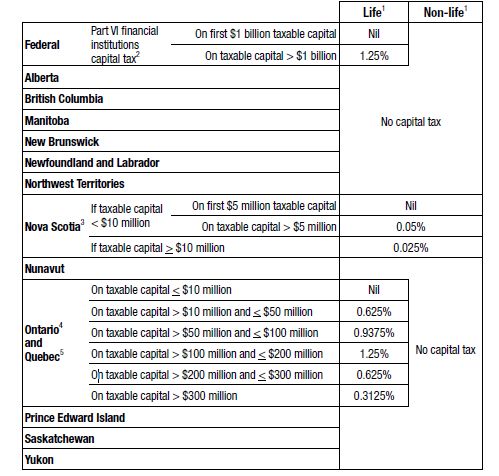

Footnotes

1. All rates in this table are for a December 31, 2012 year end. When applying the thresholds, taxable capital of all companies in a group is considered.

2. The federal Part VI tax is reduced by the corporation's federal income tax liability. Any unused federal income tax liability can be applied to reduce the Part VI tax for the previous three years and the next seven.

3. Recent and future changes in Nova Scotia are outlined on page 8.

4. Ontario capital tax may be reduced by the Ontario income tax and corporate minimum tax payable for the year.

5. Quebec capital tax may be reduced by the Quebec income tax payable for the year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.