All you need to know about Shareholders' Agreement.

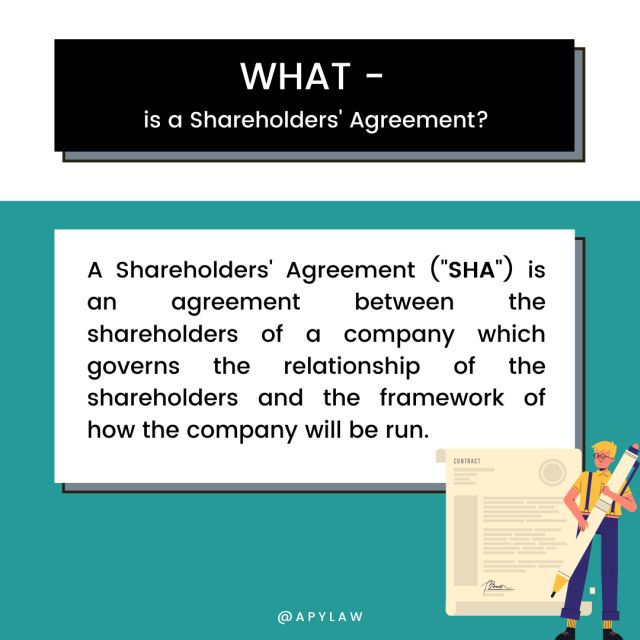

WHAT IS A SHAREHOLDERS' AGREEMENT?

A Shareholders' Agreement ('SHA') is an agreement between the shareholders of a company which governs the relationship of the shareholders and the framework of how the company will be run.

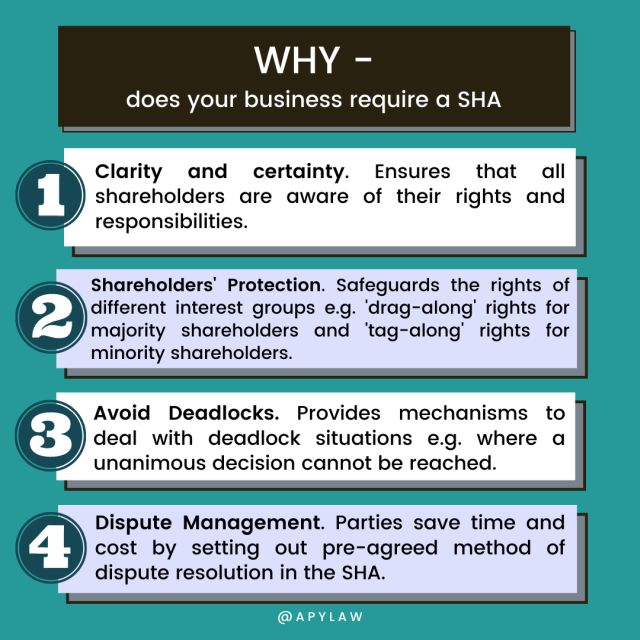

WHY DOES YOUR BUSINESS REQUIRE A SHA?

- Clarity and certainty. Ensures that all shareholders are aware of their rights and responsibilities.

- Shareholders' protection. Safeguards the rights of different interest groups e.g. 'drag-along' rights for majority shareholders and 'tag-along' rights for minority shareholders.

- Avoid Deadlocks. Provides mechanisms to deal with deadlock situations e.g. where a unanimous decision cannot be reached.

- Dispute Management. Parties save time and cost by setting out pre-agreed method of dispute resolution in the SHA.

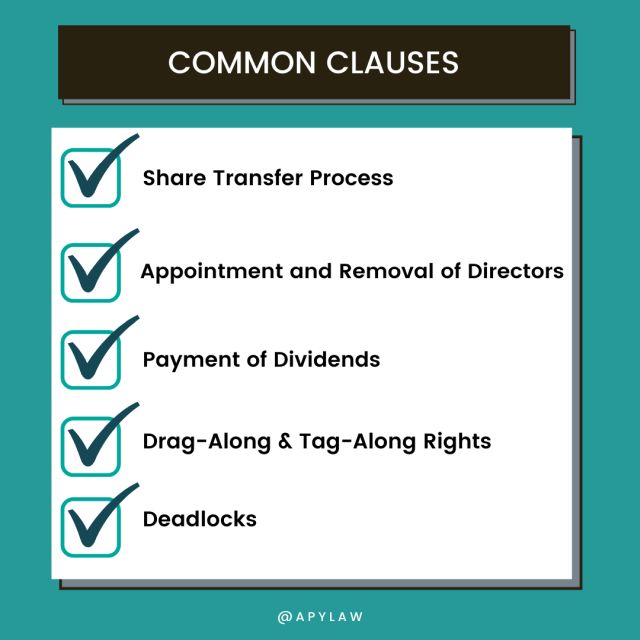

COMMON CLAUSES

- Share Transfer Process

- Appointment and Removal of Directors

- Payment of Dividends

- Drag-Along & Tag-Along Rights

- Deadlocks

WHEN SHOULD YOUR BUSINESS HAVE A SHA?

Although SHAs are not mandatory, it is prudent to have one in place at the get-go of forming a company with multiple shareholders.

Visual Aid

Originally published 04 August 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.