The Federal Trade Commission (FTC) has announced the following annual adjustments of the Hart-Scott-Rodino (HSR) filing thresholds (15 USC § 18a, Clayton Act § 7A) for stock and asset acquisitions, mergers, consolidations, joint ventures and similar transactions. The new thresholds will apply to transactions closing on or after March 6, 2024.

- All transactions valued at not more than $119.5 million will be exempt from all HSR filing and waiting period requirements (assuming no prior or related transactions between the parties or their affiliates); an increase from last year's $111.4 threshold.

- All transactions valued at $478 million and over, not otherwise exempt under one of the many substantive HSR exemptions, will require a pre-acquisition filing and will need to observe the 30-day waiting period requirement (subject to possible early termination, if/when fully reinstated).

- Most (non-exempt) transactions valued between $119.5 million and $478 million will likely require a filing based on satisfaction of the "size-of-the-person" test (with size-of-the-person thresholds being adjusted to $22.9 million and $239 million).

- The maximum daily civil penalty amount for HSR violations has increased to $51,744 per day (effective for civil penalties assessed on or after January 10, 2024, regardless of when the underlying violation occurred).

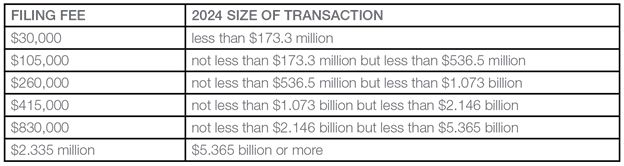

The FTC has announced the following revised adjustments to the six-tier HSR filing fee structure announced in 2023:

The FTC also announced increases to the thresholds relevant under Section 8 of the Clayton Act, which prohibits certain interlocking directorates (i.e., competing corporations with overlapping officers or directors). As of January 22, 2024, competitor corporations are covered by Section 8 if each has capital, surplus, and undivided profits aggregating more than $48,559,000, with the exception that no corporation is covered if the competitive sales of either corporation are less than $4,855,900.

The Kutak Rock antitrust team has long-standing experience and expertise in HSR pre-merger filings. In addition to preparing the necessary HSR filing documents and communicating with the FTC and DoJ, we also analyze transactions to determine if they are exempt from the HSR filing requirements, counsel on pre-closing restrictions concerning the operations of the acquired entity and advise on structuring transactions to avoid or minimize both potential antitrust problems and costly second requests.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.