The Canada Revenue Agency ("CRA") recently announced two new, more streamlined options for the 2020 tax year in order for employees to claim deductions for employment expenses related to working from home during the COVID-19 pandemic. As a result of these new options, employers will need to decide how to facilitate this process and, in particular, whether to issue a "T2200S" form (as defined below) to each eligible employee.

The new options have been adapted from the existing method under the Income Tax Act (Canada) for eligible employees who are required to pay their own expenses while carrying out employment duties to claim a deduction ("Standard Method"). The Standard Method has established eligibility criteria, applies to a broader range of employment expenses (e.g., motor vehicle expenses) and involves a more comprehensive set of forms that must be completed by the employee and employer, including the multi-page Form T2200, Declaration of Conditions of Employment ("T2200"). The Standard Method remains available for the 2020 tax year and is not discussed in this update.1

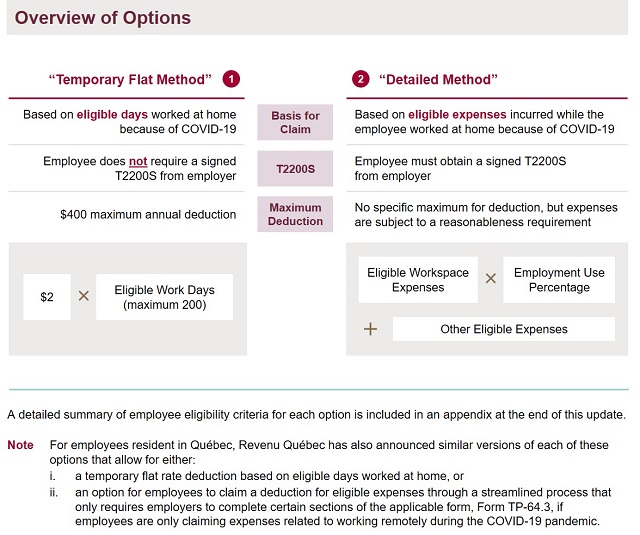

The two new COVID-19 specific options for employees to claim a deduction are: (i) the Temporary Flat Method, and (ii) the Detailed Method, each as outlined below. The Detailed Method includes a simplified one-page form, T2200S – Declaration of Conditions of Employment for Working at Home Due to COVID-19 ("T2200S") and modified eligibility criteria. The range of expenses potentially deductible to the employee can, however, be more expansive under the Standard Method versus the Detailed Method, depending on the nature of the employee's duties.

Employer Obligations

Only the Detailed Method requires employees to request a completed and signed form T2200S from their employer to support the employee deduction. The completed form T2200S does not need to be filed by the employee with their tax return, but it must be retained by the employee in case it is requested by the CRA. In completing the Form T2200S, the employer is not required to calculate the amount of the deduction but is required to report work-from-home related reimbursements (discussed in more detail below).

The CRA's guidance suggests that employers are assumed to be open to providing a completed Form T2200S (or a T2200 under the Standard Method) upon the employee's request;2 however, there does not appear to be a statutory requirement for the employer to do so in respect of eligible employees.

As a result, employers should consider each of the new options and develop a clearly reasoned position as to whether, how and when the employer will complete T2200S forms for all eligible employees wishing to claim a deduction using the Detailed Method. Because the Detailed Method could yield deductions worth more than the $400 maximum provided under the Temporary Flat Method, it is likely that employees will request an explanation if T2200S forms will not be issued to eligible employees.

There is no prescribed period to provide an employee with the T2200 or T2200S form; however, employees claiming the deduction on their 2020 tax return would need the completed and signed form from their employer in advance of the applicable filing deadline. The T2200 and T2200S forms can be provided through electronic communications (emails) and they can be executed with an electronic signature for the 2020 tax year.

Deciding on an Approach

Completing the T2200S Form

The threshold question for employers when determining whether to issue a T2200S is whether the employer is able to certify that the employee "worked from home" (as defined below) in 2020 due to COVID-19 and was required to pay for some or all of their own home office expenses used directly in their work while carrying out their duties of employment during that period. If an employer cannot certify these details, a T2200S should not be provided.

Form T2200S must be signed by the employer. It is the employer's responsibility to determine the appropriate person in the organization who is authorized to sign these forms.

