In the vast landscape of Canadian business, a unique entity thrives on values, heritage, and continuity—the family-owned enterprise (FOE). These businesses, often spanning generations, are the cornerstone of Canada's economy, generating roughly 50% of the country's gross domestic product (GDP).

Family-owned businesses also account for around two-thirds of all the private sector firms in the country and proudly employ just under 50% of the private sector workforce. This equates to 6.9 million people. Yet, beneath the surface of their success lies a challenge that is both critical and complex: family business succession planning. As the baby boomer generation continues to retire, there will be a significant shift of approximately $1.9 trillion in business assets in the coming years.

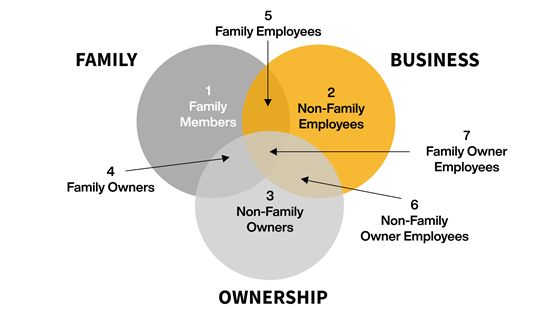

This article is designed as a comprehensive guide to navigating the intricacies of family business succession planning. Crowe MacKay's succession planning experts will help you understand the essence of family-owned enterprises and the Three-Circle Model of the Family Business System, emphasizing the significance of the diverse perspectives within the family, business and ownership systems.

Understanding Family-Owned Enterprises (FOE)

Definition and Characteristics of FOEs

Family-owned enterprises, often referred to as family-owned businesses or family businesses, are businesses where the ownership and management are intertwined with familial relationships. These entities exhibit distinctive traits that set them apart in the corporate world.

FOEs are profit-oriented and focused on preserving a legacy, values, and traditions. Unlike their non-family counterparts, FOEs prioritize the long-term sustainability of the business over short-term gains.

The Unique Dynamics of Family Businesses

The dynamics within family businesses are a world of their own. Sibling rivalries, generational differences, and the blurred lines between family members' personal and professional lives create a unique ecosystem. These dynamics can fuel the business's success or become stumbling blocks that hinder growth.

Challenges and Advantages of FOEs

While FOEs have their share of challenges, they also enjoy certain advantages. Their long-term perspective, strong familial bonds, and shared values can be powerful drivers of success. However, they must grapple with challenges like succession planning, conflict resolution, and balancing family and business interests.

The Three-Circle Model: An Essential Framework

Introduction to the Three-Circle Model

At the heart of effective succession planning in family businesses lies the Three-Circle Model—a guiding framework that helps unravel the complexities of FOEs. This model is instrumental in aligning the interests of the Family, Business, and Ownership Systems.

Explanation of the Three Circles

The Three-Circle Model revolves around three core circles, each representing a crucial aspect of FOEs:

- Family Circle: This circle encompasses family dynamics, relationships, and personal aspirations.

- Business Circle: Here, we focus on the professional management, operational aspects, and growth strategies of the business.

- Ownership Circle: This circle deals with ownership structure, equity distribution, and financial considerations.

Visual Representation of the Model

The Family Circle

Defining the Family Circle in FOEs

The Family Circle is where the heart of the family beats. It consists of family members, including those not involved in the business, their roles, responsibilities, and emotional connections to the family enterprise.

Family Dynamics and Roles within the Business

In the Family Circle, roles can be defined by relationships rather than qualifications, which can lead to both harmony and discord. Siblings may have different visions for the business, and parents may struggle with letting go of leadership roles.

Emotional and Personal Factors Influencing Family Members

Emotions often run high within the Family Circle. Personal aspirations, conflicts, and unresolved issues from the past can all come into play when discussing succession and leadership transitions.

The Business Circle

Defining the Business Circle in FOEs

The Business Circle pertains to the operational side of the enterprise. It involves professional management, day-to-day operations, strategic planning, and market dynamics. This circle keeps the business running smoothly.

Professional Management and Operational Aspects

Efficient management and operational excellence are critical components of the Business Circle. Here, decisions must be based on merit rather than familial ties to ensure the business's longevity

Business Strategy, Growth, and Market Dynamics

In this circle, strategic planning and adaptation to market trends are vital. Family businesses must compete in the same marketplace as non-family businesses, requiring a strong understanding of industry dynamics.

The Ownership Circle

Defining the Ownership Circle in FOEs

The Ownership Circle deals with the financial aspects of the business. It includes the ownership structure, equity distribution, and wealth management—often key topics in succession planning discussions.

