Who gets the surplus, who gets to decide, and what role can the court play?

With over 250,000 non-profit organisations currently registered, it's comforting to know that the law, with the support of the courts, has a prescribed process which aims to ensure a fair and equitable outcome when dealing with surplus assets of an Incorporated Association.

Our Melbourne office recently wound up an Incorporated Association by selling its business and land. If the association had continued to trade its business, it was likely that cash flow and profitability issues would soon arise. Worrells' assistance was sought to ensure that another organisation could continue the association's business operations rather than see them be shut down.

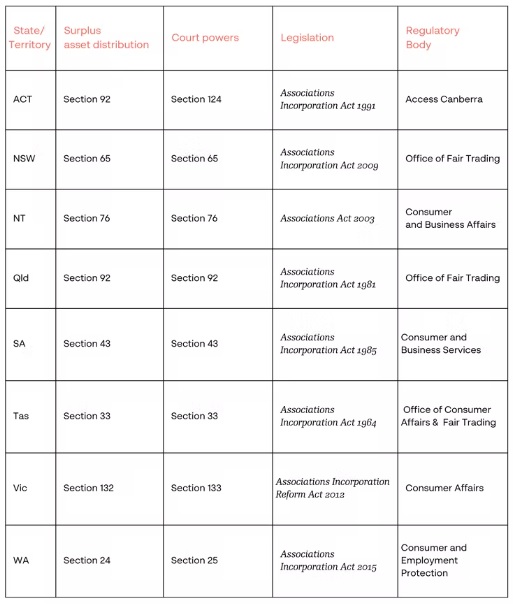

After a successful sales campaign, sufficient funds paid all creditors in full and a pool of surplus monies remained within the administration. These 'surplus assets' are distributed under the state-based legislation where the association is incorporated, see the table below.

In our matter, the Association was incorporated in Victoria and the surplus assets were required to be distributed under section 132(2) of the Associations Incorporation Reform Act 2012, which says that the rules (or constitution) of the association apply; or if not valid, a special resolution is required.

Incorporated associations can draw on or adopt the example set rules as outlined by the relevant regulatory body (for its state/territory) to create its constitution, to ensure all legislative requirements are met.

Consumer Affairs Victoria's model rules ensures that in the event of a winding-up, surplus assets "must be distributed to a body that has similar purposes and objectives to the Association", while preventing any distribution to current or former members. The model rules prescribe that members must pass a special resolution to decide the recipient.

This is all very straightforward but, in our appointment, the Association's constitution ultimately found the business and land sale resulted in no members to convene nor pass a special resolution to determine the recipient of the surplus assets.

Section 133(1) of the Associations Incorporation Reform Act allows for the Supreme Court of Victoria to make orders in these circumstances, and the association's liquidator to apply.

In good faith and in line with the legal frameworks, we contacted the former members for recommendations for a fitting recipient of the surplus assets. We considered those organisations' eligibility in concert with independent advice we obtained and shortlisted two recipients. We applied to the court with our assessment and it was ordered that the available surplus assets be distributed evenly between the two eligible recipients.

Parties requiring assistance with a formal insolvency appointment for an Incorporated Association (or otherwise) please don't hesitate to contact us. The teams at Worrells are here to help.

Incorporated Association Framework

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.