The recent judgement of the Hon'ble Supreme Court of India (the 'Apex Court') in M/s. Dakshin Gujarat Vij Company Limited vs. M/s. Gayatri Shakti Paper and Board Limited and Another, Etc.1 ('Judgment') is a landmark decision concerning captive generating plants. The Judgment has provided much needed clarity in relation to captive generating plants by interpreting the provisions of the Electricity Act, 2003 ("Act") and Rule 3 of the Electivity Rules, 2005("Rules"). However, there are certain ambiguities, particularly concerning the formulation of proportionality in electricity consumption and shareholding by captive users which have been discussed below.

What is a Captive Generation Plant? A Captive Generating Plant ('CGP') is a power plant set up by any person, cooperative society or an association of persons (including companies) for generating electricity primarily for their own use. A CGP is considered captive only if (i) at least 51% of the electricity generated,is used by the owner(s) for their own consumption; and (ii) the minimum aggregate ownership of the captive users is at least 26%. Additionally, for a CGP set up by an association of persons, the captive users are required to consume electricity in proportion of the shares held by them only, with a variation not exceeding 10%.

Captive power reduces dependability on the grid, reduces the cost of electricity (which becomes an input to production processes), and surplus electricity can also be sold to the grid, thus bringing in multiple benefits.

A brief legal background: In Tamil Nadu Power Producers Association vs. Tamil Nadu Electricity Regulatory Commission2 decided by the Appellate Tribunal for Electricity ('APTEL Judgment'), it was held that the 26% shareholding requirement was to be satisfied by the captive users collectively only at the end of the relevant financial year.

The APTEL Judgment further held that in case a Special Purpose Vehicle ('SPV') was established to own, operate and maintain a CGP, then the SPV would not be considered as an 'association of persons', thereby exempting CGPs set up as SPVs from the proportionality requirement applicable to association of persons (discussed in more detail below). Therefore, subsequent to the APTEL Judgment, SPVs were not liable to follow the proportionality requirement, and thus, a shareholder/ captive user in such SPV/ CGP could consume any amount of electricity generated from the CGP without any limitation.

Key Highlights of the Judgement: The Apex Court provided much needed clarifications on various aspects of CGPs as stated below –

- Ownership Transfer in CGPs: The Apex Court ruled that CGPs retain their status despite ownership transfers, so long as the new owner (captive user) complies with CGP requirements.

- Continuous Compliance with Ownership Requirement: Minimum 26% ownership by captive users must be maintained throughout the year, not just at the end of the financial year.

- Weighted Average in Shareholding Changes: In case of shareholding change within SPVs, compliance for consumption and shareholding requirements is to be determined through a weighted average for the financial year.

- The Apex Court's most pivotal clarification was categorizing SPVs as "associations of persons," or AOPs, thus subjecting them to the proportionality rule under Rule 3(1)(a) of the Rules.

AOPs and the Proportionality Principle: The rule of proportionality, which is set out in the second proviso to Rule 3(1)(a) of the Rules requires that the consumption of electricity by the captive users of a CGP must be in proportion of the shares held by them only, with a variation not exceeding +10%.

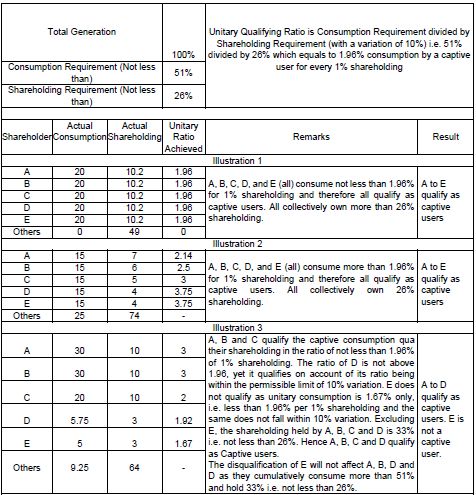

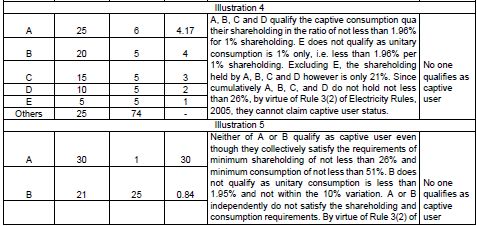

While deliberating on the rule of proportionality, the Apex Court discussed the concept of a unitary qualifying ratio.

The Apex Court held that the unitary qualifying ratio is, ratio of the minimum consumption requirement and the minimum shareholding requirement, i.e., 51% divided by 26% which is equal to 1.96%. Accordingly, it has been held that the owner of every 1% shareholding of the CGP (captive user) should have minimum consumption of 1.96% of the electricity generated by the CGP, with a variation of +10% being permissible (after factoring the +10% variation, the permissible range being 1.764% to 2.156%). Thereafter, the Apex Court relied on various illustrations (reproduced below) for providing further clarity.

![]()

As per the illustrations,

- any unitary ratio achieved which is 1.96% or above has been held to be permissible and the shareholders have been held to qualify as captive users of the CGP in all such cases – please see: unitary ratios of 4.17, 4, 3.75, 3, and 2.5, have all been held to be qualifying as captive users;

- any unitary ratio less than 1.96 has been held to be qualifying only if it falls within the permissible limit of 10% variation (i.e. if it falls between 1.764 and 1.96) – please see: unitary ratio of 1.92 has been held to be qualifying as captive user; and

- any unitary ratio less than 1.764 has been held to be not qualifying as a captive user – please see: unitary ratios of 1.67, 1, and 0.84 have been held to be not qualifying as unitary consumption.

The Apex Court's illustrations suggest that any ratio above 1.96% is acceptable, while ratios below 1.96% only qualify within the 10% variation limit. This may create a confusion where higher ratios bypass proportionality requirements and compliance is interpreted as being applicable only in case of lower ratios.

Practical Implications and Potential Ambiguities: The Apex Court has devised the unitary qualifying ratio of 1.96 which has been arrived at by dividing two minimum requirements under the Rules i.e. the minimum consumption requirement (51%) divided by the minimum shareholding requirement (26%). However, it is possible that when applied to practical scenarios, both the total consumption and total shareholding at actuals may vary from these minimum prescribed thresholds. Therefore, the feasibility of setting a uniform unitary qualifying ratio for all CGPs irrespective of actual consumption and shareholding remains to be seen.

Illustration:

|

Shareholder |

Actual Consumption (%) |

Actual Shareholding (%) |

Unitary Ratio Achieved |

|

A |

25 |

25 |

1 |

|

B |

25 |

25 |

1 |

|

C |

25 |

25 |

1 |

|

D |

25 |

25 |

1 |

The above illustration is a hypothetical situation wherein each captive user of a CGP has equal shareholding and consumption (and the consumption is in equal proportion to their respective shareholding). All electricity produced by this CGP is being consumed by the captive users themselves. However, from a strict interpretation of the illustrations and application of the unitary qualifying ratio provided under the Judgement, the captive users would not qualify as a captive user since it falls below the required unitary qualifying ratio.

Conclusion: The Apex Court has provided a landmark judgement and settled the law in relation to various aspects of CGPs under the Act and Rules. However, certain challenges may arise in meeting the compliance requirements for satisfying the proportionate consumption criteria while adopting the uniform qualifying ratio in a practical scenario. Accordingly, further clarifications may be required on the formulation and its application.

Footnotes

1. 2023 SCC OnLine SC 1276 dated October 9, 2023

2. 2021 SCC OnLine APTEL 19 dated June 7, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.