NEW YORK, April 23, 2024 – Leading international law firm Proskauer today announced a 1.84% overall default rate for Q1 2024 for loans in its Private Credit Default Index (the "Index"). The Index tracks senior-secured and unitranche loans in the United States and includes 980 active loans representing approximately $150 billion in original principal amount.

The Q1 default rate is a slight increase from the prior quarter and the second consecutive increase in the overall default rate. In Q3 and Q4 2023, the rates were 1.41% and 1.60%, respectively. However, this quarter's rate remains lower than default rate a year ago. In Q1 2023, the default rate was 2.15%.

"We expect to see variances in the default rate from quarter to quarter," said Stephen A. Boyko, a partner in Proskauer's Private Credit Group. "Overall, the private credit market remains active and resilient, especially compared to other markets – including the leveraged loan market – where lenders have experienced significantly higher payment and bankruptcy defaults."

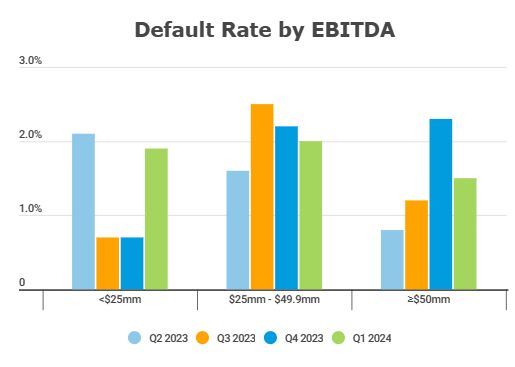

In Q1 2024, the default rate for companies with less than $25mm EBITDA increased from 0.7% to 1.9%. The default rate for the other EBITDA bands declined from Q4 to Q1. Specifically, the default rate for the $25mm-$49.9mm EBITDA band declined to 2.0% in Q1 from 2.2% in Q4. The default rate for companies with greater than $50 million of EBITDA decreased from 2.3% in Q4 to 1.5% in Q1.

The full report is available only to the Firm's direct lending clients and contains a comparison to the default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by default type, defaults in cov-lite loans and defaults by year of origination.