Welcome to the June issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The Government of Canada orders the dissolution of two Canadian businesses after a multi-stage national security review process.

- The Bureau seeks production orders in connection with an inquiry into alleged anti-competitive conduct by the parent companies of two grocery chains.

- The Bureau calls for public feedback on draft terms for an airline market study.

Merger Monitor

April 27 – May 31 Highlights

- 25 merger reviews published, 15 merger reviews completed

- Primary industries of completed reviews: manufacturing (20%); real estate and rental and leasing (13%); mining, quarrying and oil and gas extraction (13%); wholesale trade (13%)

- Nine transactions received an Advance Ruling Certificate (60%), six transactions received a No Action Letter (40%)

- Zero consent agreements (remedies) filed; zero judicial decisions filed

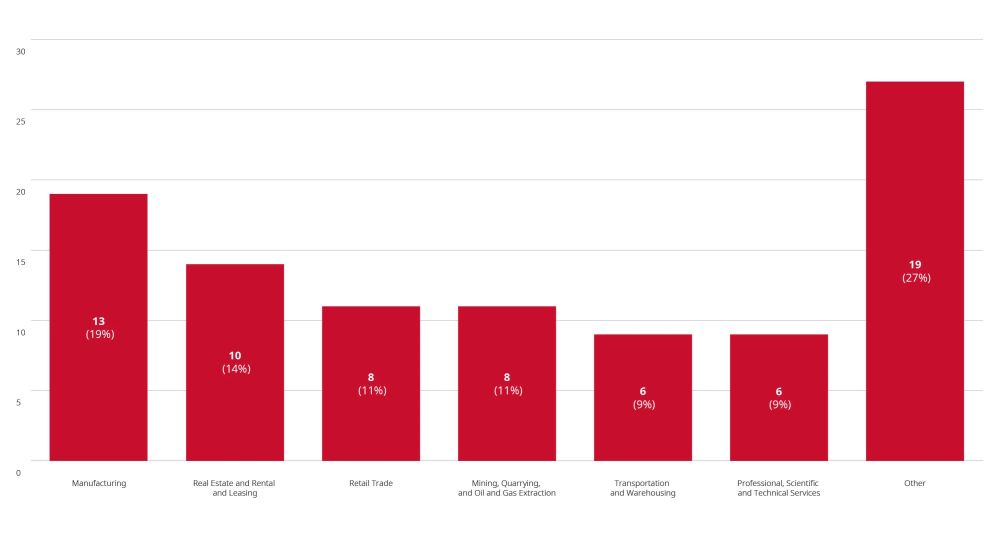

January – May 31 Highlights

- 71 merger reviews published, 70 merger reviews completed

- Primary industries of completed reviews: manufacturing (19%); real estate and rental and leasing (14%); retail trade (11%); mining, quarrying, and oil and gas extraction (11%); transportation and warehousing (9%); professional, scientific and technical services (9%)

- 37 transactions received a No Action Letter (53%), 30 transactions received an Advance Ruling Certificate (43%) and two transactions were resolved through other means (1%)

- One consent agreement (remedy) filed; zero judicial decisions filed

Merger Reviews Completed Through May 31, 2024

Enforcement Activity

Pavages Maska Inc. to Pay C$100,000 in Bid-Rigging Settlement

- On May 23, 2024, the Bureau announced that Pavages Maska Inc. (Pavages) had entered into a settlement agreement with the Public Prosecution Service of Canada for bid-rigging related to paving contracts with the Ministère des Transports du Québec in the Granby region between 2008 and 2009. As part of this settlement, Pavages has agreed to pay C$100,000 and has implemented a corporate compliance program.

Non-Enforcement Activity

Bureau Calls for Public Feedback on Draft Terms for Airline Market Study

- On May 27, 2024, the Bureau officially opened the public feedback period on the terms of reference in its draft market study notice. The Bureau requests that interested parties submit their comments by June 17, 2024. This public feedback period follows the Bureau's previous announcement that it would investigate competition in Canada's airline industry, pursuant to the December 2023 amendments to the Competition Act, which empowered the Commissioner of Competition (Commissioner) to seek production orders against private companies that are likely to have information relevant to a market study.

Canadian Digital Regulators Forum Recaps Inaugural Year and Announces Goals for 2024-2025

- On May 21,2024, the Canadian Digital Regulators Forum (Forum) published a review of its inaugural year (2023-2024). Established on June 8, 2023, the Forum's members include the Bureau, the Canadian Radio-Television and Telecommunications Commission, and the Office of the Privacy Commissioner of Canada. The Forum's review provided updates on its strategic priorities for year one, including the collaboration and information sharing that took place between its members; engagement with other federal agencies and international counterparts with respect to digital markets and platforms; and the steps it took to increase Forum members' knowledge of potential benefits and harms of artificial intelligence (AI) through a speaker series. Furthermore, the Forum expressed its intentions to build upon this foundation by further exploring potential AI policy issues in its second year (2024-2025).

