The past few weeks have been intense, with many discussions in the energy sector about Brazil's prospects in the energy industry. Brazil's potential to continue being a leader in biofuels and clean energy, along with decarbonization strategies, is undisputable.

However, Brazil's increasing prominence as an oil and gas producer and the importance of these products to the country's economic development cannot be underestimated. Brazil is currently the ninth largest oil producer and, according to data from the Brazilian National Agency for Petroleum, Natural Gas and Biofuels ("ANP"), is expected to continue reaching annual production records, potentially reaching 5M barrels per day ("bpd") by 2030. (See additional information about Brazil's production below.)

Due to the concentration of production units located far from the coast, oil production is transported by shuttle tankers. According to the International Energy Agency (IEA), Brazilian exports via tankers have increased year after year, reaching a record 1.6 Mbpd in 2023 (19% more than in 2022), with expectations that these numbers will continue to rise significantly in the coming years due to increased oil production and the limited projected increase in domestic refining capacity, forcing more oil toward export.

Maritime oil export operations can be conducted in four different ways:

- Ship to ship ("STS") operations in open sea with ships underway

- STS operations with anchored ships

- STS operations with ships moored at marine terminals

- Storage and export operations from marine terminals

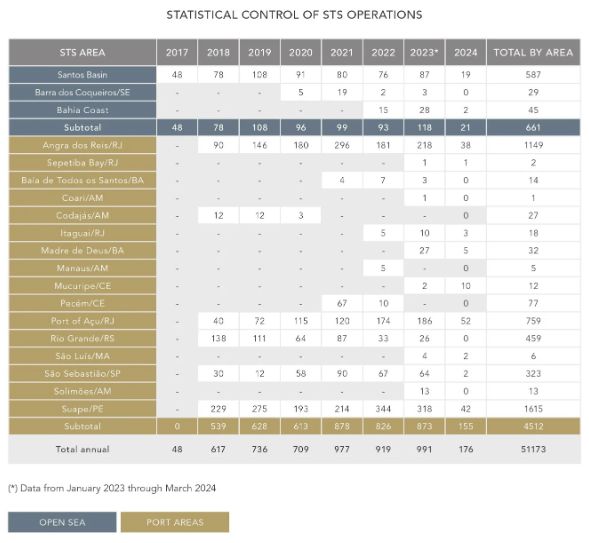

All four types of operations have increased in recent years, with a total aggregate increase of almost 50% in operations from 2017 to 2023, according to data from the Directorate of Ports and Coasts.

So the assets used in maritime transport operations will be in high demand in the coming years, specifically shuttle tankers, tankers, and marine terminals (for both storage and export, as well as STS operations). Investments in these assets in Brazil benefit from various incentives, including:

(i)Use of resources from the merchant marine fund for

shipbuilding in Brazil

(ii) Flexibility for foreign tonnage requirements in coastal

shipping, as provided in law 9.432/97 amended by BR do Mar

(iii) Subsidized financing with resources from the FMM –

Fundo da Marinha Mercante (Brazilian Merchant Navy Fund) for both

vessel construction and terminal works (especially for

dredging)

(iv) REIDI and Reporto

Our Ports & Maritime team is ready to help if you have any questions or need additional information.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.