In addition to certifying the details outlined above, the T2200S requires employers to respond "yes" or "no" to each of the following three questions.

1. Did this employee "work from home" due to COVID-19?

The CRA has provided specific criteria for whether an employee "worked from home" in 2020 due to the COVID-19 pandemic (the "WFH Requirement"):

Either of the following circumstances meet this requirement:

- The employer required the employee to work from home; or

- The employer provided the employee with the choice to work at home because of the COVID-19 pandemic, and the employee chose to work from home.

The WFH Requirement does not need to have been expressed or agreed to in writing.

Although the T2200S does not specifically require an employer to certify the duration or proportion of time that an employee spent working from home, employees claiming home office deductions under the Detailed Method must have worked more than 50% of the time from home for a period of at least four consecutive weeks in 2020 (the "50/4 Requirement"). If an employer knows that an employee did not work from home for a sufficient amount of time to meet the 50/4 requirement, a T2200S should not be provided.

2. Did you or will you reimburse this employee for any of their home office expenses?

Many employers have provided allowances or reimbursed expenses to assist employees with costs related to working from home. As noted above, an employee must have been required to pay for some or all of their own home office expenses (i.e., without being reimbursed) in order to claim a deduction under the Detailed Method. Therefore, only unreimbursed expenses will be eligible for the deduction.

Separately, and also of note for employers, in a technical interpretation letter released April 22, 2020, the CRA stated that in normal circumstances an allowance paid by an employer to an employee to facilitate teleworking would be considered a taxable benefit, as would the reimbursement for personal expenses to acquire technology used for teleworking. As a result of the COVID-19 pandemic, the CRA subsequently announced that it is relaxing this policy and is prepared to accept that reimbursements of up to $500 per employee towards the cost of personal computing equipment (including home office equipment, for example, a desk, office chair, etc.) purchased by employees to enable an employee to work from home primarily benefit the employer. Provided the employee presents a receipt for the amount, this reimbursement will not be treated as a taxable employment benefit. Nonetheless, the provision of such reimbursement must be indicated on the T2200S.

3. Was the amount included on this employee's T4 slip?

Employers will need to evaluate the appropriate tax treatment for any financial assistance provided to employees as a result of the COVID-19 pandemic. If such allowances or reimbursements are reported on the employee's T4 Statement of Remuneration Paid slip, this information must also be confirmed by the employer on the T2200S.

Options for Employers

Regardless of the approach selected, it is recommended that employers expressly remind employees that the employees are ultimately responsible for determining whether they are eligible to claim a deduction from employment income under the Temporary Flat Method or the Detailed Method. Neither the Temporary Flat Method nor the Detailed Method require the employer to calculate or certify the amount of any deduction ultimately claimed (and in practice an employer will have little visibility on this amount). As a result, employers should communicate to the eligible employees requesting form T2200S the potential audit risk that may arise if the employee claims deductions for ineligible or unreasonable expenses or ineligible periods of time, and employees should be encouraged in this regard to consult with their independent advisors

1. Employee Choice

Depending on individual circumstances (renting vs. paying a mortgage, and shared vs. dedicated workspaces), some employees may be able to claim a larger deduction under one method compared to the other. For example, individuals working from home who do not pay rent may determine that it is more advantageous to claim a deduction based on the Temporary Flat Method, since the Detailed Method disallows deductions for mortgage expenses.

As a result, some employers may choose a "wait and see" approach of issuing T2200S forms to an eligible employee only upon the employee's request. This approach allows employees to determine which option works best for them and seek supporting documentation from the employer, if required.

2. Temporary Flat Method

For employers that have already reimbursed some (but not all) of their employees' home office expenses, communicating to employees that they may be eligible to claim a deduction based on the Temporary Flat Method (and that the T2200S form will not be provided for the purposes of claiming under the Detailed Method) may be the appropriate option. Particularly where employees are expected to have less than $400 in eligible expenses to claim under the Detailed Method, the Temporary Flat Method provides a much more streamlined option with minimal employer involvement (although reimbursements may still need to be reported on each employee's T4).

As noted above, the employer does not need to provide T2200S forms to employees claiming under the Temporary Flat Method.

