The "Experienced Provider Pathway" has been put in place to reshape the qualification requirements for existing financial advisers. The pathway removes the tertiary education requirement for existing financial advisers with a decade or more of experience and a clean disciplinary record.

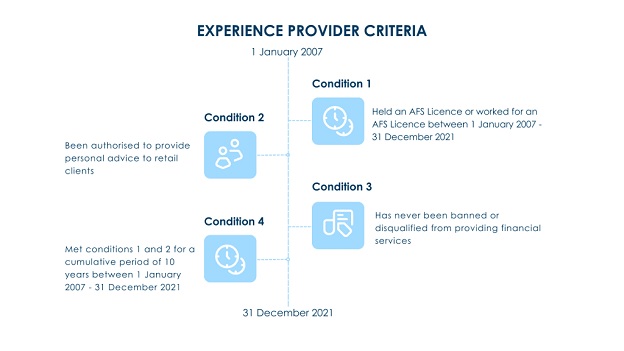

Experienced Provider Criteria

To qualify as an Experienced Provider, an adviser:

- Must have held an Australian Financial Services (AFS) Licence or worked for an AFS Licence holder between 1 January 2007 and 31 December 2021;

- During this period, they must have been authorised to provide personal advice to retail clients about financial products (other than general insurance, consumer credit insurance products or basic banking products);

- Must have not ever been banned or disqualified from providing financial services.

Advisers must have met conditions 1 and 2 for a total cumulative period of 10 years between 1 January 2007 and 31 December 2021.

The Experienced Provider Pathway

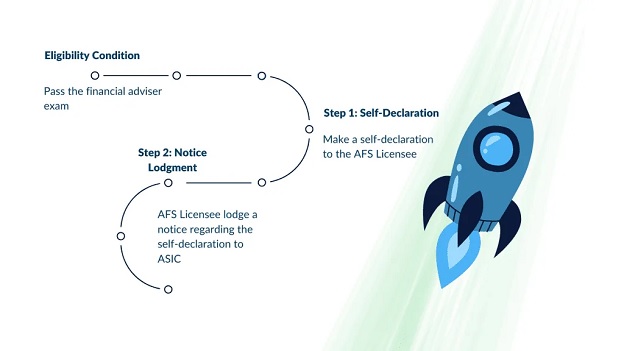

An adviser who wishes to rely on the new arrangements should take the following steps:

Eligibility Condition: An adviser must have passed the financial adviser exam by either 31 December 2021, or 30 September 2022 (if the adviser had previously sat and failed the exam twice).

Step 1: An Experienced Provider must make a written self-declaration to their current AFS licensee to confirm they meet the Experienced Provider criteria.

Step 2: From 1 July 2024, the AFS licensee must lodge a notice on behalf of the Experienced Provider to ASIC. This notice should include the Experienced Provider's name and principal place of business, along with a written statement confirming the provider meets the Experienced Provider criteria.

Timing of Notice Submission

|

Date of Experienced Provider's Self Declaration |

Timeframe for lodgement of Notice with ASIC |

|

Prior to 1 July 2024 |

Within 30 business days after 1 July 2024 |

|

After 1 July 2024 |

Within 30 business days of the date the self-declaration is provided to the AFS licensee |

Importantly, if an AFS licensee fails to lodge a notice with ASIC regarding any Experienced Providers by 1 January 2026, the Experienced Provider will be removed from the Financial Adviser Register. However, these Experienced Providers can be reinstated once they make a self-declaration and the AFS licensee has lodged a notice with ASIC.

Background:

Since 1 January 2019, all financial advisers (advisers) have been subject to specific education and training standards to provide personal advice to retail clients. This includes having an approved bachelor's degree or higher, or equivalent qualifications.