Ownership Structure and Equity Distribution

Ownership can be fragmented among family members, complicating decision-making and creating tensions. Decisions regarding equity distribution require careful consideration and planning.

Financial Considerations and Wealth Management

Managing the financial well-being of the business and the family's wealth is a delicate balancing act. Tax implications, estate planning, and wealth preservation are central concerns in this circle.

The Interplay of Circles in Succession Planning

The Crucial Role of the Three Circle Model in Succession Planning

Succession planning in family businesses is not just about picking a successor; it's about ensuring the seamless transition of leadership, preserving the family's legacy, and sustaining the business's success. The three Circle Model acts as a compass in this journey.

Balancing the Interests and Perspectives of Each Circle

Succession planning involves harmonizing the interests and perspectives of the Family, Business, and Ownership circles. Each circle has its objectives but must align for a successful transition

Potential Conflicts and their Impact on Succession

Conflict resolution is a significant aspect of succession planning. The interplay of circles can either resolve conflicts or exacerbate them. Understanding these dynamics is crucial for a smooth transition.

Family Business Succession Plan

Setting the Stage for Succession

FOEs are often built on a foundation of tradition and values, making the leadership transition a sensitive and crucial phase. To ensure a seamless succession, a well-thought-out plan is paramount

Assessing Current Leadership

Begin by assessing the current leadership structure within the family business. Identify key decision-makers and their roles. Take stock of their strengths, weaknesses, and aspirations. This assessment will serve as the basis for selecting suitable successors.

Establishing a Timeline

Succession planning is not a one-size-fits-all process. It requires careful consideration of when leadership transitions should occur. Establish a realistic timeline for the next generation's readiness and the current leaders' retirement plans.

Identifying Key Roles and Responsibilities

Clear role definition is essential for a smooth transition. In this phase, the focus is on allocating responsibilities among family members and non-family professionals, where applicable.

Leadership Roles

Determine who will take on leadership roles within the business. This includes identifying the future CEO, CFO, and other key positions. Ensure that these people have the necessary skills and qualifications.

Governance Roles

Apart from operational roles, governance within the family enterprise is equally critical. Define roles such as family council members, board of directors, and advisors. Each role should have a clear scope of responsibilities and decision-making authority.

Incorporating the Three-Circle Model

The Three-Circle Model, as discussed earlier, plays a central role in family business succession planning. Integrating this model into your plan is essential to address the unique dynamics of family, business, and ownership.

Family Circle Integration

Incorporate strategies to maintain family cohesion during the transition. This may involve family meetings, conflict resolution mechanisms, and mentoring programs to prepare the next generation.

Business Circle Integration

Ensure the business remains agile and competitive. Develop strategies for talent development, professional management, and market expansion. Evaluate whether the existing leadership aligns with these goals or if external talent is needed.

Ownership Circle Integration

Incorporate mechanisms for equity transfer, financial planning, and wealth preservation. Consider the impact of taxes and ensure that ownership structures align with the family's long-term financial objectives.

Communication is Key

Open and transparent communication is the anchor of a successful succession plan. All stakeholders, both within and outside the family, should be kept well-informed throughout the process.

Family Meetings

Regular family meetings can serve as forums for discussing succession plans, addressing concerns, and sharing updates. These meetings can also foster a sense of unity and shared purpose among family members.

Professional Advisors

Engage external professionals, such as legal, accounting and tax professionals, financial advisors and business consultants, to provide objective insights and facilitate communication. Their expertise can help bridge the gap between family, business and ownership interests.

Continuous Evaluation and Adaptation

Succession planning is not a one-time event but an ongoing process. Regularly review and adapt the plan as circumstances change.

Performance Metrics

Establish clear performance metrics and key performance indicators (KPIs) to measure the success of the succession plan. Regularly evaluate whether the chosen successors are meeting their goals and the business is thriving under their leadership.

Reassessment of Roles

As family members and business dynamics evolve, be open to revisiting role assignments and responsibilities. Flexibility and adaptability are crucial for long-term success.

Conclusion

In conclusion, family business succession planning is a complex but essential process for the continuity and prosperity of FOEs. The Three-Circle Model is a useful framework, helping family business leaders navigate the intricate web of family dynamics, business operations, and ownership concerns in their succession planning.

By embracing a holistic approach and understanding the diverse perspectives within each circle, FOE leaders can ensure a smooth transition, preserving their family's legacy for generations to come.

Secure Your Legacy with Crowe MacKay

Ready to safeguard your family business's future? Partner with Crowe MacKay for succession planning services. Our team guides family-owned enterprises through seamless transitions. Contact us today to create a customized succession plan that aligns with your values and secures your business for generations to come.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.