Overview

Power Distributed Generation ("DG"), one of the fastest-growing Distributed Energy Resources in the world, has also been ramping up quickly over the past years in Brazil. Brazilian law refers to DG as renewable power generation — mainly solar photovoltaic —by a captive customer of a power distribution concession area based on on-site or off-site power plants connected to the utility's distribution grid.

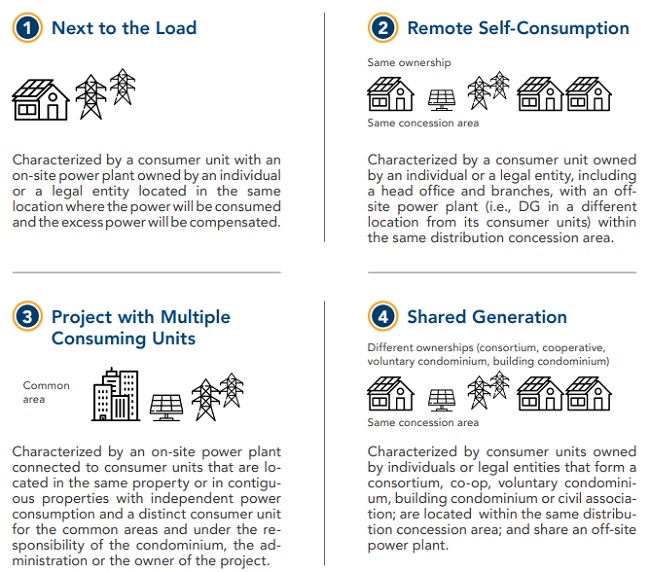

Power captive customers, whose electric energy are supplied by power distribution concessionaires (utilities), are allowed to install DG projects up to 3-5 MW (depending whether the energy source can be dispatched or not). In addition to the possibility of installing offsite DG projects, customers may also share an off-site power plant as members of a consortium, co-op, condominium, or civil association. The Brazilian net metering regulation allows customers to use the credits arising from excess power generated by the DG project within 60 months.

DG projects are subject to federal legislation and federal regulations issued by the Brazilian Electricity Regulatory Agency ("ANEEL"), especially the recently enacted Federal Law No. 14,300/2022 ("DG Legal Framework") as well as ANEEL Normative Resolution No. 482/2012, as amended ("REN 482").

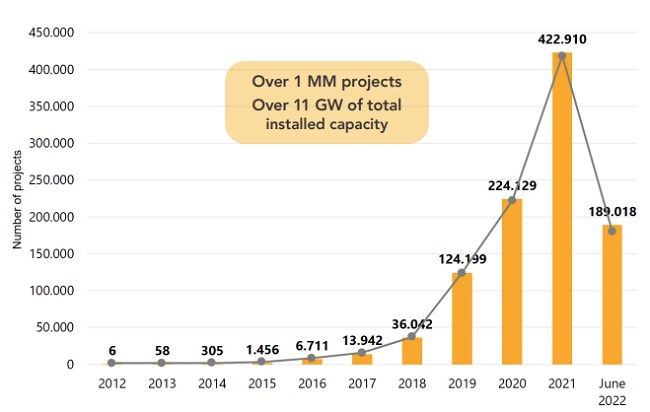

Currently, there are 1,018,792 operational DG projects, which added 11.03 GW of installed capacity to the Brazilian power generation matrix, and 99% of these projects are solar photovoltaic installations, which are more affordable than other renewable energy sources. Most DG projects are on-site power plants (84%) of residential consumers (77%) and located in the Southeast and South regions of the country —especially in the States of São Paulo (16%), Minas Gerais (15%) and Rio Grande do Sul (13%)1 .

There are several business models in the Brazilian DG market. Because Brazilian captive customers are not allowed to purchase power from or sell power to parties other than the utility to which they are connected to, DG developers and investors offer customers equipment supplies or equipment leases, which may be combined with real estate leases for offsite projects; equipment operation and maintenance (O&M); power management; and other ancillary services.

Regulatory incentives and subsidies have spurred this exponential growth of the DG industry in Brazil, where captive customers are keen to reduce costs with expensive electricity rates. In addition, access to multiple financing lines from development and commercial financial institutions as well as technological developments resulting in cheaper and more efficient equipment have also contributed to this expansion.

The chart below shows the historic growth of DG projects in Brazil to date2

Inside the REN 482

REN 482, issued by ANEEL about 10 years ago, was the groundbreaking regulatory framework applicable to DG and established the general conditions for the access of DG to the electric power distribution system and also instituted the Brazilian net metering model — the Electric Energy Compensation System ("SCEE")

REN 482 divided the power distributed generation systems into two categories based on the respective installed capacity, namely, micro and mini distributed generation.

The resolution also classified the types of DG systems into four modalities:

Footnotes

1 Based on ANEEL´s information dated June 6, 2022, available at: https://app.powerbi.com/view?r=eyJrIjoiY2VmMmUwN2QtYWFiOS00ZDE3LWI3NDMtZDk0NGI4MGU2NTkxIiwidCI6IjQwZDZmOWI4LWVjYTctNDZhMi05MmQ0LWVhNGU5YzAxNzBlMSIsImMiOjR9

2 . Id., ibid.

To read the full article click here

Visit us at Tauil & Chequer

Founded in 2001, Tauil & Chequer Advogados is a full service law firm with approximately 90 lawyers and offices in Rio de Janeiro, São Paulo and Vitória. T&C represents local and international businesses on their domestic and cross-border activities and offers clients the full range of legal services including: corporate and M&A; debt and equity capital markets; banking and finance; employment and benefits; environmental; intellectual property; litigation and dispute resolution; restructuring, bankruptcy and insolvency; tax; and real estate. The firm has a particularly strong and longstanding presence in the energy, oil and gas and infrastructure industries as well as with pension and investment funds. In December 2009, T&C entered into an agreement to operate in association with Mayer Brown LLP and become "Tauil & Chequer Advogados in association with Mayer Brown LLP."

© Copyright 2020. Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.