This edition of the Bermuda Public Companies Update summarises significant transactions involving Bermuda companies on the New York Stock Exchange and Nasdaq in the second half of 2021.

Global market update

Equities continued to rally in the second half of 2021, wrapping up yet another banner year of positive returns for investors. The benchmark S&P 500 index rose 26.89% which marks its third straight yearly gain. More companies went public in 2021 than ever before (>1,800 globally) and the overall value of mergers and acquisitions hit a record-setting US$5.8 trillion, according to Refinitiv. This historic year in dealmaking also delivered a spike in "mega-deals" exceeding US$5 billion in value.

Covid-19 and the emergence of Omicron remained a strong headwind in late November as the likelihood of additional restrictions loomed. However, markets recovered rapidly as data from South Africa and the UK pointed to lower risk of severe disease. Companies continued to struggle with supply chain disruptions as the variant surged across the globe. Rising inflation added uncertainty to the mix amidst the prospect of tighter central bank policies. Despite these ongoing and anticipated pressures, some expect the markets in 2022 to show even stronger gains.

Bermuda companies update

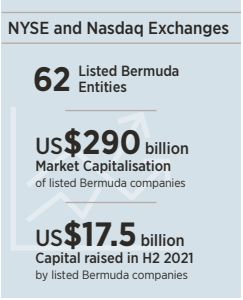

It was a busy half year for Bermuda companies listed on the NYSE and Nasdaq. Since our last edition, the total number of companies has increased slightly to reach a total of 62 (a net increase of three from the H1 2021 newsletter). There were two large de-SPAC transactions during that time: Roivant Sciences Ltd., and Wejo Group Limited were taken public through reverse mergers and listed on the Nasdaq. Both companies chose Bermuda as their jurisdiction of incorporation.

There was also one SPAC launch: ST Energy Transition I Ltd. – a blank cheque company sponsored by Sloane Square Capital Holdings Ltd. – is focused on finding an acquisition target in the clean energy space.

Bermuda re/insurers continued to raise billions in public offerings and remained active in the M&A space. Notable insurance deals announced included Athene Holding Ltd. acquiring a majority interest in home improvement lender Aqua Finance for US$1 billion from Blackstone Tactical Opportunities. Apollo and Athene completed their combination on 3 January of this year and is now trading as Apollo Global Management, Inc. (NYSE: APO).

Bermuda continues to be the global leader in insurance-linked securities with a rising interest in funds being reported by our lawyers. On page 2, we take a closer look at one high-profile matter, Markel's proposed buyout of its reinsurance fund manager Markel CATCo.

The period also

saw several capital markets and asset finance transactions in the

shipping sector as companies looked to raise funds in light of

global supply chain bottlenecks. We examine the

growing appetite for container securitisation transactions on

page 3.

The period also

saw several capital markets and asset finance transactions in the

shipping sector as companies looked to raise funds in light of

global supply chain bottlenecks. We examine the

growing appetite for container securitisation transactions on

page 3.

Bermuda companies raised a total of US$17.5 billion and market capitalisation stands at US$290 billion. Sizeable equity offerings included:

- RenaissanceRe Holdings Ltd. closed its US$500 million offering

of depositary shares.

- Triton International Limited completed a US$175 million of

Series E preference shares.

- Textainer Group Holdings Limited completed a US$150 million offering of depositary shares.

Markel CATCo buyout

2021 has been a record year for activity within the catastrophe bond market as investors see the value in cat bonds relative to other forms of insurancelinked securities (ILS) investment. Bermuda continues to be the global leader in the ILS sector and the cat bond market in particular. The island's robust regulatory framework and ability to innovate underlie its dominance in this area.

Given the ILS market is now well established, issuers and investors are both having to grapple with how historic investments in ILS have been impacted by recent, "once in a generation" natural catastrophes, such as category 5 hurricanes and rampant wildfires in the US. This is leading to interest in restructuring legacy ILS structures. A recent example is Markel Corporation's proposed buyout transaction for a portfolio of ILS issued by its sidecar, Markel CATCo. The proposal covers the publicly-listed CATCo Reinsurance Opportunities Fund Ltd. (LSE:CAT) and is designed to accelerate the run-off of the portfolio and provide investors with an early release of their capital.