Bureau Releases Update on Key Statistics for 2022-2023

- On May 16, 2024, the Bureau released its Update on Key Statistics for the

2022-2023 fiscal year. Highlights of this update include:

- The Bureau received 194 filings (including pre-merger notifications pursuant to section 114(1) of the Act and Advance Ruling Certificate (ARC) requests pursuant to section 102 of the Act), representing a 21% decrease (246 filings) from the 2021-2022 fiscal year.

- 87 ARCs were issued for non-complex reviews, representing a decrease from the 145 ARCs issued in the 2021-2022 fiscal year and the 89 ARCs issued in the 2020-2021 fiscal year

- 41 No Action Letters (NAL) were issued pursuant to 113(c) of the Act for non-complex reviews, representing a slight increase from the 34 NALs that were issued in each of the 2021-2022 and 2020-2021 fiscal years.

- The Bureau entered into seven consent agreements, representing an increase from the 2021-2022 fiscal year (four consent agreements).

- 13 supplementary information requests (SIR) were issued pursuant to section 114(2) of the Act for concluded matters, representing an increase from the 2021-2022 fiscal year (9 SIRs).

- 98% of the 128 non-complex merger reviews were completed within the Bureau's 14-day service standard, down from 100% in 2021-2022. The average review period for non-complex reviews was 10.06 days.

- 92% of the 72 complex merger reviews were completed within the Bureau's service standard (45 days or, where a SIR is issued, 30 days after responses are provided), down from 95% in 2021-2022. The average review period for complex reviews was 38.75 days.

- Lessors of real estate (13%) and oil and gas extraction (11%) were among the most frequently reviewed sectors (excluding the Other category).

- Of the complex merger reviews, gasoline (4%) and pipeline transportation of crude oil (4%) were among the most frequently reviewed sectors (excluding the Other category).

Bureau Provides New Guidance on Drip Pricing for Consumers and Companies

- On May 15, 2024, the Bureau released new guidance regarding drip pricing practices, encouraging consumers to report allegations directly to the Bureau. This update follows the Bureau's recently released guidance for companies, which describes the drip-pricing prohibition and outlines best practices for businesses. Drip pricing refers to advertising a price that is not attainable due to fixed obligatory charges or fees, except charges or fees imposed by government (e.g., taxes). Doing so is deemed to be false and misleading under the Act. The Bureau urges companies to avoid promoting unattainable prices. The Bureau also advises companies to note that variable charges and fees that make a price unattainable may still raise concerns under the Act, to consider whether the price advertised is the true price that consumers will pay, and to build and implement a robust compliance program.

Bureau Provides Submission to the OECD Regarding Competition and Data Privacy Policy

- In its May 13, 2024 submission to the Organisation for Economic Co-operation and Development (OECD), the Bureau outlined its views on the intersection between competition and data privacy policy. The submission indicates that companies' collection and use of personal information may have a direct bearing on competition and the Bureau's enforcement matters. Further, the submission asserts that with changing digital economies and platforms, the mandates of the Bureau and the Office of the Privacy Commissioner of Canada (OPC) increasingly intersect, necessitating both formal and informal collaboration between the regulators. Moreover, the Bureau submitted that the Canadian Digital Regulators Forum may further assist the Bureau and the OPC in deepening their understanding of the intersection between competition and privacy.

Bureau Launches Investigation Into Parent Companies of Sobeys and Loblaws for Alleged Anti-Competitive Conduct

- According to federal court documents, on May 6, 2024, the Bureau sought production orders against Empire Company Limited (Empire) and George Weston Limited (George Weston), the parent companies of two grocery chains, Sobeys and Loblaws, in connection with a Bureau inquiry that was launched on March 1, 2024. The production orders advance the Bureau's investigation into property controls (e.g., restrictive covenants in leases) that allegedly restrict (or are likely to restrict) competition in the grocery retail sector by limiting where grocery stores can be located, contrary to the abuse of dominance provisions of the Act.

- On April 12, 2024, Empire and Sobeys submitted a judicial review application (JR application) to the Federal Court (FC), seeking various relief types, including an order that would set aside or quash the Commissioner's initial decision to commence the inquiry. On May 28, 2024, the FC granted the Commissioner's motion to strike the parties' JR application on the grounds that (i) the Bureau's decision to commence the inquiry was not reviewable by the FC because the decision did not affect Empire or Sobeys' rights, impose any legal obligations or cause any prejudicial effects; (ii) the parties' JR application failed to include allegations of the actual or potential impact that the inquiry decision had or would have on the parties' legal rights, imposition of legal obligations or prejudicial effects; and (iii) the JR application was held to be premature (given the parties' access to other legal recourse).

