Challenging and complex M&A and IPO markets

Deal values in Norway are significantly down in the first six months of 2023, while deal volumes are closer to 2022-levels. The current macro-economic landscape in Norway, Europe and globally causes insecurity and adversely impacts deal values and volumes, while there is a growing deal pipeline waiting for the markets to stabilize and improve.

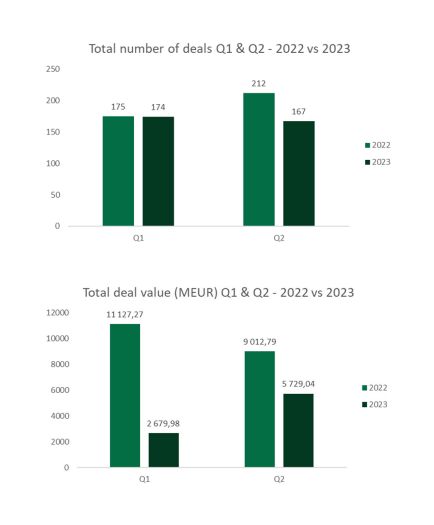

In terms of M&A deal volumes, the total number of deals in the first half of 2023 is down from 2022, with 341 in 2023 from 387 in 2022. Interestingly there is a slight downward trend from the first to the second quarter of 2023, with 174 deals in the first quarter to 167 in the second quarter, while historically, deal volumes have had an upward trend from the first to the second quarter.

Although the deal count is not materially different from 2022, deal values are significantly down in 2023. From EUR 20 billion in the first six months of 2022 to EUR 8.5 billion in the same period in 2023. And only three deals represented half of the deal values reported so far in 2023.

Public takeovers are slower than we expected at the start of the year. With the reduced share prices and low NOK to other currencies, we expected a peak in foreign investors launching public takeovers. However, the general uncertainty in the market also affects public takeovers, interested parties are hesitant, and deals are harder to conclude.

While there is still activity on private and public M&A, the IPO market has been slow with only seven listings on Norwegian marketplaces in the first six months of 2023 (compared to 17 in the same period in 2022). However, if we exclude up-listings, the IPO volumes in 2023 are close to 2022.

Deal activity is down due to market conditions

Uncertainty continues to impact the M&A market in Norway, and the number of deals in the first half of 2023 is declining. Macroeconomics and markets are volatile, with interest rates continuing to rise and the level of inflation remaining high. Access to debt financing is still challenging, particularly for larger transactions, and the funding costs are increasing with the increasing interest rates.

In addition to market and macro-economic risks, we are also experiencing a political land¬scape in Norway that has prompted certain new considerations. New taxes on income from natural resources such as salmon farmed in the coastal waters (the "salmon tax"), wind power and hydro power, have reduced and/or postponed investments in the relevant sectors.

Further, the recent proposal from the Norwegian government that the gender representation requirements that apply to Norwegian Public Limited Companies also shall apply to Norwegian Private LimitedCompanies (down to companies with 30 employees), can also make governance structures in Norwegian companies more complicated.

In addition to the Norwegian legislative changes, EU legislative initiatives and focus areas, such as the Foreign Subsidies Regulation (FSR and Foreign Direct Investment (FDI), is also expected to affect the M&A markets going forward. For more information on the effects of FSR and FDI we refer to our separate articles covering these topics at www.wiersholm.no

Although both sellers and buyers are cautious, good deals are still being completed, particularly within sectors such as oil, oil service and shipping. For small and medium sized deals, the number of transactions is relatively good. And, as further described below, the public takeover activity is stable in terms of numbers, and increasing in terms of values: so far in 2023 at EUR 18.6 billion, up from EUR 4.8 billion in first half of 2022.

Challenging markets have also led to a new boost in creativity on deal structures and risk mitigation. Joint ventures, co-investments, minority investments and club deals are often used as tools for market participants wanting (or needing) to close a deal, but are reluctant to do so on more traditional terms.

This creativity, combined with a desire, or requirement, to conclude deals give hope for the rest of 2023 and beyond.

Although uncertainty in terms of macro-economics seems to continue in Q3, we see a growing deal pipeline waiting for the conditions to improve, investors and funds with equity waiting to be invested and well prepared IPO processes. More clarity on the salmon tax that was introduced in September 2022 is also likely to lead to more seafood deals. Some expect a repeat of the situation in 2020, when the IPO markets opened before the M&A market, leading to a spike in IPOs, and also multiple dual-track deals.

Cross border activity

Cross-border deal activity in Norway is stable and slightly increasing. For overseas investments into Norway, the 'big three', Sweden, the US and the UK retain their positions in the top three, reflecting their position as Norway's strongest investment partners. This is particularly evident in terms of deal values and especially the case for the UK and US, which together exceeds the deal value from Norwegian buyers.

To view the full article click here

Originally Published by 14 July 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.