In September 2021, Markel filed documents with the London Stock Exchange detailing the restructuring proposal. The process is now proceeding in court.

Conyers is at the forefront of the Bermuda ILS sector and is advising on this matter.

Highlighted Transactions

NYSE

- closed its US$500 million depositary share offering.

(July)

- Invesco Real Estate - European Living Fund, Fcp-Raif, managed

by Invesco Ltd. (NYSE:IVZ) acquired 115 Grade A

Units in France. (July)

- Athene Holding Ltd. (NYSE:ATH) agreed to

acquire Paratus AMC Limited from Fortress Investment Group LLC.

(July)

- Axalta Coating Systems Ltd. (NYSE:AXTA) agreed

to acquire U-POL Limited from Graphite Capital Management LLP and

others for US$585 million. (July)

- Brookfield Business Partners L.P. (NYSE:BBU)

and institutional partners agreed to acquire a majority stake in

DexKo Global Inc. from KPS Capital Partners, LP for US$3.4 billion.

(July)

- News Corporation (NasdaqGS:NWSA) agreed to acquire Oil Price

Information Services, Coal, Metals and Mining and PetroChem Wire

businesses from IHS Markit Ltd. (NYSE:INFO) for

US$1.2 billion. (August)

- Brookfield Business Partners L.P. (NYSE:BBU)

and others acquired Aldo Componentes Eletrônicos Ltda. for

US$320 million. (August)

- Textainer Group Holdings Limited (NYSE:TGH)

completed a US$150 million offering of 6,000,000 depositary shares.

(August)

- SiriusPoint Ltd. (NYSE:SPNT) completed its

US$69.44 million share offering. (August)

- Triton International Limited (NYSE:TRTN)

completed its US$175 million share offering. (August)

- Paysafe Limited (NYSE:PSFE) agreed to acquire

Safetypay, Inc. from Armilar Venture Partners, International

Finance Corporation, Escort Investments and others for US$440

million. (August)

- Vouch, Inc. received US$90 million in funding from

SiriusPoint Ltd. (NYSE:SPNT) (August)

- Pine Labs Private Limited received US$202 million in funding

including participation from AIM Investment Funds (Invesco

Investment Funds) - Invesco Developing Markets Fund, managed by

Invesco Ltd. (NYSE:IVZ) (September)

- Invesco Real Estate - European Living Fund, Fcp-Raif, managed

by Invesco Ltd. (NYSE:IVZ), agreed to acquire

Caritas residential development from Maarsen Groep Management B.V.

(September)

- Corvus Insurance Holdings, Inc. received US$172 million in

funding from SiriusPoint Ltd. (NYSE:SPNT)

(September)

- GlobalData Plc (AIM:DATA) agreed to acquire the life sciences

business of IHS Markit Ltd. (NYSE:INFO).

(September)

- SiriusPoint Ltd. (NYSE:SPNT) acquired an

ownership stake in Parameter Climate. (October)

- Athene Holding Ltd. (NYSE:ATH) agreed to

acquire a majority stake in Nexera Holding LLC from Warburg Pincus

LLC and Steve Abreu for US$5 million. (October)

- Bunge Limited (NYSE:BG) agreed to sell seven

Mexico wheat mills to Grupo Trimex, S.A. de C.V. (October)

- Spice Private Equity AG (SWX:SPCE) agreed to acquire Argo

Seguros Brasil S.A. from Argo Group International Holdings,

Ltd. (NYSE:ARGO) for US$29.8 million. (October)

- Brookfield Business Partners L.P. (NYSE:BBU)

and institutional partners agreed to acquire Scientific Games

Corporation's Lottery Business (NasdaqGS:SGMS) for US$6.1

billion. (October)

- Bunge Limited (NYSE:BG) announced the

acquisition of a minority stake in Pantanal Agrícola.

(November)

- GeoPark Limited (NYSE:GPRK) accepted an offer

from Oilstone S.A. to acquire non-core Argentina assets for US$16

million. (November)

- Westfield Specialty Insurance Company agreed to acquire renewal

rights of Argo Group's US property from Argo Group

International Holdings, Ltd. (NYSE:ARGO). (November)

- Brookfield Infrastructure Partners L.P.

