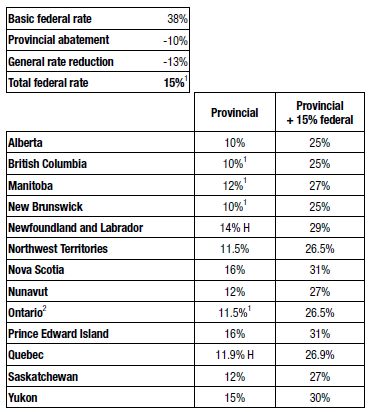

The following rates, which have been pro-rated for a December 31, 2012 year end, apply to insurance companies. For Canadian-controlled private property and casualty insurers, lower rates may apply on up to $500,000 of active business income ($400,000 in Manitoba and Nova Scotia).

Footnotes

H Tax holidays are available to certain corporations.

1. Recent and future income tax changes are outlined on pages 1 to 9.

2. Ontario corporations that, on an associated basis, have gross revenues of $100 million or more and total assets of $50 million or more, may have a corporate minimum tax (CMT) liability based on adjusted book income. CMT is payable to the extent that it exceeds the regular Ontario income tax liability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.