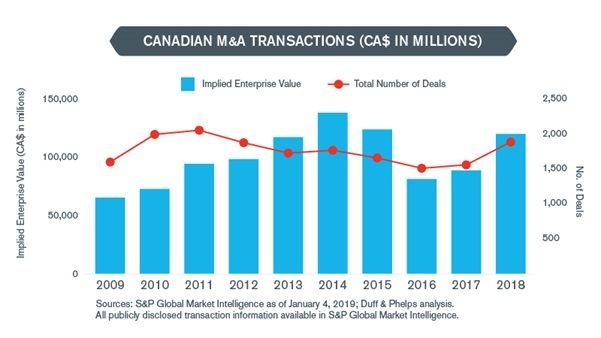

In 2018, Canadian M&A activity reached seven-year highs by deal count and three-year highs by implied enterprise value (EV). The Canadian M&A market has benefited from a relatively stable political environment as well as low financing costs and continued North American growth. In 2018, 1,874 Canadian companies changed hands, with disclosed EVs totaling $119 billion, a 20% and 35% increase over 2017 in terms of deal count and disclosed EV, respectively. Of the transactions completed, 72% were domestic acquisitions, which is in line with historical averages.

The Canadian M&A market experienced an uptick in announced deals (1,874 in 2018 versus 1,558 in 2017); however, the median deal value fell ($8 million in 2018 versus $10 million in 2017). The significant increase in the number of deals under $50 million likely led to this decrease in median deal value. Although megadeals represent only 4% of all transactions, they represented 77% of the total deal value.

The Canadian M&A market will likely remain strong, given the abundant capital available from private equity and strategic buyers, who are eager for growth now that economic expansion is starting to slow (2019 and 2020 GDP growth is forecast at 1.7% and 1.8%, respectively). Buyers will likely continue to outnumber sellers, potentially driving up valuations.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.