(NYSE:BIP) agreed to acquire a 19.9% interest in

FirstEnergy Transmission, LLC from FirstEnergy Corp. (NYSE:FE) for

US$2.4 billion. (November)

- Athene Holding Ltd. (NYSE:ATH) agreed to

acquire a stake in Aqua Finance, Inc. from funds managed by

Blackstone Tactical Opportunities Advisors L.L.C. for US$1 billion.

(November)

- Dow Jones & Company, Inc. agreed to acquire the base

chemicals business of IHS Markit Ltd. (NYSE:INFO)

for US$300 million. (December)

- Athene Holding Ltd. (NYSE:ATH) agreed to

acquire Petros PACE Finance, LLC. (December)

- FWD Group Holdings Limited entered into a US$1.425 billion

subscription agreement for a private placement with Athene

Holding Ltd. (NYSE:ATH.PRD) through Apollo and other

investors. (December)

- Höegh LNG Holdings Ltd. offered to acquire the remaining 54.2% stake in Höegh LNG Partners LP (NYSE:HMLP) for US$77 million. (December)

Nasdaq

- Arch Capital Group Ltd. (NasdaqGS:ACGL),

Warburg Pincus LLC and Kelso & Company, L.P. completed the

acquisition of the remaining 87.4% stake in Watford Holdings Ltd.

(NasdaqGS:WTRE) from Enstar Group Limited

(NasdaqGS:ESGR) and others for $540 million. (July)

- FNI agreed to acquire a 45.57% stake in Omnium Telecom Algeria

SpA from VEON Ltd. (NasdaqGS:VEON). (July)

- Immunovant, Inc. agreed with existing investor Roivant

Sciences Ltd. (NasdaqGM:ROIV) to issue 17,021,276 shares

for US$200 million. (August)

- Arch Capital Group Ltd. (NasdaqGS:ACGL)

acquired Westpac Lenders Mortgage Insurance Limited from Westpac

Banking Corporation (ASX:WBC) for US$269.52 million. (August)

- Enstar Group Limited (NasdaqGS:ESGR) completed

its US$499.15 million notes offering. (August)

- Roivant Sciences Ltd. (Nasdaq:ROIV) completed

a US$611 million reverse merger with Montes Archimedes Acquisition

Corporation. (September)

- Everspan Financial Guarantee Corporation acquired Providence

Washington Insurance Companies, Inc. from Enstar Group

Limited (NasdaqGS:ESGR). (October)

- Wejo Limited (now Wejo Group Limited

(NasdaqGS:WEJO)) acquired Virtuoso Acquisition Corp.

(NasdaqCM:VOSO) in a reverse merger valued at US$660 million.

(November)

- Helen of Troy Limited (NasdaqGS:HELE) agreed

to acquire Osprey Packs, Inc. for US$410 million. (November)

- GAN Limited (NasdaqCM:GAN) acquired Silverback Gaming Limited. (December)

Container Securitisation Thriving in Bermuda

Container leasing companies have seen an increase in demand as operational bottlenecks in the global supply chain drove up new container prices, used container prices and market lease rates to near-record levels. Lessors have been able to make use of the attractive financing markets to raise capital and leverage growth opportunities through securitisation transactions.

Dominant NYSE-listed players such as Triton International Limited and Textainer Group Holdings Limited, along with privately held companies such as SeaCube Container Leasing Ltd., have all chosen Bermuda as the ideal jurisdiction from which to launch a securitisation transaction, and Conyers has advised on most of these.

Container securitisation transactions usually involve the incorporation of a special purpose vehicle (SPV), and can be structured using either a Bermuda exempted company, or an exempted limited liability company (LLC). The SPV will purchase the container leases (or other specified assets) with some form of regular cash flow and issue loan notes or preference shares in the capital markets to finance the purchase. The repayment of principal and interest on such notes is then secured by the purchased assets and the accompanying cash flow.

Bermuda SPV structures are flexible and innovative. Key to their success is that they accommodate bankruptcy remoteness, true-sale, non-consolidation, off-balance sheet ownership, credit enhancement and certainty of security interest priority.

Notably, in December, Buss Global Management completed an asset-backed securitisation (ABS) of a portfolio of 116,000 containers with a net book value of US$275 million, which marks the first time that 100% of the equity in a container ABS has been sold to thirdparty investors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.