Investment Canada Act

Government of Canada Orders the Dissolution of Two Canadian Businesses Following National Security Review

- On May 24, 2024, the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry, announced that the Government of Canada, through the Governor-in-Council, had ordered Bluvec Technologies Inc. (a drone detection company) and Pegauni Technology Inc. (a company specializing in wireless security products) to cease all operations in Canada. This decision resulted from a multi-step national security review process under the Investment Canada Act.

Cultural Investments

Q3 2023 Highlights

- Two notifications (one for an acquisition and one for the establishment of a new Canadian business)

- Country of origin of investor: United States (50%); Japan (50%)

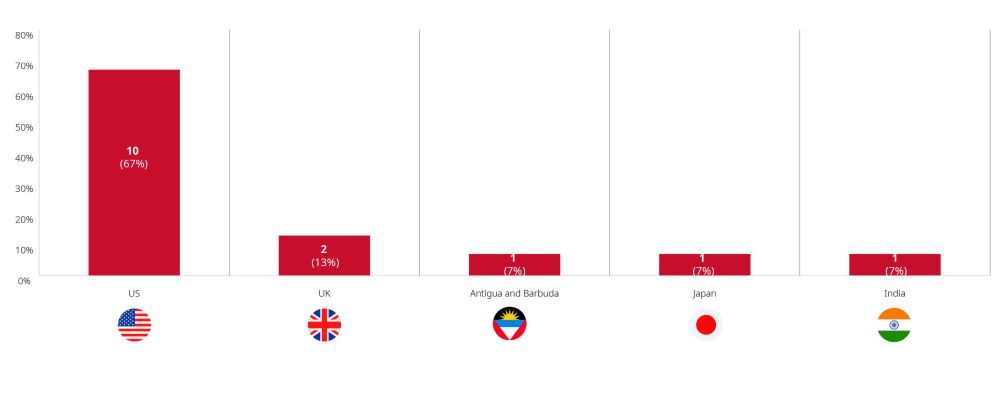

Q1 – Q3 2023 Highlights

- Four reviewable investment approvals and 11 notifications filed (seven for acquisitions and four for the establishment of a new Canadian business)

- Country of origin of investor: United States (67%); United Kingdom (13%); Antigua and Barbuda (7%), Japan (7%); India (7%)

Non-Cultural Investments

April 2024 Highlights

- One reviewable investment approval and 76 notifications filed (52 filed for acquisitions, 24 for the establishment of a new Canadian business)

- Country of ultimate control: United States (57%), China (8%); France (5%); Sweden (5%); United Kingdom (5%); Israel (3%)

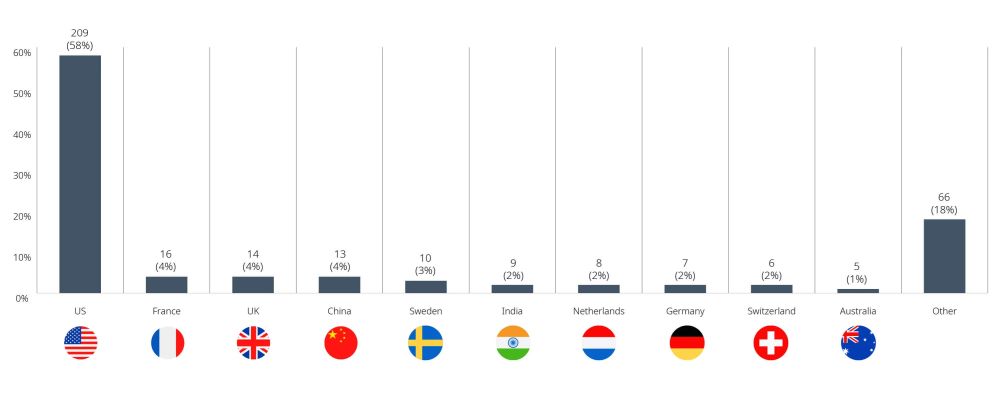

January – April 2024 Highlights

- Two reviewable investment approvals and 361 notifications filed (268 for acquisitions and 93 for the establishment of a new Canadian business)

- Country of ultimate control: United States (58%); France (4%); United Kingdom (4%); China (4%) Sweden (3%)

Blakes Notes

- On June 25, 2024, Blakes is hosting a client webinar covering recent and upcoming amendments to Canada's Competition Act. The session will feature special guest Goldy Hyder, President and CEO of the Business Council of Canada, alongside partners from the Blakes Competition, Antitrust & Foreign Investment group. Read more here and contact us by email to register.

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

For permission to reprint articles, please contact the Blakes Marketing Department.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.