For eligible employees, the Temporary Flat Method involves minimal calculations. Employees simply determine: (i) the number of eligible work days, and (ii) the result of $2 multiplied by the number of eligible work days. Employees must enter this information in the "Option 1" section of Form T777S – Statement of Employment Expenses for Working at Home Due to COVID-19 ("T777S") and include it with their 2020 income tax return.

Employees claiming based on the Temporary Flat Method do not need to account for any other members of their household when determining the amount of the deduction being claimed. Multiple employees working from the same home can each make a Temporary Flat Method claim.

Employers not providing T2200S forms may want to direct employees to the guidance and resources published by the CRA about how to make a claim using the Temporary Flat Method (available here) as well as the employee's own independent advisors.

3. Detailed Method

As outlined above, the Detailed Method requires employees to obtain a completed and signed T2200S from their employer. Employees must report expense information in "Option 2" of the T777S and include it with their 2020 income tax return.

Claiming under this method requires eligible employees to undertake a detailed evaluation of several variables, including: the proportion of their home used as a workspace (based on square footage), the proportion of the week the workspace is used as a workspace (if not a dedicated workspace) and the amount of other eligible home office expenses the employee incurred (without being reimbursed). These calculations must also account for any other members of the employee's household using or sharing the workspace. Employees are required to keep detailed records related to their claim. One critical factor that will impact these calculations is that while a portion of the cost of rent can be included in the deduction, costs associated with mortgage payments (both principal and interest) cannot be included. While claiming under the Detailed Method could be a very involved process for employees, it could result in a deduction worth thousands of dollars and well above the $400 maximum provided under the Temporary Flat Method (particularly for those who rent their home and have not been reimbursed for expenses by their employer).

Given the steps taken by the CRA to develop and facilitate the Detailed Method as an option, employers should carefully consider whether to support eligible employees wishing to claim a deduction on this basis by completing a T2200S. In addition to developing a streamlined form and process, the CRA has indicated that for the 2020 tax year it will accept an electronic signature on the Form T2200S (and Form T2200 for the Standard Method) to reduce the necessity for employees and employers to meet in person.

Next Steps

Employers should review the amount of time employees in their organization have spent working from home during 2020 due to the COVID-19 pandemic and the extent to which any home office expenses have been reimbursed. Employees are likely to ask whether the employer will be providing T2200S forms to support employees who determine they are eligible to claim a deduction using the Detailed Method. Developing a strategy and rationale for an approach will be a critical next step in navigating the challenges (and possibly, additional paperwork) associated with managing employees working from home.

Appendix – Eligibility Criteria for the Temporary Flat Method and Detailed Method

Temporary Flat Method

Eligibility Requirements

To use the Temporary Flat Deduction method to claim home office expenses, an employee must meet all of the following conditions:

- WFH Requirement

Either of the following circumstances meet this requirement:

(i) Employer required employee to work from home; or

(ii) Employer provided employee with the choice to work at home

because of the COVID-19 pandemic, and employee chose to work from

home;

- The 50/4 Requirement

Employee worked more than 50% of the time from home for a period of at least four consecutive weeks in 2020;

- Employee is only claiming home office expenses and is not claiming any other employment expenses; and

- Employer did not reimburse the employee for all of the employee's home office expenses.

This method can be used only for the 2020 tax year.

Employees claiming the Temporary Flat Deduction do not need to do any of the following to claim the deduction:

(i) calculate the size of their workspace;

(ii) keep supporting documents; or

(iii) obtain a completed and signed Form T2200S from their

employer.

Calculating the Deduction

An employee can claim $2 per "Work Day":

Work Days:

- days the employee worked full-time hours from home

- days the employee worked part-time hours from home

Note: CRA has clarified that days worked as overtime count as "Work Days"

Non-Work Days (the following do not count as Work Days):

- days off

- vacation days

- sick leave days

- other leave or absence

Note: Multiple employees working from the same home can each make a Temporary Flat Method claim without offsets.

Detailed Method

Eligibility Requirements

To use the Detailed Method to claim home office expenses, an employee must meet all of the following conditions:

- The WFH Requirement (as defined above);

- The 50/4 Requirement (as defined above);

- Form T2200S completed and signed from the employer;

- The expenses claimed by the employee were used directly in the employee's work during the period.

This method can only be used for the 2020 tax year.

