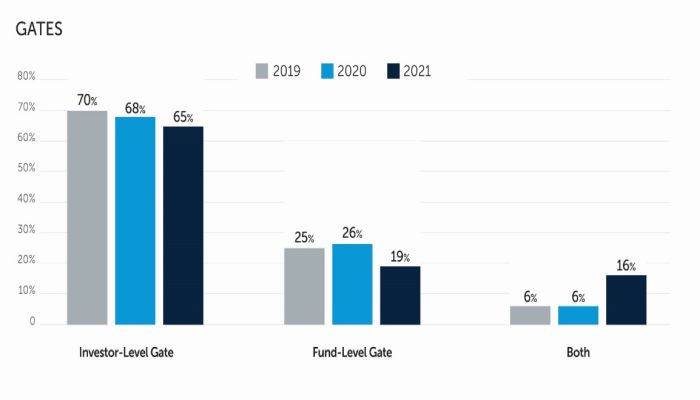

The use of gates continues an upward trend we have observed since 2018. This year, over 35% of funds employed some form of gate, and of those funds approximately two-thirds imposed the gate at the level of the investors individually, rather than the fund as a whole.

Governance Matters

Since 2016, the number of funds launching with independent directors on the board had started a gentle decline, with only a modest reversal in 2020. In 2021, the decline resumed at pace. Reasons for this decline were diverse, but included cost sensitivities for start-up managers, and, among the more established institutional managers, internal controls and governance processes that were sufficiently trusted by their investors not to require further independent oversight. Strategy likely played a role too: as a group cryptocurrency funds tend to be less likely to appoint independent directors than the traditional equity or multi-strategy funds.

The selection of an appropriate board continues to be a critical process on which managers should focus, and guiding managers through these processes remains a key part of our role as Cayman counsel.

A Fundamental Shift?

At the outset we contemplated the 'new normals', yet in many ways our data suggests a return to some of the older norms for the funds industry: a broad range of fund strategies, familiar fee pressures and funds carefully considering whether independent governance is right for them. The fundamental task remains to deliver risk-adjusted returns as contemplated in the fund's offering document.

Yet very few managers would say their business runs in the same way it did two or three years ago. They report an increasingly involved investor base with opinions on matters of governance, diversity, ESG factors and the like. For some managers, explaining how returns are delivered is as important as the delivery itself. Add in the continued challenges of attracting and retaining top-tier talent, succession planning as veterans of the Global Financial Crisis contemplate retirement, and the ever-increasing regulatory and compliance burden, the challenges for managers don't get any easier.

However, for all of the disruption and challenges that the last few years have brought, these are also times of immense and fascinating opportunity, as those shifts that are transitory, and those that are more lasting, reveal themselves. Rising to meet these challenges and take advantage of these opportunities is a task for the whole industry, across all time zones and cultures. The fund terms described in this White Paper represent not only the balance of hundreds of individual negotiations, but the beginning of these shifts into the next stage of the industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.