And what's the ATO's role?

Our construction industry has faced many challenges in recent years. In light of global supply chain shortages and the collapses of various builders, both big and small, including Condev and Hotondo Homes Horsham, the list of issues confronting the industry only seems to be growing.

What's the current predicament?

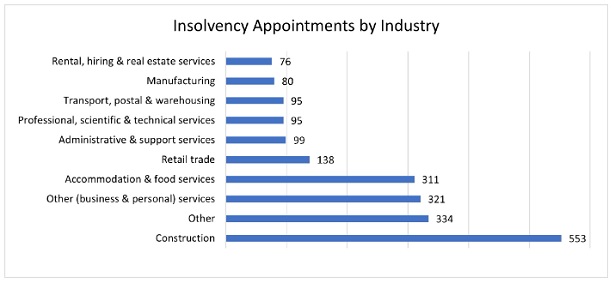

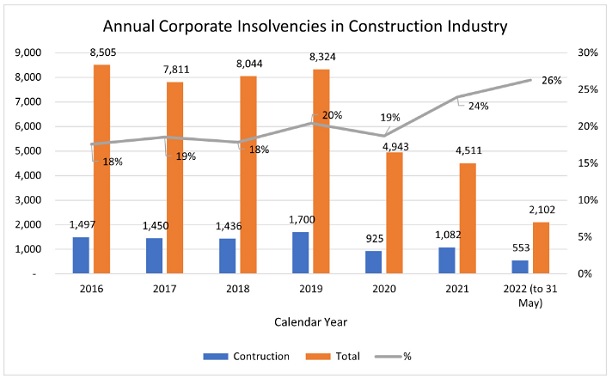

In the first half of 2022, the construction industry has experienced a greater uptick in insolvency appointments than other industries since the COVID-related lockdowns. Between January and May 2022, external administrators (i.e. liquidators, voluntary administrators, and receivers) were appointed to 553 companies in the construction industry (26% of all insolvency appointments). While this number may not be on track to meet or surpass pre-COVID levels in 2020, which typically were 17%-20.5%, it is concerning considering this is over 200 appointments more than "other (business & personal) services" and "accommodation & food services" industries (see our graph below).1

This suggests that:

- The threat and reality of insolvency is impacting the construction industry to a larger scale than other industries.

- Other industries are not yet experiencing the same economic challenges as construction is.

- Other industries may be experiencing similar economic difficulties, however, are delaying appointing external administrators.

These insolvency issues do not just extend to corporate entities. Many individuals in the construction industry are also facing financial difficulty. According to the Australian Financial Security Authority (AFSA), 125 (13%) of Victoria's 927 bankruptcies between July 2021 and May 2022 were from the construction industry, largely as company directors and employees.2

The ATO's role

These levels of insolvency appointments have occurred

before the Australian Taxation Office (ATO) has brought its debt

collection activity anywhere near its pre-COVID levels. With the

ATO's two-year debt recovery holiday seeming to be ending, many

businesses, including those in construction, are likely to face

additional challenges if they have not already.

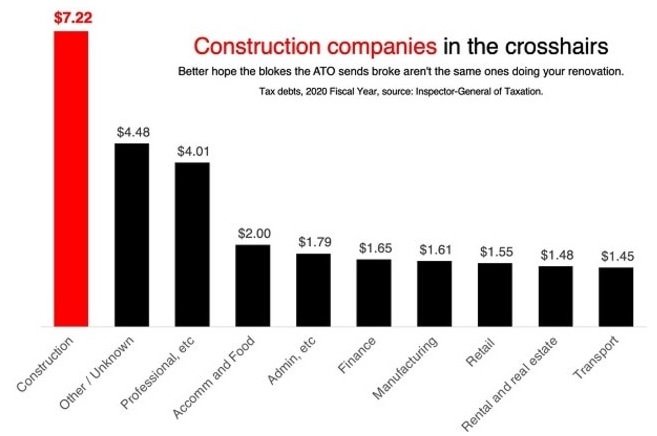

For the 2020 fiscal year alone, the construction industry owes $7.22 billion to the ATO3, almost double that of the highest of other industries.

(Source: Jason Murphy - news.com.au)

We have already seen the ATO restart its issuing of director penalty notices (DPN) to directors who have allowed their companies to incur significant tax debts. DPNs are a significant driver of formal insolvency appointments, as they make directors personally liable for their company's superannuation, PAYG withholding, and net GST debts.

DPNs are not the only drivers of insolvency however, once the ATO restarts issuing winding up applications and sequestration orders (as is expected), the overall levels of insolvency appointments will most likely skyrocket from the numbers seen in the last two years.

What can I do if I cannot pay the ATO in full?

The ATO may be willing to enter a payment arrangement for

outstanding personal and corporate tax debts. Those struggling to

stay up to date with their tax obligations should be cautious

though before entering such arrangements. One common scenario many

people are unaware of is:

- A director pays a sum of money into their struggling company's bank account.

- That amount is then remitted by the company to the ATO in payment (partially or fully) of the company's tax debt.

- The company ultimately fails, and a liquidator is appointed.

- The liquidator claws back the above payment as a preference payment from the ATO, under section 588FA of the Corporations Act 2001.

- The ATO makes the director liable to indemnify it for the payment which has been paid to the liquidator, pursuant to section 588FGA of the Corporations Act.

Anybody struggling to satisfy their/company taxation obligations should do the following:

- Ensure your lodgments are up to date. The ATO may be more willing to enter a payment arrangement if lodgments are up to date.

- Be proactive in communicating with the ATO. Do not ignore any warnings or other notices the ATO sends.

- Speak to your trusted advisor.

If you or somebody you know is having financial difficulties, Worrells can help you understand the options available. For a no obligation and complimentary discussion, contact your local Worrells principal. Positive options start by having a conversation.

Footnotes

2 https://www.afsa.gov.au/about-us/statistics/monthly-personal-insolvency-statistics

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.