Calculating the Deduction

Because the deduction under the Detailed Method is for the actual amounts paid, employees are required to determine the amounts spent on eligible expenses.

Eligible Workspace Expenses

Eligible expenses related to an employee's workspace in their home include:

- Electricity, heat, water, home internet access fees (g., monthly internet charges)

- Maintenance and minor repair costs (cleaning supplies, light bulbs, etc.)

- Home insurance (commission employees only)

- Property taxes (commission employees only)

- Other expenses (rent, etc.)

These expenses can only be claimed in respect of the periods of time an employee worked from home.

Employees are required to undertake detailed calculations to determine the proportion of the deduction claimed for their workspace. To complete From T777S, employee must calculate their "employment use percentage", which is based on (i) the proportion of the finished space in the home used as a work space, multiplied by (ii) the proportion the week the space is used for work (i.e., a designated space used 100% of the time for work vs. a common/share space used for a 40-hour work week). Eligible workspace expenses are multiplied by the "employment use percentage" to determine the applicable "employment use amount" that can be claimed.

CRA provides detailed instructions here and a calculator here to assist employees in determining these amounts.

Salaried employees and commission employees cannot claim the following expenses in respect of their workspace:

- mortgage principal or interest

- home internet connection fees (g., one-time setup or router costs)

- furniture

- capital expenses (replacing windows, flooring, furnace, etc.)

- wall decorations

Other Eligible Expenses

Office Supplies

The CRA has expanded the list of office supplies that are eligible expenses. As a general rule, items that can be claimed are those that are "used up" while directly performing your job (e.g., postage, envelopes, stationery, pens, highlighters, sticky notes, ink cartridge, printer paper, etc.). Employees can claim only the expense, or portion of the expense, used for work.

The CRA has posted a list of expenses that many people working from home due to COVID-19 incurred, but cannot be claimed under the Detailed Method. Examples of these expenses include office chairs, desks, computer monitors, headsets, laptop stands, power bars and surge protectors and webcams.

Employees who are paid on a commission basis may also claim for costs associated with the lease of a cell phone, computer, laptop, tablet, fax machine, etc. that reasonably relate to earning commission income.

Phone Expenses

Certain cell phone expenses may also be claimed where all of the following conditions are met:

- The cost of the plan is reasonable;

- The cost of the plan has been reasonably apportioned between employment and personal use; and

- The employee is able to show the cellular minutes or data consumed directly while performing employment duties (as well as the cost of the minutes or data).

Costs associated with long distance telephone calls made for work (from a cell phone or a land line) may also be included the claim for a deduction under the Detailed Method.

Home Office Expense Forms

|

Who Completes the Form? |

Standard Version |

Simplified Version |

|

Employee |

T777 Statement of Employment Expenses Use for: Standard Method claim for deduction (i.e., the process that ordinarily applies independently of COVID-19) Applies to eligible expenses that an employee is required to pay for under the terms of their employment contract such as lodging, motor vehicle expenses). The employee must also have employer complete T2200. |

T777S Statement of Employment Expenses for Working at Home Due to COVID-19 Use for: Home office expenses only · Option 1 – Temporary Flat Rate Method · Option 2 – Detailed Method If this option is selected, the employee must also obtain a T2200S completed and signed by their employer. |

|

Employer |

T2200 Form T2200, Declaration of Conditions of Employment Use for: Standard Method claim for deduction (i.e., the process that ordinarily applies independently of COVID-19). Employee must keep a copy in case the CRA asks to see it at a later date. |

T2200S Declaration of Conditions of Employment for Working at Home Due to COVID-19 Use for: Detailed Method (home office expenses only). Employee must keep a copy in case the CRA asks to see it at a later date. |

GST/HST/QST

An employee of a GST/HST and/or QST registrant (other than certain financial institutions) that is entitled to deduct home office expenses from employment income may be able to claim a rebate of the GST/HST or QST paid on these expenses.

Footnotes

1 Only the employer may complete and sign form T2200. The T2200 for the 2020 tax year will be available for download on the CRA website on January 18, 2021.

2 See, e.g., What the changes are, "What are Form T200S and Form T2200", available from the CRA here; and FAQs, "What is form T2200S used for?", available from the CRA here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.